A car is not typically something you’d pay on a credit or charge card. Not all dealers accept them beyond the deposit, for starters. Then there’s the issue of the credit limit and potential fees. But when the stars align, it can be very rewarding indeed.

Read on for a story of how some family members earned nearly 90,000 American Express Membership Rewards points with a new car.

Low fees, high rewards…

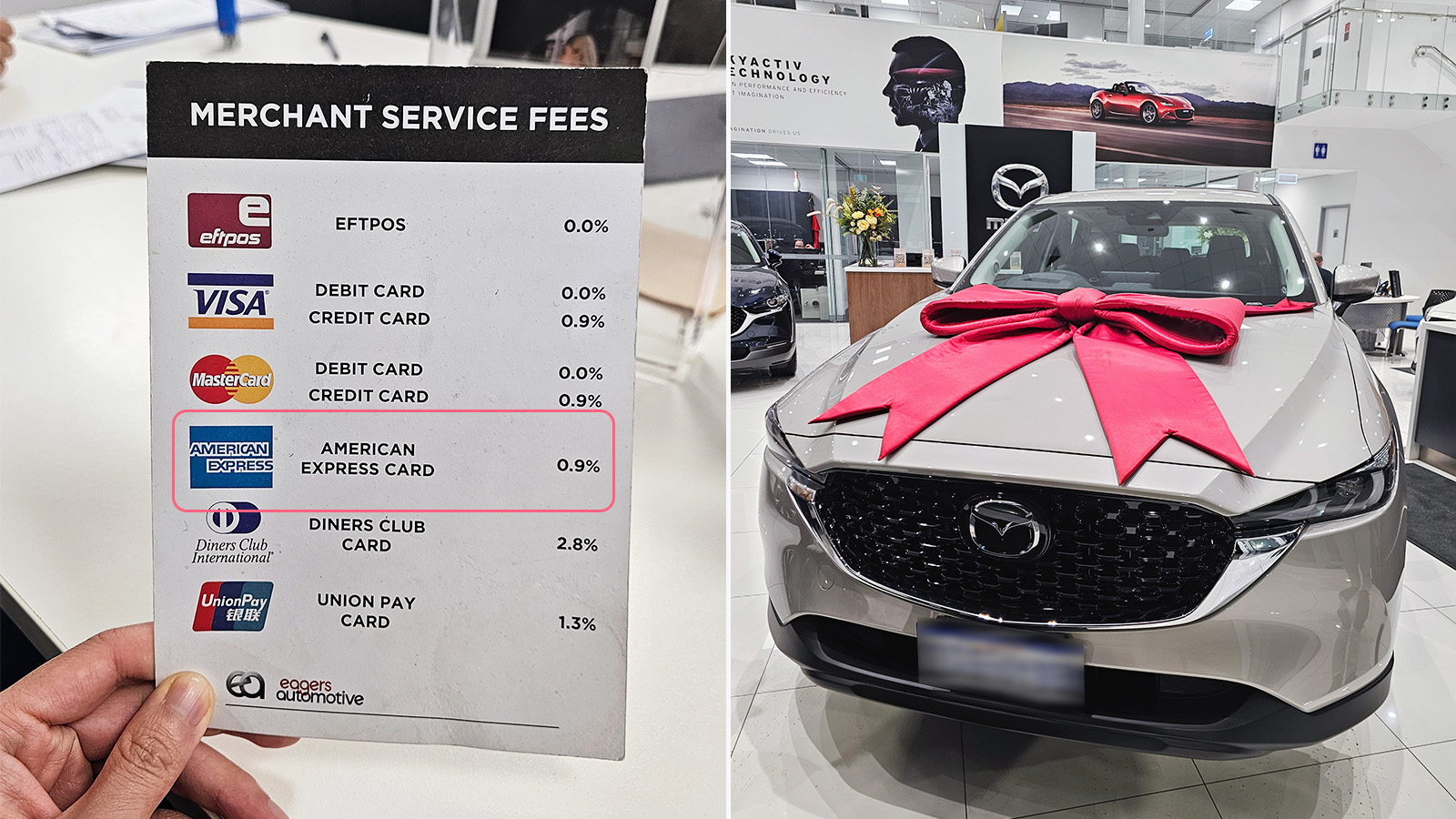

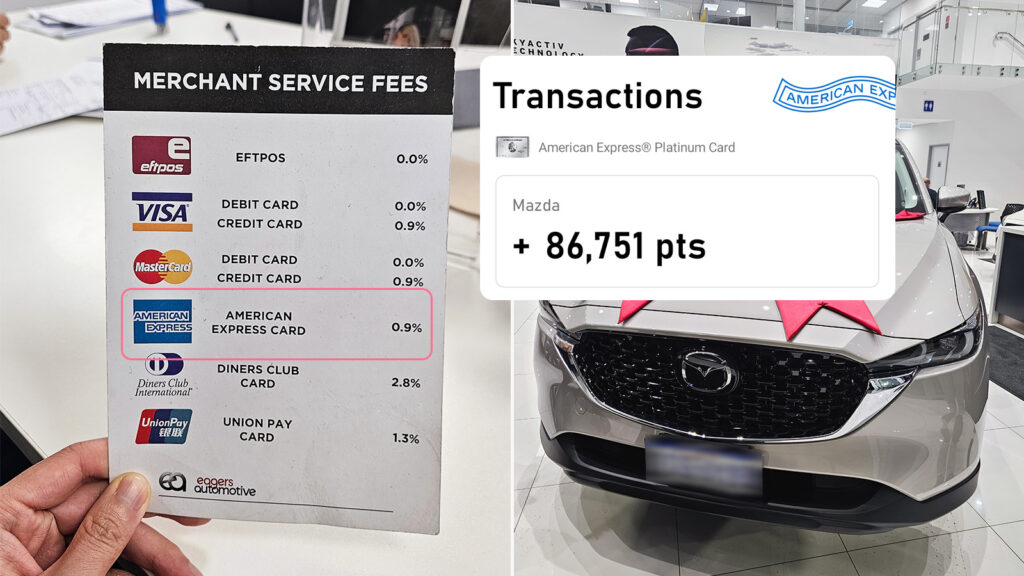

The story starts in the back office of a Mazda dealership in Western Australia. They’ve decided on a car and are talking terms when I spot the merchant fee list. American Express is listed with only a 0.9% fee – in line with Visa and Mastercard.

That’s one of the lowest Amex fees I’ve seen (beyond being fee-free), especially for such a large purchase. I know they have the Amex Platinum Charge Card, which has no pre-set spending limit and earns 2.25 Amex MR points per dollar spent.

Low fees and high rewards? This is a rare opportunity to make the most of a big purchase.

This is important: they already have the cash on hand and are planning to pay via bank transfer or cheque. Both methods have no fees attached, but they also don’t earn any rewards. So, how does using a card stack up? After they pay the deposit and we leave, I start running the sums.

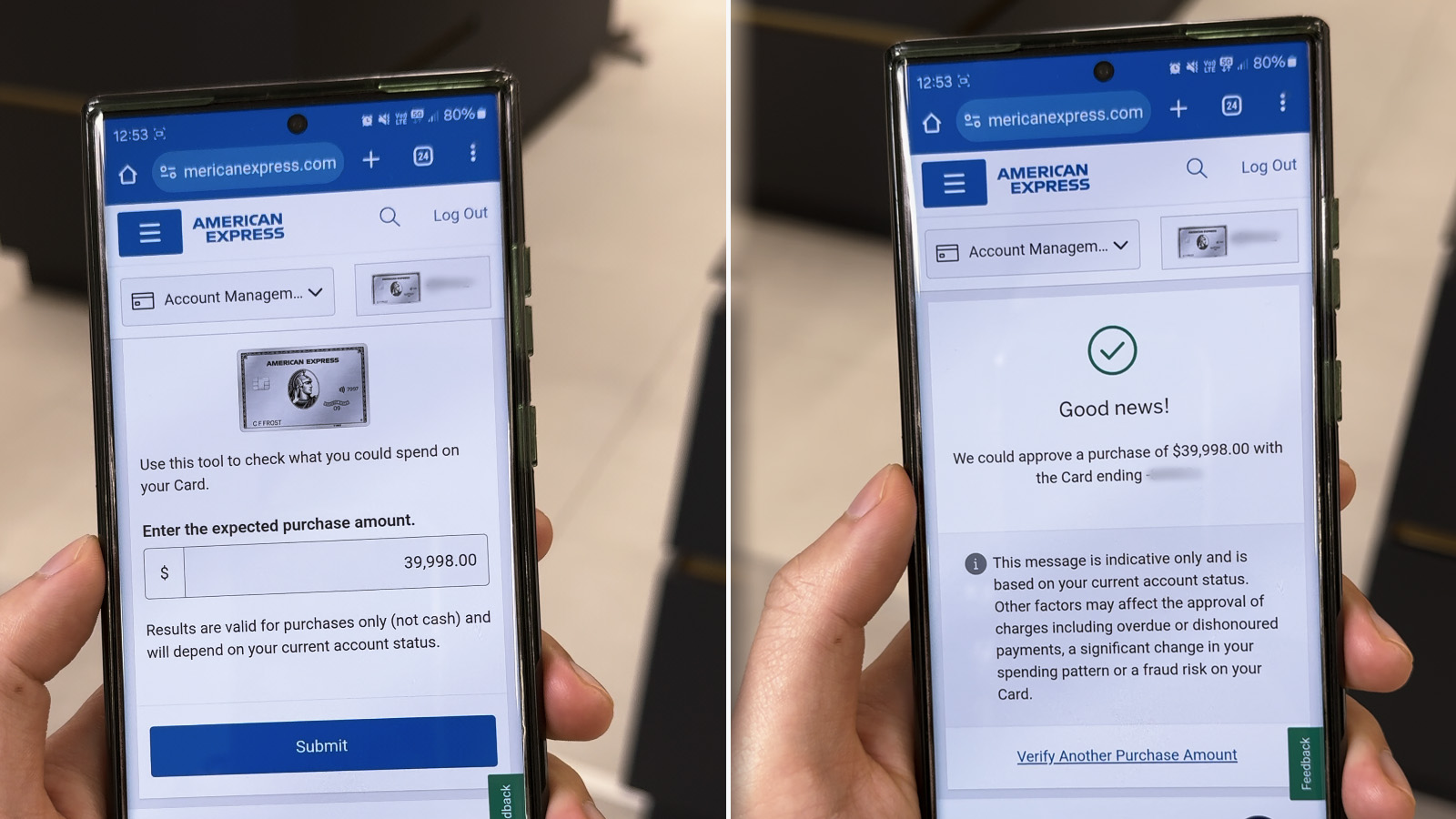

Firstly, having a charge card makes life a lot easier as there’s no credit limit. They can log in to the Amex website and use a tool to check whether Amex will likely approve a transaction of just under $40,000. Luckily, they’ve had the card for a while so Amex knows their spending and repayment history.

It comes back with a tick.

Is the fee worth the points when buying a car?

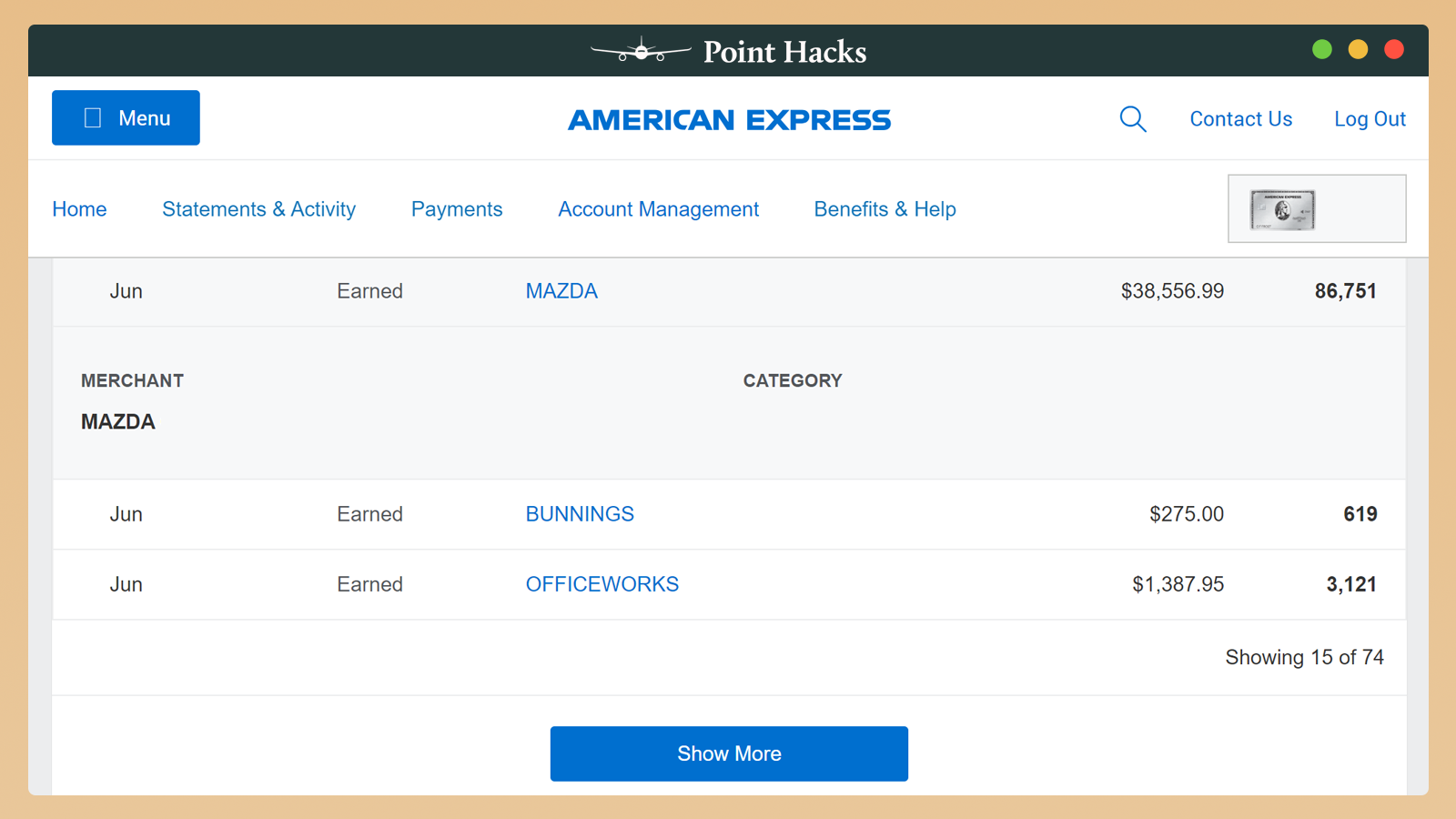

Next, the fee: 0.9% of $38,556.99 (the remaining balance after the deposit and other add-ons) is $347. For that payment fee, they would earn around 86,753 American Express Membership Rewards Points.

Is it worth it? Value is always subjective based on what you would use the points for. If you were to get gift cards – which I generally don’t recommend – you’d be able to redeem $425 worth. So that’s already more than the fee.

But I have flight redemptions in mind. Those Amex MR points could convert to at least 43,376 Velocity Points on a normal day or almost 50,000 Velocity Points during a 15% transfer bonus. That’s nearly enough for a one-way Business Class reward with Singapore Airlines from Perth to somewhere in Southeast Asia.

Plus, they can keep their cash in the bank for an additional month, giving them the potential to earn more interest in a savings account, or another month of offsetting their home loan in an offset account. The following month, they’ll transfer the full amount over to Amex to settle the bill without incurring any additional cost.

That is a steal for $347 in fees, so I give them my green light recommendation. While they are prepared to pay the extra, they get another stroke of luck. On pick-up day, Mazda doesn’t bother adding the fee. Net result: 86,753 Membership Rewards points at no extra cost!

Buying a car on a card isn’t for everyone, but if you have the opportunity, definitely consider it.

Key takeaways: earning points on a car

- Before signing on a car, check with the dealer to assess whether they will take credit cards for payment (not all do), and what the fee is. You may be able to discuss waived or lowered card fees as part of your overall negotiations.

- Check if the overall fee is worth the points earned to you. For example, if you are on a mid-tier card that earns 0.5 airline points per dollar, that might not be enough to warrant the fee. Ideally, you’d want to earn at least 1 airline point per dollar. Of course, if there is no fee, then any rewards card is worth using.

- This method is best suited for those who are originally planning to buy the car via bank transfer/cheque, and already have enough cash on hand to cover the full purchase cost.

- If the dealer allows it and you decide to pay some or all of the car amount on a credit card, only charge what you can afford to pay off in full the following month to avoid interest fees or other charges. The retail interest rate on credit cards is usually more than 20% p.a. and any late payments may incur significant costs that outweigh the points.

- If you wish to charge more than your current credit limit, check with your bank whether they will permit you to ‘pre-pay’ your card with cash in order to make the transaction. Otherwise, consider splitting payments across multiple cards or just paying up to your limit and the rest with a different form of payment. Some points are better than none.

American Express Platinum Card

This is a case study and does not take into account your personal financial circumstances. Be sure to do your own research into potential fees and other restrictions with using a credit card for a car purchase.

And you could then buy the car? Or would the limit still trigger?

However this was while American Airlines still received 25,000 miles for 60,000 Marriot. so with a 50% bonus transfer from Amex to Marriot I got a free flight to Tokyo for my time.