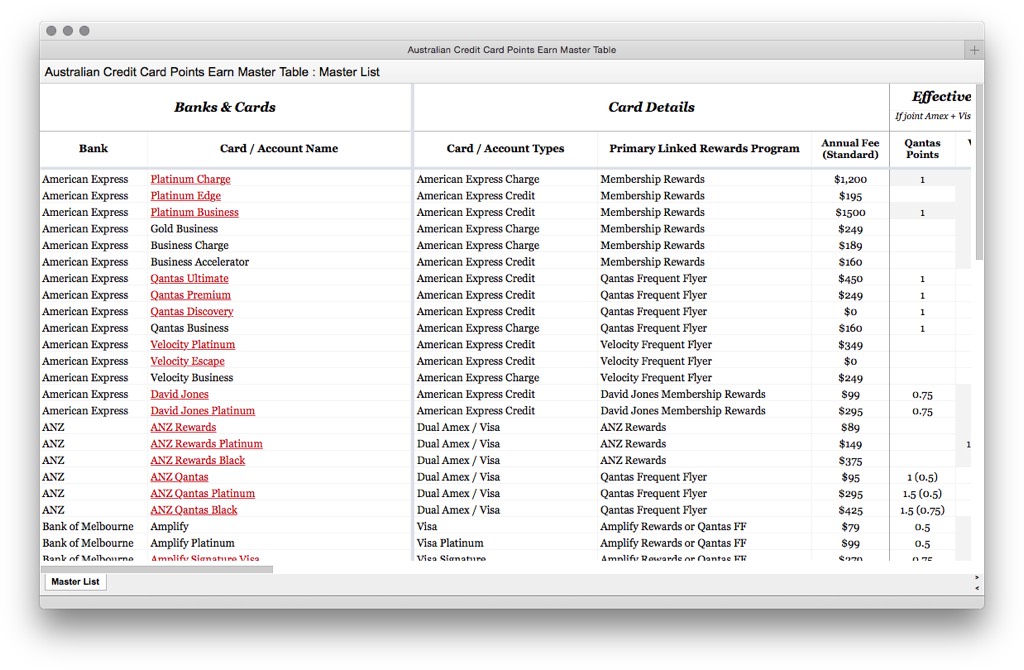

One of the hardest things to get your head around when looking at rewards and frequent flyer credit cards is exactly how many cards are out there on the market and how many points they will actually earn when you use them.

I’ve spent (quite literally) days compiling this master resource to help – note, you’ll need to be Point Hacks Community member to gain access..

The table has a large amount of the data you might want to know to effectively select a credit card that suits your own personal spend habits. For those working through the ‘Earning more points from your credit card’ email course, I hope this will become invaluable in a few weeks.

This is what is covered off:

- Issuing bank and card or account on offer

- Card types (American Express, Visa, MasterCard) – and their different flavours, e.g. Visa Prestige or World MasterCard

- Standard annual fees

- Effective earn rates per $ – factoring in transfer rates to partner programs and earn rate on the card

- The full set of frequent flyer or hotel program transfer partners for each card

- Bonus point categories on spend – e.g overseas transactions, with airlines

- Work in progress – whether the card issues points on ATO transactions

- Points caps – what cap is in place on the card and how many points you’ll earn once you exceed it

- Airline lounge access benefits – whether any are offered

What it doesn’t include:

- Current bonus or sign up offers – points or discounted annual fees

- Any existing transfer offers, such as the 15% bonus to Velocity that runs every so often

If you have ideas for any more comparison points that are essentials, add a comment and I’ll get them added in.

Hope you find it useful!

Thanks heaps for this; I appreciate the massive/awesome effort involved!

Is it possible to enable filtering on the Google Sheets version? Being able to filter out irrelevant rows would make it easier to find what I’m after, especially when viewing it on an iPad!

Cheers.

Noticed the HSBC cards were missing. Perhaps a subconscious comment the latest changes to their rewards program? Anyway I can confirm that as June this year, they were giving points on ATO payments. I couldn’t find anything in their new T&Cs to suggest that it would change. Will let you know next month if it has …..

I have summarised up the HSBC card as per your format. What’s the best way to submit it?

Andy

However, the T&Cs show a slightly improved picture. They have one bonus point per $ on overseas spend and one for QF spend too. I can personally confirm the former as of last Feb. Ref: Section 5.2 http://www.hsbc.com.au/1/PA_ES_Content_Mgmt/content/australia/common/pdf/personal/plat-qantas-rewards-tc.pdf

Also there’s own brand Platinum for $129 (though currently on offer “free for life”). Converts to KrisFlyer and Asia Miles at 0.5 points/$. No capping. Probably not worth a recommendation though except as a “free” Visa card to earn on ATO spend.

Andy

This might be me missing something but is it missing a column for the ‘sign on’ points available? i.e. initial sign on bonus of 50,000 points for the ANZ cards