American Express adds $400 worth of dining credits to the Platinum Card

What we'll be covering

Amex is sweetening the deal for Platinum Card Members by adding two $200 dining credits that can now be used every year (at least, up to the end of 2025).

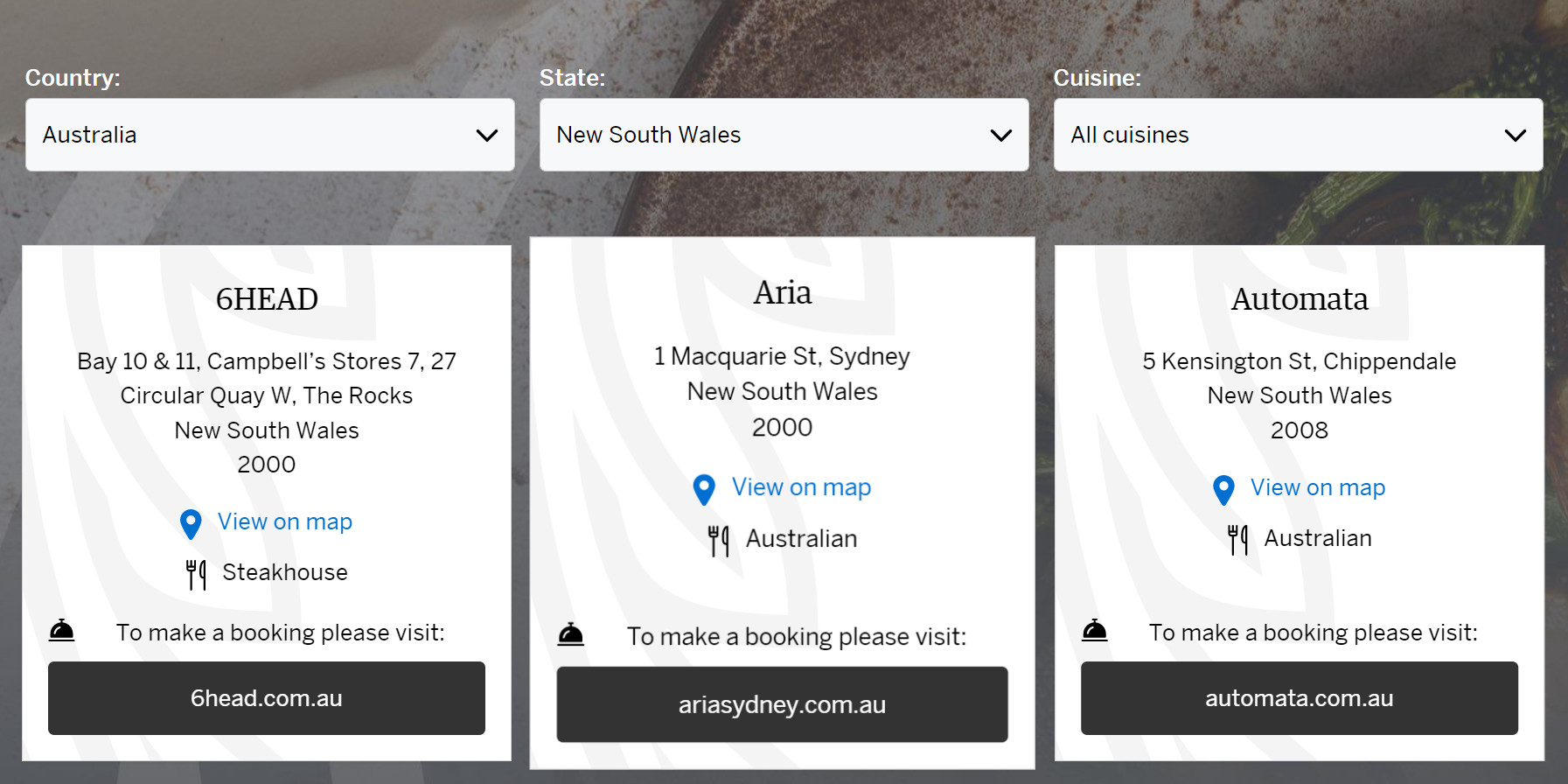

After activation, you can use one of the $200 credits at selected restaurants within Australia, and the other $200 credit overseas. Amex curates the list of restaurants, so expect to use up your credits at high-end establishments!

How do I get the Amex $400 dining credits?

Simply put, you just need to be a current, primary American Express Platinum Card Member. The restaurant credits will show up in your ‘Amex Offers’ section and you can just click ‘Save to Card’ to enrol. Make sure that you enrol for both the Australia and the overseas dining credits.

At the start of each year, the two dining credits will also refresh. So be sure to re-enrol in both offers before starting your gastronomical splurges in those years.

American Express Platinum Card

Unfortunately, Amex Platinum Business cards aren’t eligible for this dining offer.

How do I use the Amex $400 dining credits?

Once you’ve activated the credit, choose where you want to dine and enjoy! Use your linked Amex Platinum Card to settle the bill, and the $200 credit will later show up. It may take from five to 150 days for the credit to show up, but we normally see these offers credit very quickly.

Visit the Amex Dining Directory to see the full list of eligible restaurants in Australia and abroad.

And if you want to delve deeper into the fine print, take a read of the Global Dining credit T&Cs [PDF].

Summing up

American Express is enhancing the Platinum Card for Australian Card Members with a tasty treat – two lots of $200 dining credits per year: one for use in Australia and one for abroad, from now until 31 December 2025.

Just remember to enrol in both of the credits now, and again at the start of 2025. Then go out and enjoy the many flavours that our world has to offer.

If it does at the very least I would hope they will remove the currency conversion fee1 of 3% for foreign transactions as they do for US issued cards.

The travel credit is better imo – you will use them instead of your own money. This resturant perk is probably not something I would do otherwise, so it’s not really a money saver.