Buying now and paying later is a whole lot more rewarding when you use American Express cards as a payment method for your fortnightly instalments. This is a hotly-requested feature as Amex cards tend to have higher earning rates for rewards points than comparable Visa and Mastercards.

And if you’re shopping up a storm at one of the Afterpay Day sales, then earning bonus frequent flyer points is the cherry on top.

Plan It or AfterPay?

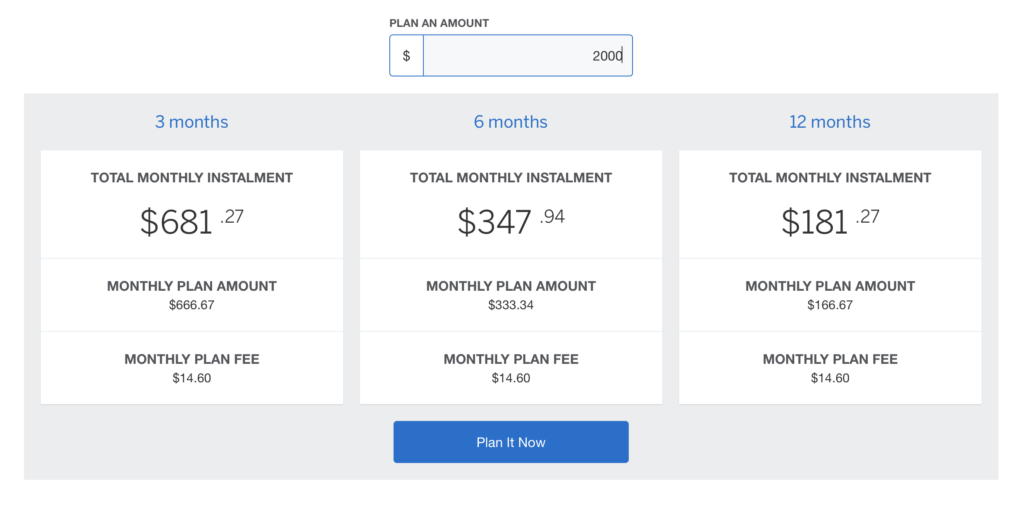

The move comes months after American Express launched its own ‘buy now, pay later’ service called Plan It, where Card Members can break down selected purchases to interest-free instalments over 3, 6, or 12 months.

However, a monthly plan fee applies and you’d only earn credit card rewards points on the instalment payments.

Compare that to AfterPay where you’re locked into four instalments, each two weeks apart. But assuming you don’t default on payments, there is no interest or fees charged so savvy shoppers can end up ahead with a longer cash flow period.

There’s also the possibility of ‘triple-dipping’ on points with AfterPay. Say you purchase $200 worth of goods through Catch.com.au while:

- going through Qantas Shopping

- using Afterpay at the checkout, and

- making payments on your Qantas American Express Ultimate card

You could earn 400 Qantas Points through Qantas Shopping, 200 Qantas Points through AfterPay and 250 Points through your credit card, for a total triple-dip amount of 850 Qantas Points.

Summing up

If you use AfterPay and hold an American Express credit card, then this is a no-brainer. Login to your AfterPay account and navigate to ‘Billing’ to enter your Amex card and set it as your preferred payment option.

If you haven’t already linked your Qantas Frequent Flyer account to AfterPay, it’s now too late to do so, unfortunately. But if you have, then enjoy potentially earning more than triple the amount of points you usually would, thanks to AfterPay and American Express.

Hopefully AfterPay will allow it’s customers to earn Qantas points again in the future.