This post is the next in the series outlining how to get the most from your credit card or frequent flyer program points – and a key part of squeezing points for the highest value is to use them strategically, not just because you can.

One key principle is that you shouldn’t treat points like money – points don’t have a fixed monetary value. There is usually a floor to their value, often somewhere around 0.5c to 1c per point. However, just because you can get that value out of a point, doesn’t mean you should redeem them at value. In this guide I run through an example of a poor redemption, and offer some guiding principles on when not to use your points.

Don’t redeem points for physical goods unless you absolutely have to

You can achieve the 0.5c – 1c value I mentioned before by buying iPads, toasters, or by swapping them for gift cards (for example). When you redeem for physical goods (which is essentially the equivalent of converting your points into cash), the airline is having to purchase the physical reward on offer, and as such, usually assigns a fixed monetary value (and a low one) to their points.

On the other hand, flights which are made available for frequent flyer points redemptions are basically an internal cost to the airline, and as such have a more variable value – these may otherwise go unsold so the airline is willing to give you a better valuation for your points when you use them for flights.

The best value is always going to be realised by using your points for flights, and if you can earn and save enough, in Premium Economy, Business, or even First Class.

The only time it’s really worth cashing out points for physical goods at such a low value is if you have an orphan account in which you don’t think you can earn more points, and don’t have enough to redeem them for flights.

Don’t redeem for flights where the points redeemed are outweighed by the accompanying cost of the taxes and fees

A second are where you might under-value your points is by using them for flights where the accompanying cost in taxes with the points ticket is relatively high – compared to the cash fare.

This why targeting Premium cabin redemptions pays off. Why use your points for flights nearer the front of the plane? Often because usually the taxes and fees that come with most points redemption tickets these days wipe out a good chunk of the value of using points for an Economy ticket.

Qantas are often especially bad at doing this, especially on ultra long-haul / multi-stop flights as they pass on a large chunk of the taxes that would be paid with a paid fare on points bookings too.

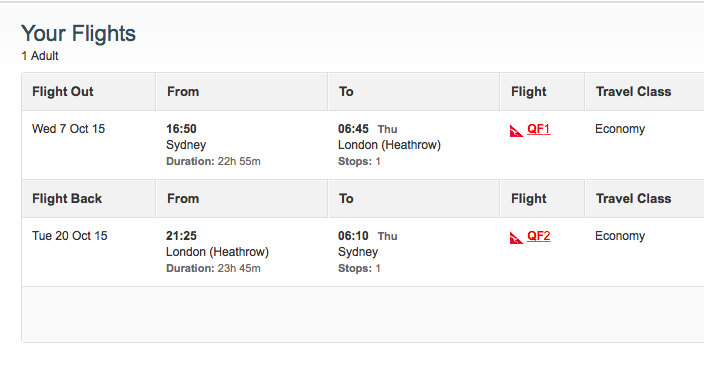

I’m going to show you this with an example of a return flight to London in Economy.

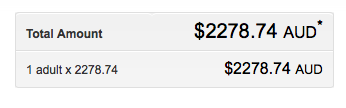

Picking a date where an Economy return points redemption is available yields a cash fare of $2278.

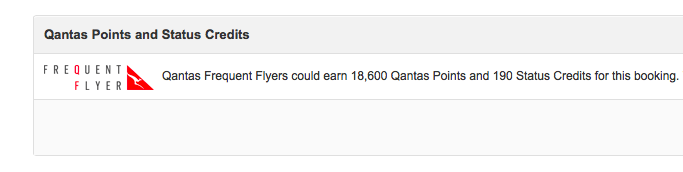

As a regular Bronze Qantas Frequent Flyer member, you would also earn 18,600 Qantas Points on this booking.

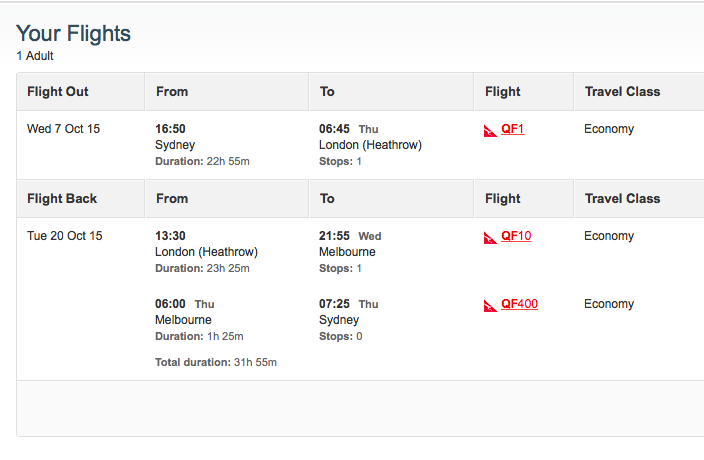

Redeeming points on exactly the same flights and dates yields the following price:

The points flights for these dates involved a connection in Melbourne, but that doesn’t impact the points paid (or materially the taxes).

As you can see, the taxes on the points redemption are an amazing $918. On top of that, you’ve outlaid 128,000 points for your ticket, as well as missed out on 18,600 points for travelling on a points fare, rather than a paid fare.

All up, assuming you had to travel on these dates and you would make a booking regardless, using Qantas Points this flight has cost your Qantas Points balance 128,000+18,600 points = 146,600 points.

You’ve saved what you would have paid on the cash fare, less the taxes paid with the points fare – so $2278-$918 = $1360.

As a result, you’ve valued those 146,600 points at 0.93c per point (1360/146,600 * 100).

This is a great example of how using your points for Economy fares can yield really poor value. If the Economy fare were even cheaper – i.e. on sale, the maths would be even more in favour of just paying for the ticket instead of using points.

The points fare does come with one benefit – it’s a lot more flexible than the paid fare, costing only 5,000 points to cancel if you decide to change your plans.

This is why it’s useful to target programs that try to minimise the additional taxes and fees that come with a points ticket – this will end up yielding better value for the points you have earned.

By comparison, Business or First Class redemptions can often yield over 5c per point when you come to redeem – so 5x the value in this example.

Outside of premium cabin travel, what examples do work for redeeming your points?

Outside of long-haul travel in premium cabins, there are some pretty straightforward examples of when using points can make sense:

- When the cash fare for a short flight is usually comparably high – i.e. low-traffic routes to a poorly served destinations often have high fares, or where a single airline has a monopoly on a route

- For last minute bookings where cash fares make booking using cash more expensive

- Where you absolutely need flexibility in your booking which a low cost cash fare won’t offer

Summary – Knowing when not to use your frequent flyer points

The key takeaways from this guide are…

- Get a sense for the value of your points, and the kind of value you can achieve for them. Set a rough valuation of your points over which you would use them – for example, mine for Qantas points is somewhere north of 2c at which I’ll consider using them

- Understand how to calculate the value of a redemption – do your own practice runs using the methodology above

- Run the rough calculation whenever you consider using your points

And finally, a bit of pragmatism – if you really have no use for flights using your points – and that’s fair enough.

You just won’t get as much value out them as you would otherwise, but getting some value from them is more important than not using them at all, so if you’re sure you won’t be flying with them, then cash out as you need.

The full set of back to basics guides to using your points effectively:

- Introduction →

- Understand why using points can be valuable – (understanding the cash vs points multiplier in Business & First class) →

- Get to know Qantas Frequent Flyer and Virgin Australia – their programs and their partners →

- Using Cathay Pacific Asia Miles and Singapore Airlines KrisFlyer programs as slightly more advanced options →

- Know where to search for frequent flyer award space most efficiently →

- Target flexible programs and points that can be transferred to where you need them →

- Know when you shouldn’t use points →

- Get some knowledge on the best airlines and ‘products’ to make the most of your flight

“128,000+18,600 points = 146,600 points.”

Isn’t it LESS the 18,600 as you will be getting it back?

How much research or consideration have you done in factoring in the value of your points as a percentage of your spend? Reason I ask this is because of the recent banking offers by ING Direct and by ME Bank where they offer to give you a 5% cashback for all tap & go (PayWave/PayPass) purchases for a 6 month period (after which it reverts to 2% with ING Direct).

I cannot imagine that you could get anywhere near 5% return with any of these credit cards; not even with the Platinum Edge and the 3 points/$ at supermarkets.

In relation to the 3 points/$ at supermarkets, have you also ever considered how this might stack up against purchasing gift cards at 5% off? This is fairly accessible for WISH gift cards which can be used at Woolworths and Woolworths/Caltex petrol stations. Coles gift cards are not so easy to obtain for such a price anymore.

I’m just thinking that for one who has access to all the things I have mentioned above, it may not actually be so worthwhile after all to opt for using a credit card at places like supermarkets/petrol stations when it’s quite easy to get hold of gift cards at 5% off for these places. Not to mention, you could even use your credit card to purchase the gift cards in the first place, although I doubt it would be counted as a supermarket purchase.

Sorry for the long post! Your thoughts?

The downside of the gift card route is obviously that you have to front-up the $$ for a large enough card (or make frequent card purchases). There’s definitely an admin overhead that comes with it. I considered a 5% off deal on BP cards recently but decided against it due to the simple fact I’d have to remember to find a BP and use it.

But yes, definitely need to consider non-points options in the mix. Cash is cash, and can often be better than points. But cash isn’t much of a hobby either!

I guess if you value Membership Rewards points at 2c/pt and you get 3pts/$1 at supermarkets, I can see where you would derive greater than 5% return from your spend then.

I think the admin overhead point is also fair, and the hobby point is also very fair. Can’t really fight that..

Another question if you don’t mind (which you have partially covered in some of your articles).

I think the applicable payable taxes when redeeming points is extremely relevant when it comes to valuing points as cash. Is there a simple/easy way to figure out what the required points AND taxes between two city pairs would be? I do understand this can vary from airline to airline. Just thinking that this would be particularly applicable to your articles where you post “guides” on how to get cheap Business/First class tickets by buying points, but I always get the feeling that there’s more to it than just the purchase of points as you also need to pay for taxes.

Subject of another guide there I think!