The recently announced increase in redemption surcharges for Velocity Frequent Flyer has left many reassessing whether the Velocity program is still worth participating in, especially given that this announcement came hot on the heels of the devaluation in the transfer rate between Velocity and KrisFlyer.

While it is easy to see the negative in surcharge hikes, this guide takes a look at the contrarian arguments in favour of the surcharge increase.

Recap of the changes

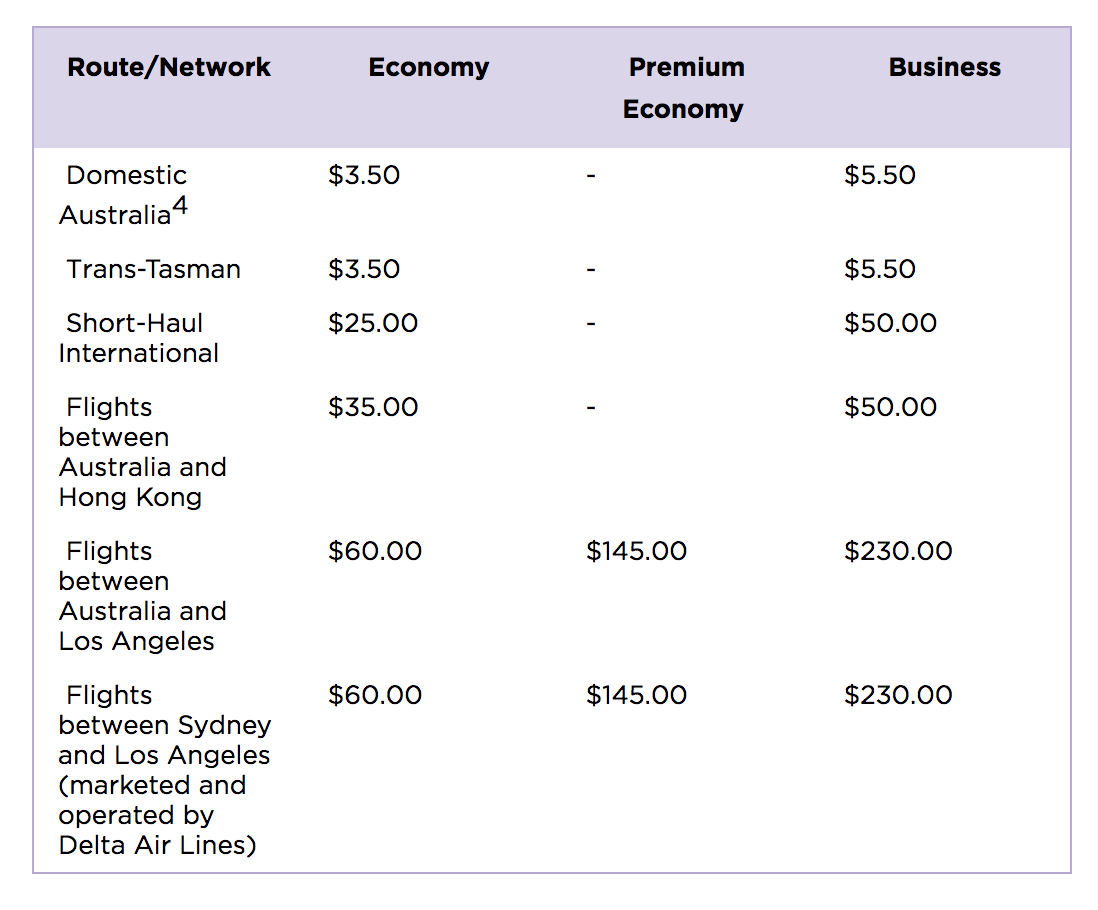

From 1 January 2019, Velocity Frequent Flyer will be introducing a ‘Carrier Charge’ on all Virgin Australia-operated flights and Delta Air Lines-marketed and -operated flights between Sydney and Los Angeles. The Carrier Charge is on top of the current taxes and fees that are applicable.

The amount of the charge is based on the route and is shown below:

You can read more about the changes here.

Why could this be a good thing for members?

At the risk of having e-tomatoes thrown at my screen, I believe that these carrier charges could well become a welcome addition for Velocity members. While frequent flyer programs were once a mechanism for rewarding customer loyalty, those days have long past us.

Today, frequent flyer divisions of airlines are a business, and serious business at that, with many airlines’ loyalty divisions representing one of the most, if not the most, profitable divisions of airlines. Velocity Frequent Flyer is no exception, with the division’s financial results positively helping the Virgin Australia Group’s bottom line in the 2017-18 financial year.

Velocity Frequent Flyer was once regarded as one of the better frequent flyer programs for reward seat availability

However, one of the most frequent complaints leveled against Velocity over the past 18 months has been the dramatic reduction in award availability, especially in relation to international long-haul routes. While there may be a number of reasons for this, including the limited supply of Airbus A330 and Boeing 777 planes flying these routes with an increasing membership base, this is by far the sole reason, especially given the lack of long-haul award availability with Velocity’s partner airlines like Singapore Airlines and Etihad Airways when trying to redeem through Velocity as well.

How can increase in surcharges improve award availability?

I would argue that Velocity’s historically low award fees and taxes have played a part in the decline of award availability and that surcharges may assist in improving this availability.

The supply-side argument

Adding surcharges to award bookings will see the gap in revenue that Virgin Australia receives from a full-fare-paying customer versus one redeeming for an award fare narrow, given that an increased surcharge in effect means that a member redeeming a reward seat will be forking out a higher ‘co-payment’ for the seat.

Think of the surcharge like an excess that is payable when you make an insurance claim. This decrease in the revenue gap due to the higher surcharge may well entice Virgin Australia to start releasing more award seats, given that they face a decreased cost if they miscalculate forecast demand and release too many award seats.

Award seats in ‘The Business’, such as those on the A330s that fly to Hong Kong, are currently in scarce supply

The demand-side argument

The surcharge hike may well deter some members from seeking out these limited award seats, thereby reducing the competition for them. Less competition means a greater chance of snagging that reward seat.

The longevity argument

As hard as it may be given Velocity’s exceptional financial performance, it pays not to lose sight of the fact that profit is never guaranteed, and that these surcharges may provide an ‘economic buffer’ to secure the longevity of the Velocity Frequent Flyer program, especially in times of economic weakness that will invariably arise at some point in the future.

What can you do to mitigate these charges?

It is clear that the impact of the Carrier Charges is skewed towards international long-haul destinations. Therefore, avoiding long-haul award seats may be your best bet in minimising the impact of these charges.

While this may not be a suitable option for many of you reading this guide, some within the Point Hacks Community suggest that given the seat availability issues, plus the fact that Velocity’s surcharges no longer represent exceptional value as compared to Qantas and other competitors, they are looking to redeem their Velocity Points for domestic bookings and reserve their Qantas Points for international flights where availability is better.

Domestic Business Class redemptions still represent great value even after the new surcharges, with plenty of award availability on offer

For those adamant on using their Velocity Points for long-haul flights, you can proceed to transfer your points to Singapore Airlines KrisFlyer miles at the current rate of 1.35:1, which opens yourself up not to just Singapore Airlines flights but flights on all Star Alliance and other airline partners. However, be aware that from 1 January 2019, the transfer rate between Velocity and KrisFlyer will devalue to 1.55:1.

Summing up

Now, let me be clear—if availability does not improve as a result of these surcharges, then this is a very unwelcome impost on Velocity members. However, while none of us like to pay more fees and taxes, if it results in greater award availability, then this may take some of the sting out of the charges.

A frequent flyer program with no fees, taxes and charges and no seat availability is in my view a program with no value.

Will you be looking at changing your Velocity redemption strategy as a result of these changes? Share your thoughts in the comments below.

An interesting point of view, but your perspective doesn’t appear to address some key factors and appears to be somewhat naive.

Please consider the following:

1) Sure loyalty programs are big business, but you can’t just dismiss their loyalty function that sweepingly. Many folk are still into the mindset of being beholden to either VA or QF – the immediate evidence are some of the responses to this very article (all or nothing attitude and declarations of bail out from some despite the VA scheme offering far better earn / burn that QF and access to more partners)!

2) VA needs to provide a proportion of its inventory for rewards otherwise it risks brand / reputational harm: VA makes a big deal out of being the airline with the greater access to reward seats: this will be the ultimate driver to increase the amount of rewards available, but only up to the point where VA can maintain some semblance of claim to better access of rewards than QF.

3) The economics for the airline don’t work as simplistically as you portray. The financial liability of used points is accounted for when the points are used – this creates a motivation for an airline to restrict reward seats / dissuade passengers from using their points at all. The bottom line is the airline doesn’t want the member to use the points at all, but still has to make a prudent proportion of the inventory available for such.

4) One of the financial risks to the airline is rising fuel prices. A financial sensitivity analysis of their costs would show fuel cost as one of the top variables. By introducing a fuel levy the airline can pre-prepare itself for a period of fuel costs rising – perhaps more easily sold to the punters as simply bringing into line with was their main competitor QF does rather than adjusting the points required for a reward (which are currently similar to those in the QF scheme).

5) There is little incentive for VA to have a point of differentiation from QF on reward availability on premium trans Pacific product by having a noticeably more generous approach to reward stock (beyond maintaining a claim of relatively better reward available generally). Their business class product is the equal (QF 787) or better than (A380) the QF rival product.

Looking at the whole picture provides little encouragement for an expectation of increased award availability.

The answer (as always) is a mixed frequent flyer strategy, designed to harness the relative strengths of the VA and QF loyalty schemes, with due consideration to personal circumstances.

But now they are not only increasing surcharges for reward seats but also devaluing Velocity points when you transfer to Kris Flyer.

Coupled with reward seats for international long haul through Velocity are almost impossible to come by, are super expensive and slightly more available through Etihad, and almost impossible through Singapore airlines – why should I stay with Velocity?

Short answer is I’m sadly not. Who knows if these surcharges and people leaving the program will mean greater availability in the future? No guarantees and a long time to wait.

I learned that Velocity makes most of it’s revenue by selling customer data to major banks, as that’s any rewards program’s greatest asset. No customers + no data to sell = less revenue?

As Leigh said, the only realistic solution is to collect a small stash of V points for domestic Australia flights in future and move everything over to Kris Flyer before 1st Jan 2019.

And we know how good Singapore Airlines is – with lower surcharges than most airlines, great reward seat availability, fairly inexpensive points cost for business class reward seats – and a great experience in flight – seats, food, entertainment, service.

Keep up the good work Singapore Airlines.

Poor show Velocity and Virgin Australia – staying profitable shouldn’t come before customer service and rewarding customers.

However, my issue with this is the airlines (or any reward program for that matter) is allowed to apply “enhancements” to everything. i.e. for the points that they’ve already sold. It almost like you having your own currency and are able to devalue your currency after selling them at face value. Not only the governments are able to do this to date. This is why a separate Reserve bank is set up to print money and Government is set up to mange money! This power needs to be regulated. I’m thinking a condition something like for points already banked to members to retain old rules, or give them a grace period of about 2-3years minimum to redeem under old rules.

As suggested in the thread, I’ll probably hold a smaller stash handy for domestic redemptions (especially if they do another one of those 30% off specials) but beyond that, will likely limit my involvement in the program.