Yesterday Bankwest started notifying existing customers of the Bankwest Qantas World and Platinum cards that they will be cutting their points earn rates from June 20th.

Bankwest’ Qantas World MasterCard currently earns 1 point per $ – being cut to 0.66 Qantas Points per $, and the Bankwest Platinum MasterCard is currently 0.75 points per $, moving down to 0.5 Qantas Points per $.

Bankwest are the next bank to move with changes to their rewards cards – generally due to the RBA caps on interchange rates that are coming into force this year.

A decrease in points earned essentially reduces the cost to a bank of fulfilling the benefits of the card to customers, requiring fewer points purchased from the airline for the same amount of spend. In addition, the reduction of the interest free period from 55 days to 44 helps earn more revenue from card users who want to carry a balance from month to month.

We’ve added Bankwest to the list of rewards changes that have been made so far.

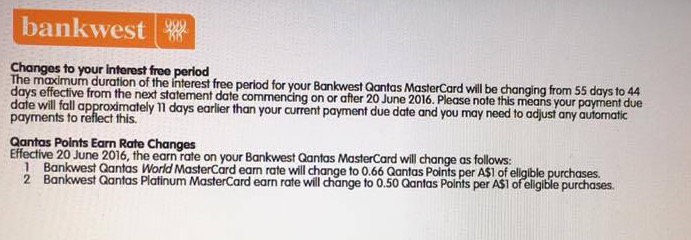

Here’s a quick shot of a statement supplied by a reader showing the official info –

Annoyingly, as an existing cardholder I am yet to receive a notification of the changes. My statement was generated around a week ago – hopefully those without statements from the last few days will get an official notification soon.

The Bankwest website is also not showing these changes to potential new applicants, both of which strike me as poor form from Bankwest, who are otherwise well respected for their generally good customer service.

This is a significant loss to affected Bankwest cardholders, who valued the Bankwest Qantas World and Platinum cards for their respectable Qantas Point earn rates alongside no foreign transaction fees, and were previously affected by a points earn devaluation as recently as June last year.

Bankwest have decided to keep the no FX fee feature (at least to our knowledge, there’s been no other changes to the products announced) – but especially for the usual $220 annual fee for the World MasterCard, this change will hurt points earning, and the appeal of, the World and Platinum Bankwest MasterCards significantly.

Thanks for the useful info. I just received this change in the email today.

I am now considering to call them up and cancel the card as I just got it since late April, and hopefully a partial refund on the Annual fees.

Dear xxxxx,

As a valued customer we’d like to inform you of some changes that are taking place that will affect your Bankwest Qantas MasterCard®.

Changes to your interest free period

The maximum duration of the interest free period for your Bankwest Qantas MasterCard will be changing from a period of 55 days to 44 days from your next statement day on or after 20 June 2016. Please note that this means your payment due date will fall approximately 11 days earlier than your current due date.

If you have a payment set up that is aligned to your due date then this will automatically change to reflect the new due date. Please ensure that you have sufficient funds from your source account so as not to incur penalty fees. If you have set up recurring payments on fixed dates then please ensure you adjust any payments to reflect the shorter interest free period.

Changes to your Qantas Points* conversion rate

As you know, currently every eligible dollar spent on your MasterCard earns you 1 point on a World card and 0.75 points on a Platinum card.

We are writing to notify you that as of 20 June 2016, the earn rate on World and Platinum cards will change. This means that for every eligible dollar spent you will be awarded 0.66 points on a World card rather than the existing 1 point and 0.50 points on a Platinum card rather than the existing 0.75. There are no changes to the earn rates on Classic or Gold cards at this time.

All of your other benefits associated with your Bankwest Qantas MasterCard will remain the same.

Now I am regretting this given the cut in earnings. I’d rather stick to a Citibank debit card with no FX and no fee.

Is anyone aware of another card that offers $0 foreign transaction fees with >0.66 QFF points per dollar earning rate?

The 3% foreign transaction fees charged by most cards far and above outweighs any QFF points benefits for those spending a lot of time overseas.

This is a big reduction meaning you have to spend 50% more to get the same points