The first part of this American Express Platinum Business Card series highlighted how the card can help businesses better manage their finances and work seamlessly with suppliers and customers overseas.

In this section, we take a look at two further key benefits of holding the card – the ability to earn valuable American Express Membership Rewards points and the advantage of having up to 55 days to pay for your purchases.

[amex-business-plat-benefits]

Note: This guide has been produced in partnership with American Express, a Point Hacks commercial partner.

Earning Membership Rewards points

The American Express Platinum Business Card is one of the highest flexible points-earning cards on the market.

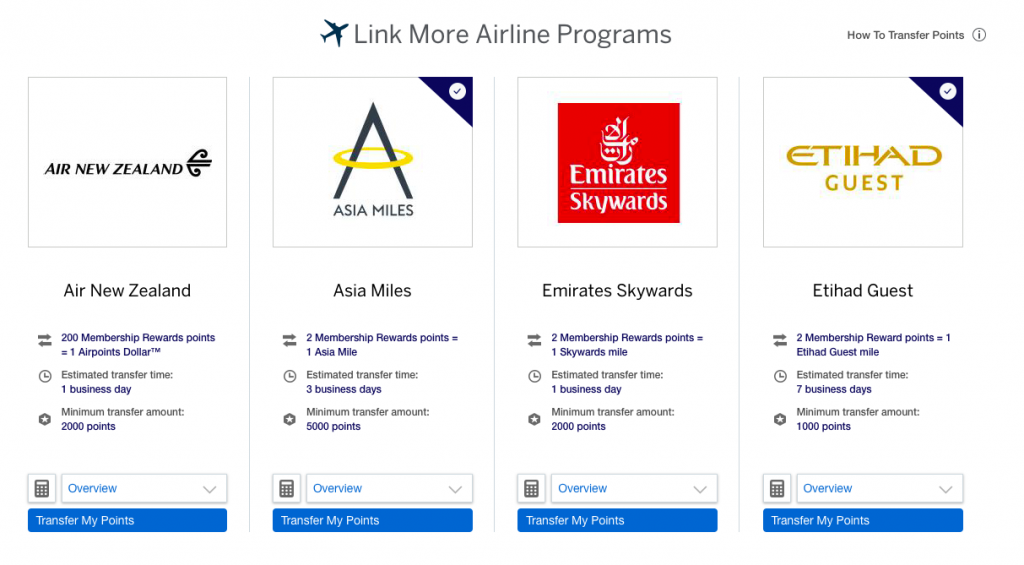

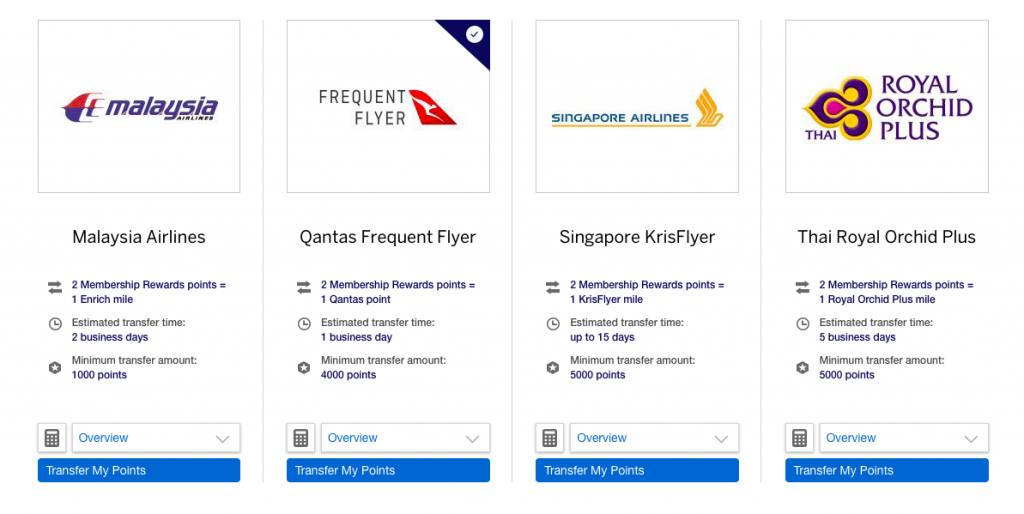

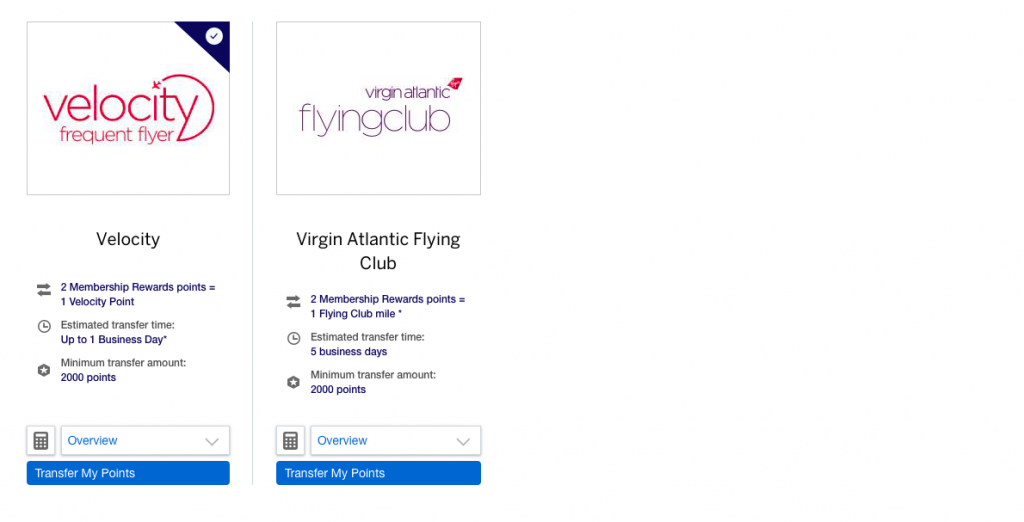

Many points earners like the flexibility of American Express Membership Rewards points and value them highly, given their ability to be converted to 11 airline and hotel partners or, alternatively, be redeemed for gift cards or used to pay for eligible purchases.

Card Members can earn 2.25 Membership Rewards points for every dollar spent on the card, excluding government spending, however, given the points transfer at a rate of 2:1 for eight of the program’s nine airline partners, including Qantas, then the effective earn rate is 1.125 frequent flyer points per dollar spent.

A full range of partners in American Express Rewards Ascent Premium is shown below:

The advantage of being in the Ascent Rewards Premium program is that Qantas Frequent Flyer is also a partner redemption, unlike that found in the Ascent Rewards program that is attached with most other Membership Rewards earning American Express credit cards.

To simplify things, the below table lists your effective earn rate per dollar of non-government spend with four of the most popular airline partners.

Effective Frequent Flyer Program Point Earn Rates

| Frequent Flyer Program | All spend except on government bodies |

| Qantas Points | 1.125 points / $ |

| Singapore Airlines KrisFlyer miles | 1.125 miles / $ |

| Cathay Pacific Asia Miles | 1.125 miles / $ |

You would need to spend $88,889 on your American Express Platinum Business Card to earn 100,000 points with any of the above airlines.

All government spend will earn you a reduced rate of 1 Membership Rewards point per dollar spent, which equates to an effective frequent flyer program earn rate of 0.5 points per dollar.

‘Government spend’ is defined in the terms and conditions as payments made to bodies including “the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies”.

If you’re wondering what your small business can do with 100,000 frequent flyer points, then the following might spur your creativity.

- Best uses of 100,000 Qantas Points

- Best uses of 100,000 Asia Miles

- Best uses of 100,000 KrisFlyer miles

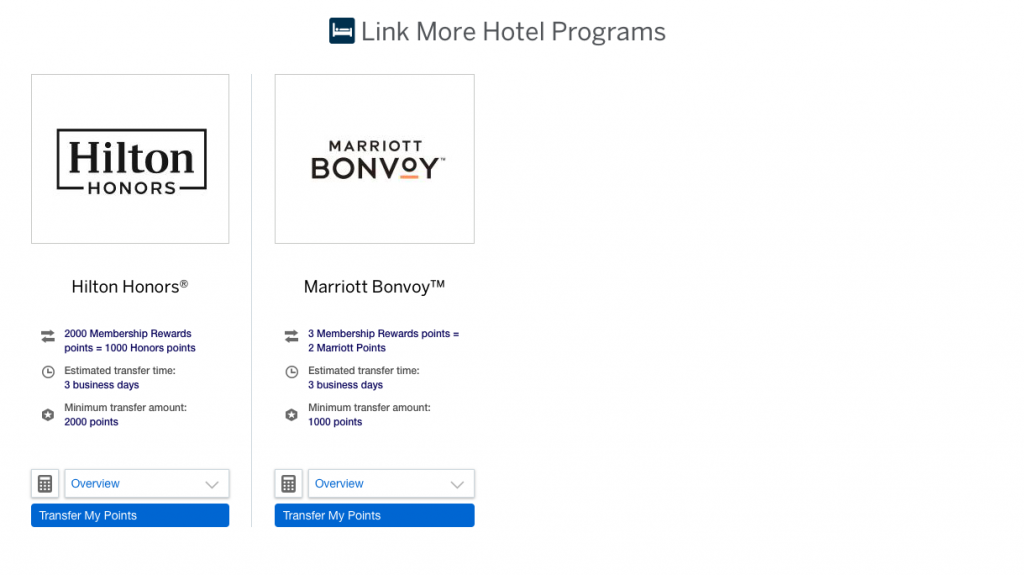

The Membership Ascent Rewards Premium program has two hotel partners, which are Marriott Bonvoy and Hilton Honors.

Membership Rewards points transfer to Marriott Bonvoy at a rate of 3:2 and to Hilton Honours at a rate of 2:1.

Up to 55 days to pay for purchases

Cash flow is a common problem facing many small businesses, and holding an American Express Platinum Business Card can assist.

You have up to 55 days to pay for your purchases to a supplier depending on when the transaction is made and when the statement is issued.

The time period depends on when you make a purchase, when your statement is issued and whether or not you are carrying forward a balance on your account from your previous statement period.

However, having no pre-set spending limit plus up to 55 days to pay for purchases can allow you to make significant upfront payments to keep suppliers happy while giving your business the time to balance cash flow.

Summary

American Express Membership Rewards points are a highly valued points currency given the flexible nature of the points program. If you run a small to medium business, you could quickly rack up plenty of points by putting all your business expenses on the Card.

Having up to 55 days to pay for purchases also helps to improve cash flow for your business and keep suppliers happy, so this is definitely a card to consider if you can put most of your expenses on the card to preserve cash flow and your business frequently requires staff travel.

Community