Qantas has changed Aquire to a more simplified program called Qantas Business Rewards. The move was intended to make it easier to access for small businesses, and we have written a separate guide about it here. We left this guide up for reference only.

Some members of Qantas’ Aquire SME loyalty program are receiving anniversary loyalty bonuses, so it’s worth checking your account to see if you have had the same…

In this guide, we cover who the Aquire program is aimed at, whether it is worth a joining fee, how to earn points through sign-up bonuses, Qantas flights, partners and credit card spend, and how to transfer your Aquire Points to your personal Qantas Frequent Flyer account.

Are you receiving an ‘anniversary gift’ of 2000 points every year?

Point Hacks Team Member Matt freely admits he is not an active member of Aquire and doesn’t usually check his Aquire balance. By chance he went into his account and saw that he was awarded a 2000-point ‘anniversary gift’ in both December 2015 and December 2016.

This bumped his account past the 3000-point minimum to transfer to his personal Qantas Frequent Flyer account at a ratio of 1:1, with that transfer taking place within 24 hours.

If you are an Aquire member, it’s worth checking your account to see if you too have also received some anniversary bonus points – two other accounts we manage didn’t receive a bonus, so potentially this is for early joiners as Matt signed up soon after Aquire launched in 2014.

Who is Aquire for?

Aquire is open to any business entity with an ABN, from those like me who operate as a sole trader up to those with multiple employees. Larger ACN entities aren’t eligible. The program costs $89.50 to join one-off, although deals are often run to waive or reduce the fee.

Points can be earned primarily from flying with Qantas, by adding your ABN into the booking on qantas.com, or with a range of partners. The points earned on Qantas flights are between 30% and 50% of the base Frequent Flyer points earned. I’ll cover this and the partners off in greater detail further down this guide.

If you do have any questions on Aquire, they have a dedicated customer service number you can call on 13 74 78.

Offer history: previous sign-up promotions

If you missed the last round of sign-up promotions, don’t despair. Aquire run membership drives frequently to try and persuade those with an ABN to join the program. If you have a business/are a sole trader that hasn’t joined (or have access to an ABN that hasn’t been used with Aquire yet!), it might be worth waiting until the next one runs – although bonus points aren’t always on offer.

- May 2016: free membership

- February 2016: double Aquire points and 50% more status credits on all eligible flights

- December 2015: free membership

- November 2015: up to 20,000 points

- September/October 2015: free membership

- April/May 2015: 10,000 points

- January/February 2015: reduced membership fee ($50) + 5,000 points

- December 2014: free membership + 5,000 points

- November 2014: 20,000 points

Qantas flight discounts

Booking Business Class or Premium Economy as a Qantas Aquire member at least 10 days before you flight will offer you a 10% discount.

Booking Economy Flex (Domestic or International) tickets upwards of 7 days before travel will earn you 5% discount as an Aquire member.

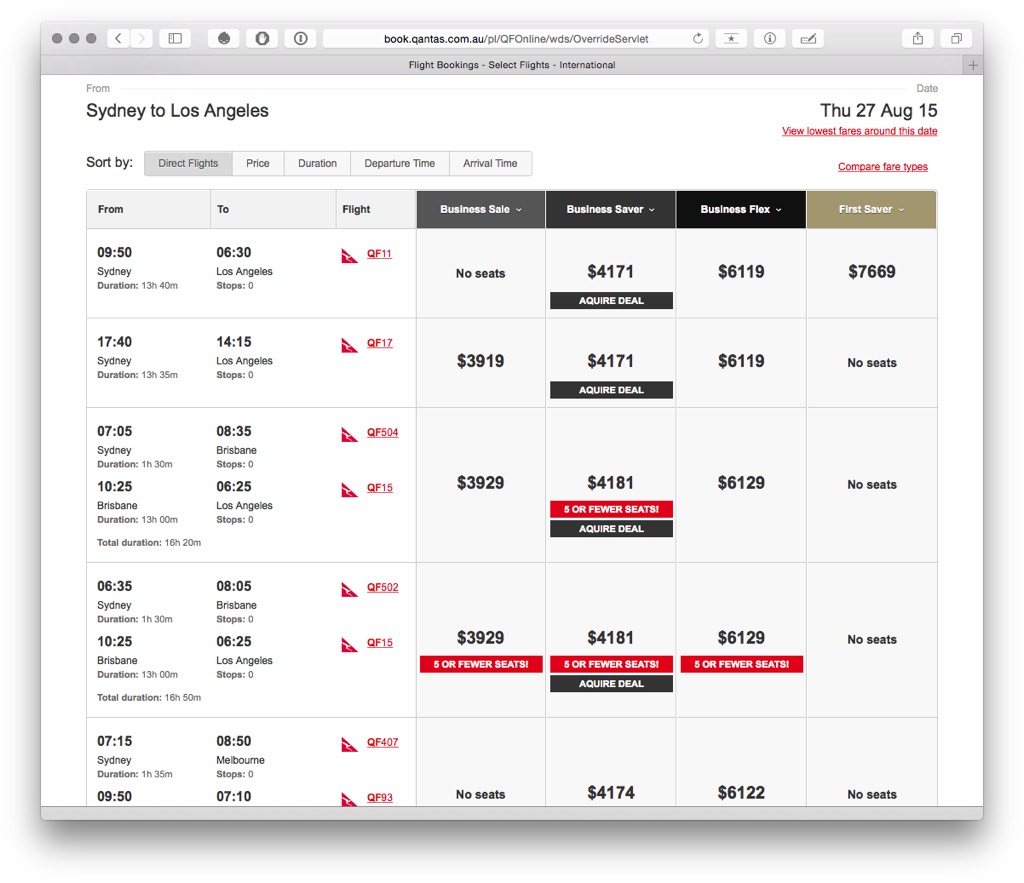

The discounts will show in the Qantas.com booking flow for eligible flights as below:

The savings are obviously pretty substantial if you book and pay for long-haul Business Class flights to Europe or the US on Qantas operated flights.

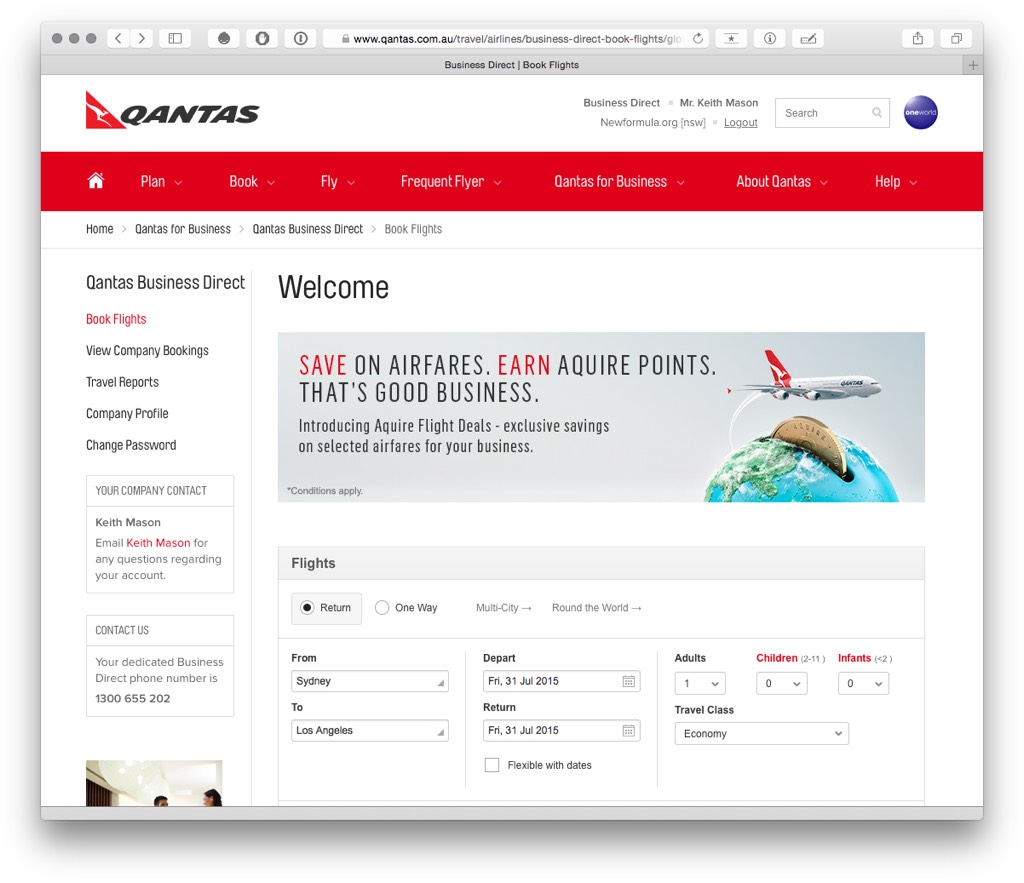

To access them, you’ll need to register for Qantas Business Direct for free, as well as Aquire.

Once you are logged into Qantas Business Direct, you’ll then get access to a booking page to enable the Aquire discount in the results, which looks like this:

There’s a little more on Qantas Aquire Flight Deals here.

What can I do with Aquire points?

Aquire points can be transferred to a personal Qantas Frequent Flyer at a rate of 1:1. Pretty simple – there’s no other opportunity to use them, although points can be transferred to any associated members Qantas Frequent Flyer accounts, meaning you can reward employees or others associated with your business with your points.

There’s a minimum transfer requirement of 3,000 points, so bear that in mind – you’ll need to build up a head of steam in your Aquire earning to get anything out of it.

However, and this is a big gotcha about the utility of the program, small business owners with only one employee in their Aquire program won’t able to transfer over their Aquire points earned from Qantas flights to Qantas Frequent Flyer until (and I’m quoting almost verbatim from the Aquire terms here) both:

- 20,000 Aquire Points have been earned from eligible flights; and

- At least two Aquire Flyers, as defined in the Terms and Conditions, have each travelled on one or more eligible flights within an applicable membership year.

Until those requirements are met, Aquire points earned on eligible flights in each applicable membership year will be held in the Member’s Account on a pending basis.

Translating this into friendlier language, before you can transfer your points earned from flights to Qantas Frequent Flyer, you’ll need two Aquire flyers in your account, both taking a flight that would earn Aquire points every year, and you’ll have needed to earn 20,000 Aquire points from flying.

Not only that, but if you haven’t reached the minimum threshold of 20,000 Aquire points from eligible flights in one membership year, the points under this threshold will expire on a yearly basis.

Argh! These terms are buried in their FAQs and aren’t clearly outlined anywhere else.

For points earned from partners though, such as the Westpac Aquire Visa, Staples or others, these are transferrable to Qantas Points without the requirements listed above. You’ll still need to meet the minimum 3,000 point transfer requirement though.

I think I’ll meet the requirements to make engaging in Aquire worthwhile. So how do I earn Qantas Aquire points?

Earning Aquire points on Qantas (and Qantas codeshare) flights

Aquire points can be earned on all Qantas-coded flights (flights with a QF flight number) where the ticket has been issued by Qantas, and the flight is operated by Qantas, Emirates, or American Airlines. This includes (full cost) Any Seat Awards, on Qantas but excludes Classic Awards.

The number of Aquire points earned is calculated as a percentage of the Qantas Points usually earned on the flight by a Bronze Qantas Frequent Flyer, regardless of the travellers actual elite status with Qantas.

You can find the table that outlines the percentage earn here. In a nutshell, the Aquire points earned are going to be between 30% and 50% of the base Qantas points on a given flight.

For SMEs with several employees, all flying frequently, these extra points could add up quite quickly and become a nice little earner. To functionally get the points into your Aquire account, you’ll need to both add all the traveller’s details into your Aquire account, and ensure your ABN is adding in the ‘special requests’ section of the booking on Qantas.com.

Earning Aquire points through business credit-card sign-up bonuses and spend

Business credit cards such as the Westpac BusinessChoice Rewards credit card offer a sign-up bonus of 40,000 Aquire points after making an eligible purchase. This offer has been running for almost a year, but finishes up at the end of February this year. Aquire will also waive their joining fee for those who take on this offer.

The card itself will earn your business 1 Aquire point for every $1.50 of ‘eligible’ spend, and will transfer across to the Qantas Frequent Flyer program at 1:1 (so 0.66 Qantas Points per $ after transfer to Qantas Frequent Flyer). There is no cap on point earn, and it allows up to 10 employees to hold supplementary cards for the one account. There’s a $150 (per card on the account) annual fee.

However, while 40,000 Aquire points is a nice one-off bonus, it may be better to look at business credit cards that earn Qantas Frequent Flyer points directly or that let you transfer points to the Qantas program (for example, the Westpac Altitude Business cards). For those that already hold one of these cards, the terms for this offer make it clear that those “switching or upgrading from an existing Westpac card” will be ineligible for the sign-up bonus.

Earning Aquire points with other partners

Aquire has slighty increased the number of its partners over 2016, with everything from advertising, banking, logistics and office supplies covered.

You will find earn ratios of up to 4 Aquire points per dollar (sometimes on top of discounted pricing), and a number of sign-up bonuses for new business. For example, an advertiser may really want you to start an account with them, offering a bonus of 20,000 Aquire Points for signing up.

One standout is Secure Parking, which will give you 250,000 Aquire points for a new monthly parking contract.

Of course, you’ll need to read the fine-print carefully, as there are lots of exclusions for both point earn and sign-up bonuses, as well as some caps/thresholds and contract requirements for some partners.

Note that Avis and Budget car rental and Crown Hotel will both let you double-dip and earn Qantas and Aquire points for the same transaction.

Full list of current Aquire partners

| Partner | Aquire Points per unit | Unit | Bonus/sign-up points | Category |

|---|---|---|---|---|

| Access Group | 1:1 | per dollar | Construction & Trade | |

| AHRI | 3:1 | per dollar | Recruitment, Staffing & Training | |

| AVIS | 4:1 | per dollar | Travel / Vehicle Hire, Leasing & Parking | |

| Budget | 4:1 | per dollar | Travel / Vehicle Hire, Leasing & Parking | |

| Corporate Cleaning Services | 1:1 (down from 2:1) | per dollar | 5,000 | Cleaning & Waste Services |

| Crown | 3:1 | per dollar | Accommodation | |

| Deloitte Private | 1:1 | per dollar | Banking, Finance & Accounting | |

| Digital Pacific | 3:1 | per dollar | (Down from 10,000) | Phone, Internet & Cloud Solutions |

| Get Capital | 1:1 | per dollar | (Down from 10,000) | Banking, Finance & Accounting |

| GIO | 1:1 | per dollar | Insurance | |

| Harvey Norman Commercial | 1:1 | per dollar | Other | |

| HR Advance | 2:1 | per dollar | 50,000 | Recruitment, Staffing & Training |

| JinHang Lighting | 1:1 | per dollar | Other | |

| Kikka Capital | 1:1 | per dollar | 5,000 | Banking, Finance & Accounting |

| Komatsu | 1:1 | per dollar | Construction & Trade | |

| Macquarie Leasing | 1:1 | per dollar | Vehicle Hire, Leasing & Parking / Banking, Finance & Accounting | |

| Madison | 1:1 | per dollar | 5,000 | Energy |

| Meemeep | 2:1 | per dollar | Freight, Delivery & Storage | |

| Octet | 1:3 | per dollar | Banking, Finance & Accounting | |

| Office EQ | 2:1 | per dollar | Office Supplies | |

| Pacific Magazines | 2:1 | per dollar | 20,000 | Advertising & Printing |

| Qantas | 5:10 | per QFF point earned | Travel | |

| Qantas Freight | 1:1 | per dollar | Freight, Delivery & Storage | |

| QBE | 1:1 | per dollar | Travel / Insurance | |

| Randstad | 1:1 | per dollar | Recruitment, Staffing & Training | |

| Regus | 1:1 | per dollar | 10,000 | Office Supplies / Other |

| REMONDIS | 1:1 | per dollar | 5,000-10,000 | Cleaning & Waste Services |

| Sapphire Export | 1:1 | per dollar | Other | |

| Secure Parking | 3:1 (down from 6:1) | per dollar | 250,000 | Vehicle Hire, Leasing & Parking |

| Seven / Prime Media | 2:1 | per dollar | 20,000 | Advertising & Printing |

| Simply Energy | 1:1 | per dollar | 15,000 | Energy |

| Snap | 1:1 | per dollar | Advertising & Printing | |

| Staples | 2:1 | per dollar | 10,000 | Office Supplies |

| Storage King | 3:1 | per dollar | 5,000-10,000 | Freight, Delivery & Storage |

| Vero | 1:1 | per dollar | Insurance | |

| Vodafone | - | - | 7,500-20,000 | Phone, Internet & Cloud Solutions |

| The West Australian | 2:1 | per dollar | 20,000 | Advertising & Printing |

| Westpac | 1:1.5 (down from 1:1) | per dollar | 40,000 | Banking, Finance & Accounting |

| Yahoo!7 | 2:1 | per dollar | 20,000 | Advertising & Printing |

There’s still no single massive mainstream partner to call out (except for the obvious Qantas connection), but if you are you are running a SME, it may be worth going through the list and considering what providers could be useful to you, provided it makes financial sense to switch. Remember to carefully check what counts as an ‘eligible purchase’ and factor this into your research.

For those who are sole traders, nothing in this list will really inspire you. However, you could consider switching your office supplies and printing from Officeworks or similar to Staples to take advantage of the extra earn.

Conclusion: what’s my view on Qantas Aquire business loyalty program?

Aquire is a useful program for businesses that know they will have multiple flyers travelling with Qantas on a regular basis. If there’s a join fee offer in place there’s no reason not to join, take a minute to understand the partners and try to keep it in the back of your mind for partner points earn.

Given the 20,000-point minimum and two flyer policy restrictions in place to be able to transfer points earned from flights to a Qantas Frequent Flyer account, even as an ABN holder I won’t be able to make use of the points earned from flights – I just won’t earn enough.

Small businesses with multiple travelling employees are only one target of Aquire though, so it’s understandable the average member of the travelling public won’t be able to take advantage of the flight benefit.

Qantas are using Aquire to actively engage small business owners in their brand and by building business, not just personal loyalty, so the program does have value for those who can use it, and you’ll just need to put a little mental energy into understanding how it might work for you.

6 Allow up to 8 weeks after completing the survey for Aquire Points to appear in your account.

Was there a survey you needed to complete to be rewarded the 10,000 points if so they it very much appears this email is targeted and not all can enjoy the 10,000 points.

Also, I’m stuck on 15000 pending Aquire points, which will likely expire in April for my new membership year. Bummer.

Find other people to join your business, quick!

Is there a way to confirm that I’ll be eligible for the bonus points, assuming I meet the conditions (e.g. spend the $50 at Staples)?

I sent an enquiry to see what had happened (there’s nothing in the conditions indicating that it’s limited to only targeted members) and they promptly contacted me to confirm that they were crediting the points to me.

Happy days!

Thanks for the links. Just a question: I thought that there was something like a minimum of 2 QF legs that need to be flown before the points could be transferred to a QFF account. Has that changed?