PayRewards inks points transfer deal with Accor Live Limitless

ALL becomes PayRewards' first hotel and experiences points transfer partner.

What we'll be covering

PayRewards members will soon be able to convert their business’ points across to Accor Live Limitless (ALL). That’s thanks to a new partnership between pay.com.au and ALL, Accor’s lifestyle loyalty program. The deal marks Pay’s first hotel and experiences transfer partner, and fifth conversion partner overall.

From 2 April 2024, customers can receive one ALL Reward point for every four PayRewards Points converted. For example, 8,000 PayRewards Points can become 2,000 ALL Reward points. In turn, those 2,000 ALL Reward points are akin to a €40 (~AU$66) saving on a future hotel stay.

We are thrilled to partner with pay.com.au and to become its first hotel and experiences transfer partner. This partnership isn’t just about rewards — it’s about opening up a world of opportunities by turning business transactions one step closer to a holiday or limitless experience.

– Adrian Williams, Accor Pacific COO, 21 March 2024

PayRewards members can already convert PayRewards Points across to a stable of airline partners. There’s Qantas Business Rewards, Virgin Australia Business Flyer and Singapore Airlines KrisFlyer, all at a 2.5:1 rate. Joining that is PayRewards’ latest addition, Qatar Airways Privilege Club. Transfers to Qatar follow a 3:1 conversion rate, with a 25% transfer bonus running until the end of March.

This collaboration provides an exciting opportunity for business owners to diversify their redemption options, by converting PayRewards Points to ALL Reward points and redeeming the points they earn on their business expenses for hotels, experiences and more.

– Ed Alder, pay.com.au CEO, 21 March 2024

Note, Point Hacks is affiliated with Pay.com.au.

Exclusive PayRewards bonus offer with Accor Live Limitless

If you’re not already using pay.com.au to earn points on your business’ payments, here’s an offer to get you started.

Start by signing up to Pay as an eligible new customer between 2-30 April 2024. Then, make $10,000 or more in eligible transactions within the first 30 days, and connect your PayRewards and Accor Live Limitless accounts. This unlocks a bonus 5,000 ALL Reward points, worth €100 towards a future hotel stay.

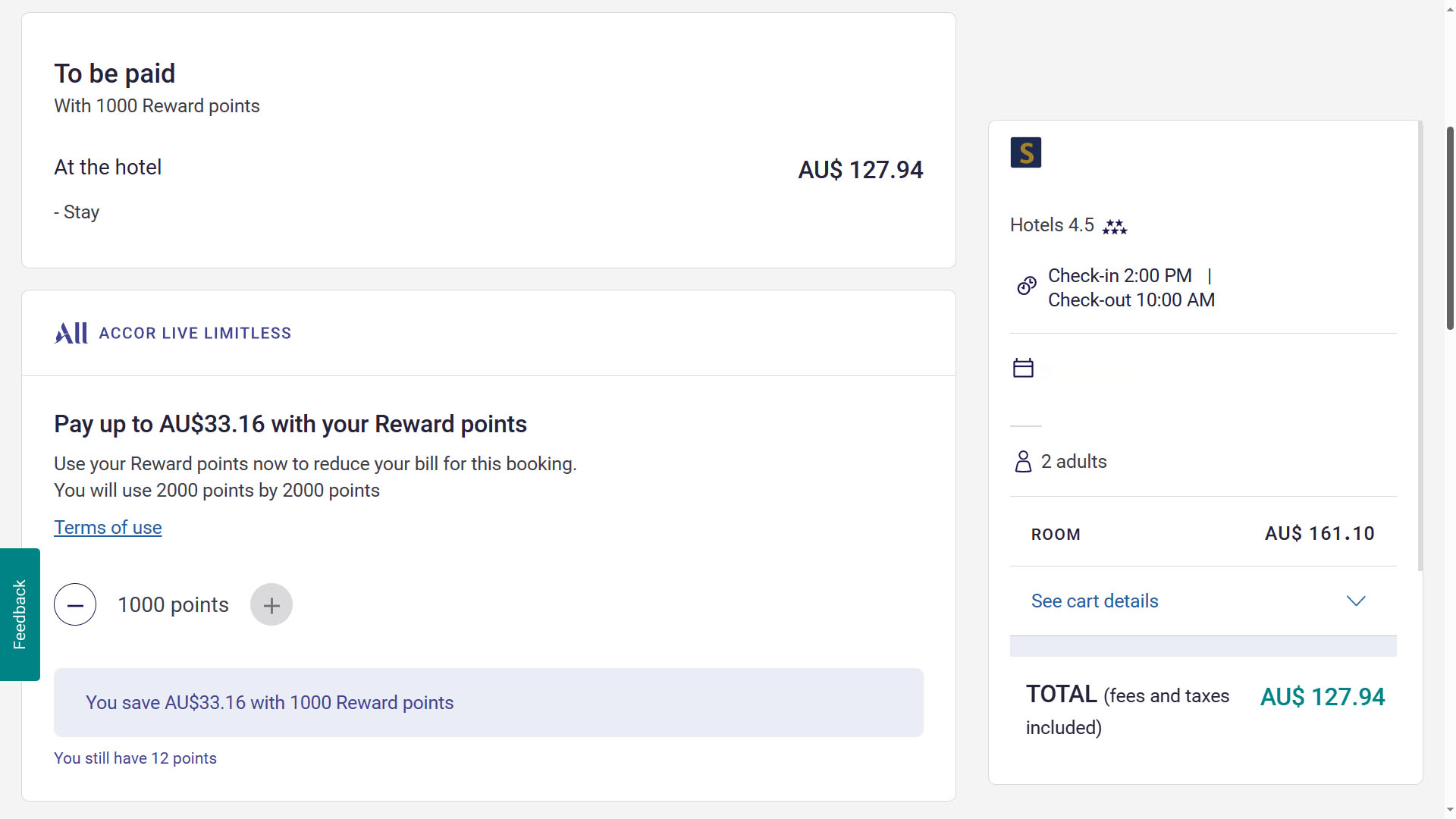

When used towards accommodation, ALL Reward points can be redeemed online during the booking process. Alternatively, hotel guests can redeem their ALL Reward points in person by enquiring at hotel reception – including on check-out day.

Outside of the hotel space, points can also be redeemed towards experiences and events. For instance, points can be spent on concert tickets at Accor Stadium. They can also be used to access tickets to the Toyota AFL Grand Final and the Ampol State of Origin, among other events on the sporting calendar.

Send your Accor points balance soaring even further

Along with making the most of PayRewards, there are other ways to maximise your benefits directly with Accor.

For example, the chain’s paid Accor Plus subscription shoots you straight to Accor Live Limitless Silver status. This allows you to earn even more ALL Reward points on paid hotel stays, along with a bonus 20 Status Nights each year. That could see you fast-tracked to ALL Gold status after earning just 10 Status Nights of your own.

Most Accor Plus memberships also provide a complimentary room night every year, and up to 50% discounts on dining across Asia Pacific. These savings can easily offset the Accor Plus annual fee. In fact, the American Express Platinum Card even includes one complimentary Accor Plus Explorer membership.

If you’re mainly interested in elite status with Accor, your Qantas membership could also get you there faster. For instance, Qantas Gold, Platinum and Platinum One members can be boosted to ALL Silver. Just link your Qantas and Accor Live Limitless accounts and complete one eligible stay to climb the ladder.

Qantas Points Club Plus members can achieve the same boost to ALL Silver, but after two eligible stays. And speaking of points, it’s also possible to convert credit card points from CBA and NAB across to ALL. From CommBank Awards, the conversion rate is 5:1 – while from NAB Rewards, it’s 6:1.

For users of pay.com.au, this provides the potential to double-dip on Accor points. Use that points-earning credit card to pay bills through Pay, to earn credit card points as usual. As well, opt to earn PayRewards Points when you make those same transactions to be rewarded again. Then, you could convert all your PayRewards, CBA Awards and/or NAB Rewards to Accor Live Limitless.

Summing up

The Accor hotel portfolio covers brands at every end of the market. There are premium and luxury brands like Sofitel, Fairmont, Pullman and Peppers through to more affordable alternatives like Mantra, Novotel, Ibis and more.

Because ALL Reward points are redeemed at a set cash value (albeit in Euros), travellers don’t need to rely on reward room availability, as with some other hotel chains. If there’s a room available for booking using dollars, more often than not, you’ll be able to use points to pay for it. (Some exceptions apply, such as with certain package rates).

Having a hotel transfer partner in Accor also makes PayRewards more flexible. While airline frequent flyer points are relatively easy to earn in Australia, there aren’t as many opportunities to do the same with hotels. Savvy business owners could make the most of PayRewards’ flexibility by using some of their points towards flights, while making a separate conversion to Accor Live Limitless to reduce their hotel bills along the same journey.

When it comes to earning PayRewards Points, there’s no monthly or yearly cap to get in the way. Businesses can opt to earn up to two PayRewards Points for every $1 transacted on pay.com.au. This includes payments funded by credit card, as well as bank transfer.

In fact, if you’re particularly savvy, you could take your rewards even further. That’s because you can also use pay.com.au to pay off your credit card via bank transfer, and earn points on that too. That’s one serve of PayRewards Points from those initial payments to suppliers through pay.com.au. And then, another serve of PayRewards Points when paying that balance off your credit card. Happy days.

Also read: You can now convert PayRewards Points to Qatar Airways Privilege Club

Feature image courtesy of Sofitel Auckland Viaduct Harbour.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Community