Update: James, a reader has heard from ANZ that life and income protection insurances only are eligible for the 10k Qantas Point bonus. While you’ll still earn points on dollars spent for the Critical Illness and Accident Protection cover, you won’t get the bonus points.

My reading of the terms confirms this, and I’m sorry I didn’t notice this first. For anyone that’s signed up for either of those policies expecting to get the bonus points, and who don’t want to continue with the cover, you may wish to cancel them now before any further monthly premiums are incurred.

Original Post:

ANZ’s insurance subsidiary, OnePath, has long had a relationship with Qantas Frequent Flyer where you can earn points on certain premiums, as well as offering bonus points for when acquiring new customers. I remember a few years back hauling in 60,000 points or more for myself and a few family members on a range of premiums at the time.

They haven’t had too many offers recently – I missed posting about a 20,000 point bonus last year for 12 months of premiums, but they are back with a 10,000 Qantas Point offer for 6 months of premiums for new customers, which has a much more appealing, shorter, waiting period. This is a great deal, depending on how much your premiums calculate to, and you can actually stack offers with two products to get a total of 20,000 points, assuming you’re a new customer.

Here are the terms, bolding mine:

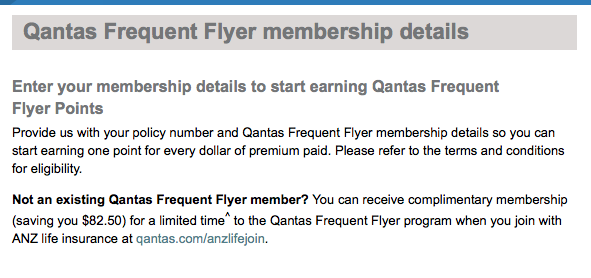

The bonus 10,000 points offer is not available for new policies within the OneCare range of products and is only available to customers who: (a) apply for a new eligible OnePath policy or eligible ANZ life insurance or income protection directly, either online via qantas.com/lifeinsurance or over the phone by calling 1800 500 229 for OnePath Life or 1300 376 978 for ANZ; (b) hold and pay the premium for the eligible OnePath policy or ANZ life insurance or income protection for a minimum period of six months; and (c) supply their Qantas Frequent Flyer membership details to OnePath Life within 30 days of taking up the eligible OnePath or ANZ life insurance or income protection policy.

Bonus Qantas Points may take up to two months to be credited to your Qantas Frequent Flyer account after the minimum holding period has expired. The maximum number of bonus points customers can earn through acquisition offers is capped at 20,000 bonus points per customer. If customers acquire more than one eligible OnePath policy or ANZ life insurance or income protection product with the same product name, they are only eligible to be credited with bonus points available as part of an acquisition once.

So, according to the above, take out two different products as a new customer, pay the premiums for 6 months, and you’ll be 20,000 points better off. The comment around ‘same product name’ means you can’t get two policies of the same type, one from ANZ and one from OnePath, and be eligible for the bonus.

The links to apply for the policies, whether they are Onepath or ANZ branded, are all on the Qantas landing page about the offer.

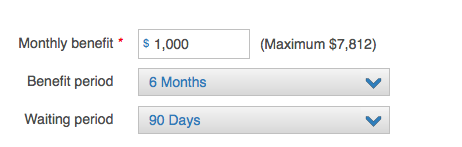

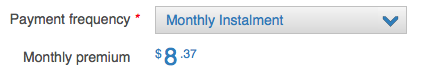

Here’s how this works out for ANZ/OnePath Income Protection Insurance – if you select the right options with the policy, and still answering the questions around your personal circumstances truthfully, I was able to get the premium down to $8.37 per month, for a total of 10,000 points for about $50.

On the premium calculation screen, you’ll need to bring the monthly benefit right down to $1,000, set the benefit period at only 6 months, and the waiting period to the maximum of 90 days.

This then yielded my monthly payment of $8.37. Paying monthly will make it easier to administer the 6 months worth of premium required.

For Life insurance, I was quoted $11.15 for the lowest level of benefits.

All of these ‘minimum cover’ premiums are close enough together in my view that you’re better off just picking the two products you actually might want insurance for, rather than just the outright cheapest.

Also, be truthful in your answers – don’t just tweak your personal details to get the lowest premium, which is probably bordering on fraudulent. What if you actually wanted to use the policy?

Final step – Adding your Qantas Frequent Flyer number to your OnePath account

One competition of signing up for a policy, you’re then given the option to add your Qantas Frequent Flyer number to your OnePath account.

This then pings you out to the OnePath admin area, where you can input your membership details (with the form underneath the below).

Some things to note…

If you do get a quote but don’t take it up, ANZ will call you to follow up and try and convert you into a customer. You’re obliged to give a phone number as part of the quote process. I’d be inclined to decline taking up the offer over the phone to ensure you get your bonus points with the online registration instead.

I can’t see that ANZ have stated an end date for this offer. This doesn’t mean it’s running perpetually though – I just think they probably don’t legally need to state a date, so haven’t, and the bonus points could go away at their discretion.

If you don’t want the premiums after the 6 months is up, you’ll of course need to call and cancel them after the 6th premium has gone out to ensure you’ll get the bonus points. You may end up keeping them (and this is, of course, what ANZ are hoping).

Finally, there’s nothing to stop your significant other also signing up (with their Qantas Frequent Flyer account linked) for these bonuses as well.

Does this apply for the One Path policies? I have in writing from One Path that critical illness cover receives the 10K bonus points and that the wording in the clauses is misleading…

I can see by what you’ve written above that you (understandably) believe that the bonus applies to all of their insurance products. It would definitely be worth updating this page, maybe even bumping it. People who pay 6 months worth of premiums, only to find they won’t get their points, might be a bit annoyed.