With up to 150,000 points on offer on the American Express Platinum Card, I thought I’d really get stuck into what you get for the jaw-dropping $1450 annual fee.

Over the course of a few posts I’ll try and really get into detail about how the Platinum Card benefits work, what happens when you first receive your card, and how to start using some of the benefits to start getting value from the card.

As a reminder, the headline points earn for the Platinum Card is:

- 2.25 Membership Rewards points for every dollar you spend on your Card, except at government bodies in Australia

- 1 Membership Rewards point for every dollar spent at government bodies in Australia.

American Express Rewards points transfer at a rate of 2:1 to its frequent flyer program partners.

Outside of pure points earn, the Platinum Card is known for it’s travel, dining and lifestyle benefits and partners, and this is where I’ll focus in the upcoming few posts, as this info is hard to come by in heaps of detail online.

So, first let’s look at what you’ll receive once (if) you’ve been approved for the card.

What comes in the American Express Platinum Card welcome pack

Firstly, a box with a bunch of paperwork, along with your card inside, will show up on your doorstep.

Amex definitely decided that using a few trees are in order to welcome you to your $1450 per year Charge card. Once you open it up, you’ll start cracking through the paperwork.

There’s the welcome letter:

The Quick Start Guide:

And the most important, the absolutely massive benefits pack:

There’s also a form to give Amex all of your personal travel details for when they make reservations on your behalf:

First steps for Platinum Card Members

Given the weight of the $1450 fee you’ve taken on, you’re going to want to get stuck in to ensuring you’re getting the most out of your benefits. After activating your card and setting up / adding it to your online profile, here’s where to start…

Add any supplementary and additional cardholders

You may have done this during the application process already, but if you haven’t, now is the time to make sure you have the most possible points-earning power by adding any necessary additional cardholders to your account.

There’s a distinction here which is unique to Amex, and I think to the Platinum Card – supplementary cardholders are the usual extra cards for other people who use your card, but you can also request additional cards as well. These are extra cards in your own name.

Potentially other banks can do this too, and the reason to do so is primarily if you want to allocate business expenses to one card and personal expenses on the other – reports can then be run to pull out spend on each card which is handy for expenses and tax time.

Consider whether you want to take on the additional complimentary Platinum Reserve card

If you know you’ll want to also apply for the complimentary Platinum Reserve card (which offers the same points earn categories, but also a free Virgin Australia flight or hotel night as well) then you’ll need to apply again for this card through Amex by filling out an application form, which you can request over the phone or through secure messaging online.

At first glance it makes sense to get the Reserve as well, but there are some considerations to be aware of.

Firstly, the card is not just sent to you immediately – American Express will perform a credit check before they will approve you for the card, so be aware of that.

Then, there’s also the limitation that American Express apply to how many Amex-issued cards you can hold – this is 2 charge cards plus 2 credit cards in total.

If you already hold another two credit cards from American Express – say the Business Accelerator and the Platinum Edge – you’ll be asked to close one before being given access to the Reserve.

This isn’t a recommendation to go one way or the other with the Platinum Reserve card, just that you should be aware of those factors before going ahead.

Set up Apple Pay

As soon as you’ve activated your card, you can then also set it up in Apple Pay if you’re an iPhone user. There’s more on Apple Pay here, and ANZ also just came on board as Apple Pay compatible. It’s pretty handy when managing spending across credit cards.

Request Priority Pass membership over the phone

The Platinum Card comes with Priority Pass lounge membership (which I’ll go into in more detail in a future post) for you and a supplementary cardholder.

That membership needs to be requested over the phone with Amex as well, so make sure you request that – it will take a few weeks to come through.

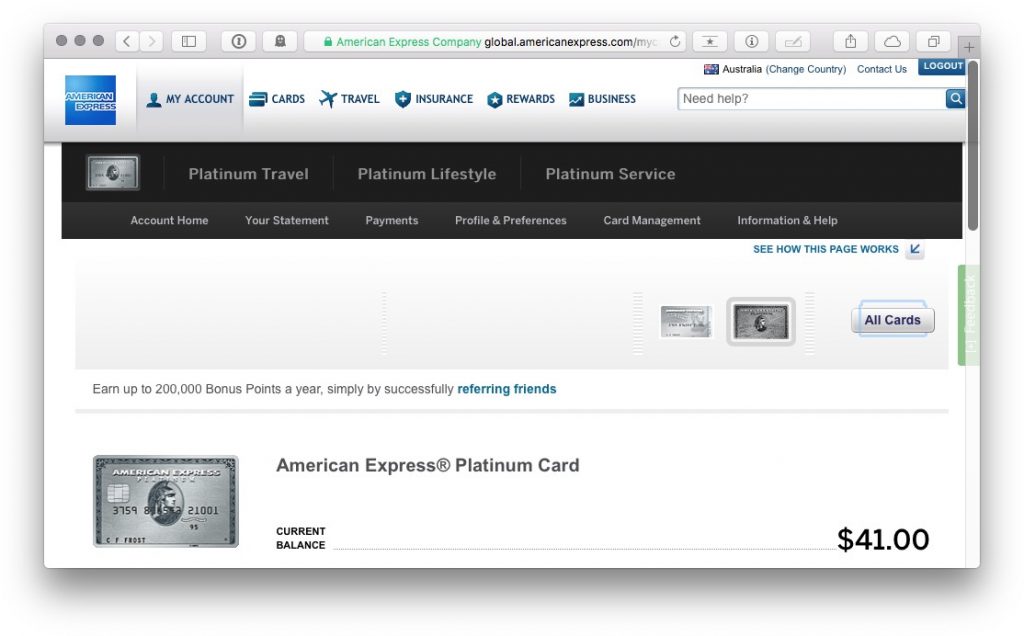

Get stuck into the Amex Platinum Card dedicated website

Once you’re logged in with an activated Platinum Card, you can then start browsing around the features unique to the Charge on the Amex website. These all appear with a new black menu bar appearing once you’ve logged in.

I’ll dig into most of these in more detail in upcoming posts, but in short, you’ll have access to:

- Platinum Travel services – trip booking, lounge info, travel offers and city guides

- Platinum Lifestyle services – Dining offers, Shopping offers and Events

- Platinum Service – Concierge, insurance, and a directory of all card benefits

Summing up

That’s it! $1450 is a whopping annual fee for a single credit card, and definitely isn’t for most people.

Hopefully by getting into the offering from Amex in more detail you’ll start to get a sense of its relevance for you.

this site is very helpful….

I just got my Platinum Charge card… and i wanted to get the platinum reserve as well…

based on your experience or do u have any experience that the application for the reserve card being knock out?

another thing though

I already have the explorer card- with $25k limit…

I was hoping to convert that explorer card to platinum reserve card as a companion card to save the annual fee of from the explorer card.. but the rep said that it is not possible… they said that i can only downgrade my explorer to essential, velocity premium and qantas premium..

anyway given the situation that i have high credit limit with my explorer with a balance of less than a thousand. do i have a high chance of getting the platinum reserve card?

about the question that i’ve read about MR points from different tier lets say (explorer card- gateway MR/ platinum charge- Accent Premium)

-from my experience when i called them, the rep asked me which MR tier i want to keep, she suggested to keep the Accent Premium as it is the highest tier and what they did was merge the two so that all my points from explorer and platinum charge will go to one MR bucket and also to avoid having lots of MR membership. – this is just to answer the question above.

What are the benefits of the Platinum Reserve for year 2017 ?

just received my Amex platinum business charge card .With the packaging and welcome pack being nothing like the personal Amex platinum card ,wondering is it normal to come in such a basic white envelope with just a bunch of terms and conditions and the card ? Even the login once you have activated the card doesn’t seem to have the features such as that black menu bar with all the platinum features listed but rather a basic grey layout,I’m unable to even find the concierge section via the website ? I have even contacted Amex and concerige in which their response was that only via phone and email can they be contacted ? Just abit confused as to what the real deal is ? I have read your review on the personal platinum card and the screenshots you have captured which look nothing like what I currently can see ,any help or suggestions would be great thank you

In terms of online access a common problem (again, talking about the personal card from my experience) for those who hold other Amex cards as well as Platinum is that online services don’t reflect your Platinum cardholder-ship when you log in and show you the right portal. Amex should be able to correct that if you ask them to make your Platinum card your primary card online, or words to that effect. AFAIK the Business Platinum online services should reflect the personal card, but if I have been misinformed there I will fix that up in this guide. Please report back if you have success.

Thanks for your reply ,no I haven’t ordered any supplementary cards yet just applied for one the one business platinum card at his stage,seems to me that no one at Amex has any idea of that portal you mentioned which gives you all the platinum options ? Although they have mentioned that after the first bill cycle that it should appear ? I’m just a little confused as to how to go about this moving forward ? Also are you familiar with any options with Amex which will allow you to transfer funds such as a direct deposit as you would with your normal everyday bank account ? Thanks again

As to your last question – check out RewardPay.

I have also heard you get a status teir with Hertz with this card?

Can you confirm?

I collect points in multiple programs for J/F redemptions and as much as I’d like to get an Amex Platinum, I struggle to see any major benefit(s) that jumps out as being worth the hefty $1,200pa fee.

I already have the $195pa Plat Edge (through your link!) so the value proposition becomes:

– 100k points – ineligible as not new Amex customer

– $300 travel credit – not really useful for award redemptions

– Companion card with annual Virgin return flight – Plat edge already has this

– Access to VA lounge – good benefit but irrelevant if already flying J/F redemptions

– Lower points earn on day to day expenses than Plat edge

– Membership in hotel elite tiers – still need to hit re-qualification targets from my understanding and if you already have elite status from other methods (quite easy these days), it’s another irrelevant benefit.

So as an existing Amex customer, I don’t see the value. Am I missing something big here? Are there some undocumented benefits that make it worth the $1,200? (I recall Amex Plat used to have CX Gold/OW Sapphire status at one point)

Otherwise your points are all valid, but I’d disagree that the $300 travel credit is not useful – use it for a hotel instead and it’s a free night at a good hotel bookable through Amex travel.

The hotel status might be renewed in perpetuity as a Charge cardholder but I am looking into that specifically in the next few days to make sure I have this right, as a new holder I’m not fully across that.

But yes, the Charge totally won’t make sense for many people.

Any chance of a quick thought comparing the $1200 Personal Platinum charge vs the $1500 Business version; Given I could separate out business expenses on 2 separate personal cards as per your note above, the only real difference I can see to justify the extra $ is included business insurance?

Thanks!

IMHO it’s certainly worth getting the card for the initial 100000 points (or 120,000 with referral). It’s a more difficult question of whether it’s worth keeping it past the first year.

The longer answer is that the merchants need to be categorised as restaurants to count. If it’s the same account across a whole pub/club, then it won’t count. Sadly it seems that overseas restaurants primarily count as foreign spend and not “restaurants”, so you only get 2x points on these (and incur the foreign-spend fees).

To their credit, they gave me a good-will points-bonus in consolation.

I note that the Platinum Edge and Platinum Charge have different rewards programs – if you hold both do the Platinum Edge points accrue to the Platinum Charge’s rewards program or are they stuck in separate accounts for life?

Thanks

i have a westpac black altitude MC/AMEX – i have a special APP and i have involved their black concierge services 5 or 6 times and found them totally useless.

They have wheedled out of every request and you seriously get the impression of them in an office with their feet up.

This is where this card could become tempting.

Also i have a collegue who gets flight upgrades with his AMEX – is that the AMEX Black or this one?

o

I’m eager for the The Platinum Edge as I’d use it exclusively for earning points 3x per $ on groceries and other shopping…

My Velocity Plat card works wonders too earning points and great value… so.. should I get this car or the Platinum Edge one?