Well, the inevitable happened – after yesterday outlining the changes to points caps and earn rates on the Citi Premier Visa, I thought cardholders had gotten away with avoiding further devaluations to the Signature and Prestige Mastercard.

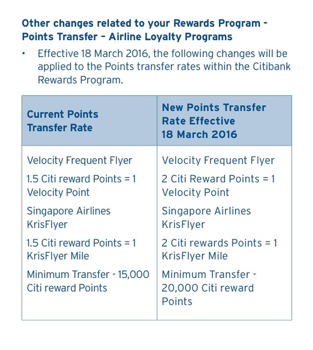

Unfortunately, I was wrong – and Citi’s previously flagged reduction in transfer rates from 1.5 Citi Rewards points = 1 Velocity point or 1 KrisFlyer mile to 2 Citi Rewards points = 1 airline point, is coming through.

This time though, they are giving at least 90 days notice, with the changes pegged to come through on March 18th.

Here’s a screenshot of the communication of changes to existing cardholders:

The key changes are self evident – the reduction in transfer rate and increase in minimum points transfers. Transfer those points over by mid March!

Previously from November 2015…

In a positive turnaround, Citi have reversed their decision to cut the points transfer rates from Citi Rewards to Velocity and KrisFlyer, which saw Citi cardholders face a loss in points value of around 25%.

AusBT are reporting, and Citi are confirming via Facebook comments, that the new rates will be reversed in coming days – so don’t transfer your points out of Citibank in the short term until that’s been fixed.

This is actually fairly amazing. Behind the scenes at Point Hacks I’ve heard of several members out of pocket for the equivalent to the tune of millions of points, and also witnessed a powerful movement of many of them banding together to put an immense amount of formal pressure on Citibank to resolve this in their favour.

The fact that their efforts, and everyone else who pressured Citibank through public channels – the AFF forum, Facebook members, AusBT and your comments here – shows that banks need to think through any changes they make to rewards programs, and make them within the scope of their terms.

Having said that, Citi have added new a clause to their terms and conditions since this minor fiasco, which appears to allow them to do this in future without any legal recourse:

3.6. Points Transfer – Travel Loyalty Programs

3.6.4. We may change the Points Transfer program rules including participation of travel loyalty program providers, regulations, policies, benefits, conditions of participation or points/mileage levels (if applicable), in whole or in part at any time with or without notice.

How confident that leaves us about whether they would actually do this in future, I don’t know. The best tactic is probably to keep on top of your points balances, ensuring you transfer them out strategically to airline partners on a regular basis.

Regardless, it’s clear they will face an immense consumer backlash from an extremely passionate community if they do something similar in the future. Well done to those who put the effort in to push Citi on this one.

I’ll let you know once the transfer rates have been updated in Citi’s systems.

Previously from November 2nd

The Citi Rewards program has long been a favourite of points collectors looking for an alternative rewards program that’s not linked to an American Express.

The transfer rates from Citi Rewards were just cut – down from 1 Citi Reward to 0.666 KrisFlyer or Velocity miles, to 1 Citi Reward to 0.5 airline miles. This is for both the $700 pa Citi Prestige Mastercard and the Citi Premier – almost a 25% cut in value.

What’s worse is that this was done on November 1st, and existing cardholders were given no notice. This, to be honest, is a pretty appalling way to run a rewards program.

Old vs new earn rates for the Citi Premier and Prestige Mastercard

I’ve summarised the differences in the previous transfer and therefore earn rates for the two key cards and the new below.

| Old | New | |

|---|---|---|

| Citi Rewards Transfer Rate | 1 Citi = 0.66 Velocity / KrisFlyer | 1 Citi = 0.5 Velocity / KrisFlyer |

| Citi Prestige earn rate / domestic | 1.33 Velocity / KrisFlyer per $ | 1 Velocity / KrisFlyer per $ |

| Citi Prestige earn rate / international | 3.33 Velocity / KrisFlyer per $AUD | 2.5 Velocity / KrisFlyer per $AUD |

| Citi Premier earn rate / domestic | 1 Velocity / KrisFlyer per $ | 0.75 Velocity / KrisFlyer per $ |

| Citi Premier earn rate / international | 2.65 Velocity / KrisFlyer per $AUD | 2 Velocity / KrisFlyer per $AUD |

It’s not a pretty sight for either set of cardholders.

The Citi Prestige Mastercard has a $700 annual fee, so for this to go to a 1 point per $ earn card for two of the major airline currencies on the market, when there are higher earning cards out there, is not good.

For Citi Premier cardholders this means that their effective earn rates on spend have been cut from a relatively market leading position.

I reached out to Citibank who provided this official comment on these changes:

Any changes made are always in line with the rewards terms and conditions. We believe our rewards program continues to provide excellent value for our customers. We continually review our rewards program to ensure it provides value for all of our customers. We have recently conducted one of these reviews in light of recent external market changes and the impacts on our Rewards Program.

What can you do about this?

Firstly, if you are interested in whether this is above board, the Citi Rewards terms are here.

Term 6.2 is the key one:

6.2 We may vary these Rewards Program Terms and Conditions from time to time. We will notify you of a change in the following ways:

* If we change the rate at which all Points in the program are generally earned or converted we will give you 90 days written notice of that change;

* We will give you 30 days written notice of other changes to these Rewards Program Terms and Conditions;

* If we change the Point value of individual goods or services in the program to reflect changes in the price charged by our suppliers for those goods or services, or if a particular Reward is unavailable we will notify you on our rewards website at the time you redeem your Reward.

I don’t know if Citi are within the terms of their program to make a change with no notice if they claim that the price charged by KrisFlyer or Velocity has increased.

I don’t believe that a points transfer is a ‘good or service’, but wouldn’t be surprised if that term is leant on to disclaim the lack of notice.

I am no lawyer, so if you have a specific reading of the terms, I’d love to hear it in the comments.

So, firstly, contact Citi and express your displeasure. Ask for discounts on your annual fee and/or bonus points as compensation. If you don’t get a satisfactory outcome, maybe it could be worth asking the Financial Ombudsman to get involved.

If you are willing to share any successes, again, please do so in the comments.

How it should have been done?

I don’t think making changes to a rewards program is a problem. Businesses and contexts change all the time, and as consumers we need to be prepared for that.

However banks and rewards programs need to recognise that member engagement is only possible if there is consumer trust in the program. Trust needs to be engendered by providing clear notice of changes, in writing, allowing the consumer to take action based on the change.

Regardless of Citi being in the right or wrong according to the letter of their terms, they will have screwed many consumers by reducing the value of their hard-earned points balances, without offering the ability to do anything about it.

What are the non-Citi Visa options for Velocity earn?

For heavy non Amex users, this leaves few Velocity-linked cards that earn 1 point per $.

The Virgin Money Visas lead the pack at 1 Velocity points per $ on the Flyer Visa, and 1.25 points per $ on the High Flyer Visa.

The Virgin Money cards are also issued by Citibank – but are managed by an independent business to Citi. My understanding that points earn rates, bonuses and other key product features are managed by Virgin Money, not Citibank, but I suppose there’s also a small risk of product changes there.

Summing up

I’ll also change the Point Hacks card guides to Citi Rewards, and the Citi Premier and Citi Prestige Mastercard in the next day – unfortunately I’m travelling most of today but will try and get this done ASAP.

Finally, I’ve also tried to confirm with Virgin Money that the Flyer Visas remain unaffected for the foreseeable future. Again, I’ll add any comment I can on that to this post.

Thanks to a Point Hacks commenter for the heads up, and AFF for links to terms and their opinions.

So rest assured if you happened to transfer points this last week (accidently or deliberately) then you will receive a top up on Sat. Not sure what would happen if you are one of the people that got a top-up after complaining and then transferred.

Regarding FOS – the Financial Ombudsman Service – it’s important to note this is not an independent umpire by any means but an industry funded pet that is a strategic defence against a real independent body limiting the finance industry cowboys. While small financial entities (who pay little to FOS) may be checked in bad conduct, the large financial entities (the big banks and insurance arms, etc) hold huge sway and really own the FOS (if they are unhappy with any FOS action, you can be assured it’ll quickly be undone by hook or by crook). FOS sat on it’s hands, for example, for the majority of the recent financial services scandals – only taking token action after the Commonwealth Government agencies had already intervened. It’s nothing more than a paper tiger, creating the illusion of some consumer protection in what is still a wild west industry.

Some industry ombudsman entities have a reasonably decent track record (TIO is pretty fair), but FOS has a very bad track record and dirty hands. As such, you can be assured appeals to FOS with regards to poor actions that Citibank previously took in this matter would have had zero effect.

This change by Citibank was all about the negative publicity created, which Citibank was aware would hurt new credit card applications and other new business (and it’s ability to generate profit) – that’s why it worked.

Hopefully this will got to the ACCC because this is just amateur comedy hour from Vitibank and regulatory oversight would slow them down!

Good evening

As a loyal customer I was disgusted to find out that the transfer rate from Citi Rewards to both Krisflyer and Velocity has been devalued. I have a Signature and a Prestige card and my wife has a Signature card (was about to apply for a Prestige card until this morning). Last week we had a combined number of points that would convert to 554,230 Krisflyer miles and this week you have taken from us 138,558 Krisflyer miles – with absolutely no warning. We were about to convert to Krisflyer for award First Suite tickets.

Whilst you will defend your action with the Terms and Conditions, what you have done is immoral and defines Citibank as being untrustworthy. I, on the other hand, have

• been a loyal customer for many years,

• held numerous of your cards (all of which you will see have an excellent record)

• hold a bank account with you (also excellent record)

• was just last week considering your CitiGold offering as we had xxxxxxxxxxxxxxxxxxx

• am appalled to have introduced my wife and sisters and their husbands to you as customers

Citibank has violated my trust.

There are 3 courses of possible action here.

Within 7 days credit my rewards account (proportionally between the Signature cards of my wife and my Prestige Card) with —- points – restitution for what you have taken from us,

Let us know personally that you will NOT do this so that we may wind up our affairs with Citibank as soon as possible, or

Reverse this decision, give clients appropriate notice and allow them to display loyalty, or leave.

It would appear that you are willing to lose many clients, since you have clearly thought through this prior to making the change.

You will see from your records we put a lot of money through your accounts and are particularly aggrieved at this very poor client treatment.

I called your Prestige line this morning and voiced my displeasure and annoyance and specifically requested that my contact records reflect the conversation and that the Client Service Manager call me personally. I very much doubt that there is such a level of care.

No doubt the plan will be to return to the lower earn rate, they’ll just give more warning as per the T&C’s.

Hope I’m wrong, and I applaud Citibank for responding in this way and accepting they managed it poorly, but still.

Citibank signature account holder had 99k in points and no annual fee

Went through the supervisor process was advise of clause 6.2 I asked if he could confirm if Singapore or Virgin had increased there fees to Citibank recently he said no I said you have just mislead me by stating clause 6.2 as the reason for change but that is not the case he went away came back and offered my 5000 points I said that did not cover my loss and would tak this up with the Financial Ombusman he went away and the offered 30,000 to cover my loss and inconvienence I an happy 🙂 one for cardholder zero Citibank 🙂

I have a lot more points than you and I hold a prestige and I’m a high spender. Even that they treat me this way, I wouldn’t put too much faith on the 30k points.

I’ve lost 760,000 KrisFlyer miles or 4 J class return tickets to Europe

Apparently they “have to” since it’s an “industry wide change” and that it’s supposedly “public knowledge” and apparently they are notifying customers “soon”

Now from what I can take from that, the “industry wide change” is the most concerning. I’d like to see if other programs follow suit. Might as well cash in on that 15% Velocity redemption before ANZ follows?

http://www.accc.gov.au/media-release/accc-ends-investigation-of-proposed-retrospective-point-value-changes-to-the-nab

I’m not saying people are not impacted, but if as someone has already said Citibank are giving some points back in compensation or waiving annual fees in response, that would be interpreted as some part in resolving the dispute.

I am not going to accept this as if they put this on their rewards terms and condition, there should have been a prior notice to all existing customers. There must have been a broken communication or update process between Citi and airline, otherwise Citi would be breaching it’s rewards T&C everytime there is a change. Anyway, I am calling AGAIN in 2 weeks for a resolution.

$700 pa for 1 point per dollar and no ATO?

Tell em the’re dreaming son!

Qantas transfers are now 1citi=0.5qff cutting the value in half.

Also reduced SQ & Velocity transfer rates.

Only reason why I directed to Citi in the first place was to hit minimum transfer 15k quickly since I’m not a high spender and it was 1.5 Citi to 1 VA and I only transfer during the bonus VA promotion.

Now I’m hoping for compensation is free upgrade to Citi Prestige to maintain back the $1 spend to 1 VA. My Visa Signature is the annual fee free…

I have spoken to the Customer Contact Centre in relation to the terms and conditions. After initially saying that Clause 6.2 only related to products bought out of ‘the Citibank Catalogue”, the operator then claimed that changing the points redemption value was permitted under the final point of Clause 6.2 “If we change the Point value of individual goods or services in the program to reflect changes in the price charged by our suppliers for those goods or services, or if a particular Reward is unavailable we will notify you on our rewards website at the time you redeem your Reward”.

I used to tell everyone about how good the Citibank Signature Card was. Now I’m just P’d off with them.

go to financial ombudsman? I think they have bigger problems to deal with like people in financial stress about to lose their home than a problem of points earning

You call the relevant authorities for anything ranging from one extreme to the other, so just because they have better things to worry about doesn’t mean you can’t/shouldn’t complain.

Having said that, I agree that it’s a little extreme to call the Financial Ombudsman, but on the other hand, I do think companies need to stick to their T&Cs and if they say they will give 90 days notice and don’t, then they need to be held accountable to that.

You don’t see the cops telling you to go away for reporting your phone as being stolen, despite the severity of other issues that are facing them.

Keith – could you add an edit comment function?