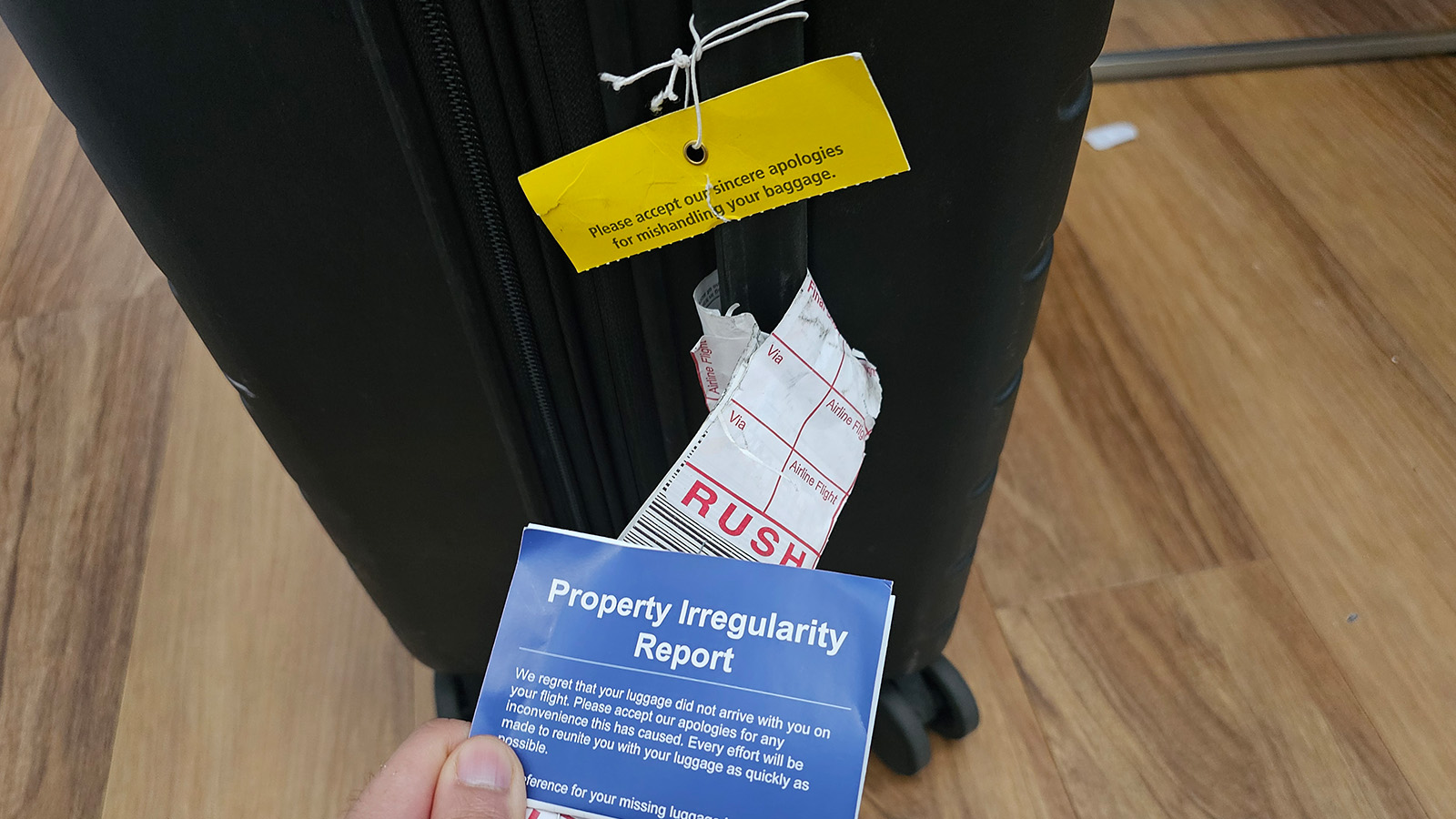

I’m standing at the baggage carousel one fine morning in Sydney, having just flown in from Colombo via Singapore with my colleague. As we idly chat about how priority baggage just doesn’t seem to work anymore, I’m aware of a growing realisation brewing in the back of my mind: maybe our bags didn’t make it?

Sure enough, the carousel eventually grinds to a halt. We glance up and down the belt; there’s not a bag in sight. If I were still overseas, I might start to panic a bit. But thankfully, we’re on our way home. Our ticket still has a Qantas flight from Sydney to Melbourne left; then, I’m swapping to Virgin Australia to reposition back to Perth.

After confirming our bags are simply delayed in Singapore, not missing, I let all concerns vanish. Instead – and it slightly embarrasses me to admit this – I feel a touch of intrigue. As it happens, I’ve paid the taxes on my itinerary on an Amex Platinum Charge Card. Now, I can finally put its travel insurance coverage to the test.

American Express Platinum Card

1. Registering our missing bags

We trudge over to the Menzies desk, as they are British Airways’ baggage handlers. With the baggage receipt information on our boarding pass (keep those; it’s very important for the insurance claim!), they trace the bags to Singapore and file a report for us. My bag will get sent back to Perth.

Now, there’s not much more to do but continue on with our journey to Melbourne.

2. Checking the PDS

I have two potential policies to claim from – an annual multi-trip policy and the American Express Platinum Card insurance policy. After comparing both, the Amex policy wins out with a more lenient definition of ‘returning home’ and a shorter waiting period before I’m eligible to claim.

Due to my rather convoluted itinerary, I’m still in Melbourne six hours after my arrival in Sydney. And since that’s not the airport I first departed from (Perth), my understanding from the PDS is that I’m covered for up to $700.

Although I’m travelling on a points booking, I pay the taxes of the flight on my Amex and that appears to satisfy their eligibility criteria.

3. Shopping for clothes

Since I’m headed back home in a few hours, I decide to limit my insurance claim to a change of clothes. At 1pm (just after six hours have passed from landing in Sydney), it’s time to go for a stroll across Melbourne Airport’s terminals in search of fresh threads.

Unfortunately, there aren’t many suitable clothing outlets in Melbourne compared to the Qantas terminal in Sydney. Sleepwear from Peter Alexander in Terminal 4 clearly isn’t going to cut it!

Eventually, I stumble across Australian Way in the T2 check-in hall, where I pick out a new shirt and a knit to keep warm. The final bill? $201.18, including a card payment fee.

If I was going to stay in Melbourne for a night or more, then I would consider claiming additional reasonable expenses such as toiletries and changes of clothing. With the American Express Platinum card, the coverage doubles if the bags are still not returned after 48 hours and you’re not back home yet.

4. Claiming online

I can’t actually lodge the claim until I receive my bag back. This saga unfolds on a Wednesday, and my bag finally shows up in Perth (via Melbourne) on the following Monday.

From there, I hop onto the Chubb portal that handles American Express claims. It asks for various documents, such as the initial baggage report, my boarding passes, the baggage delivery receipt and my clothing receipts. But once that’s all done, I’ve got a claim number, and I’m told to sit tight.

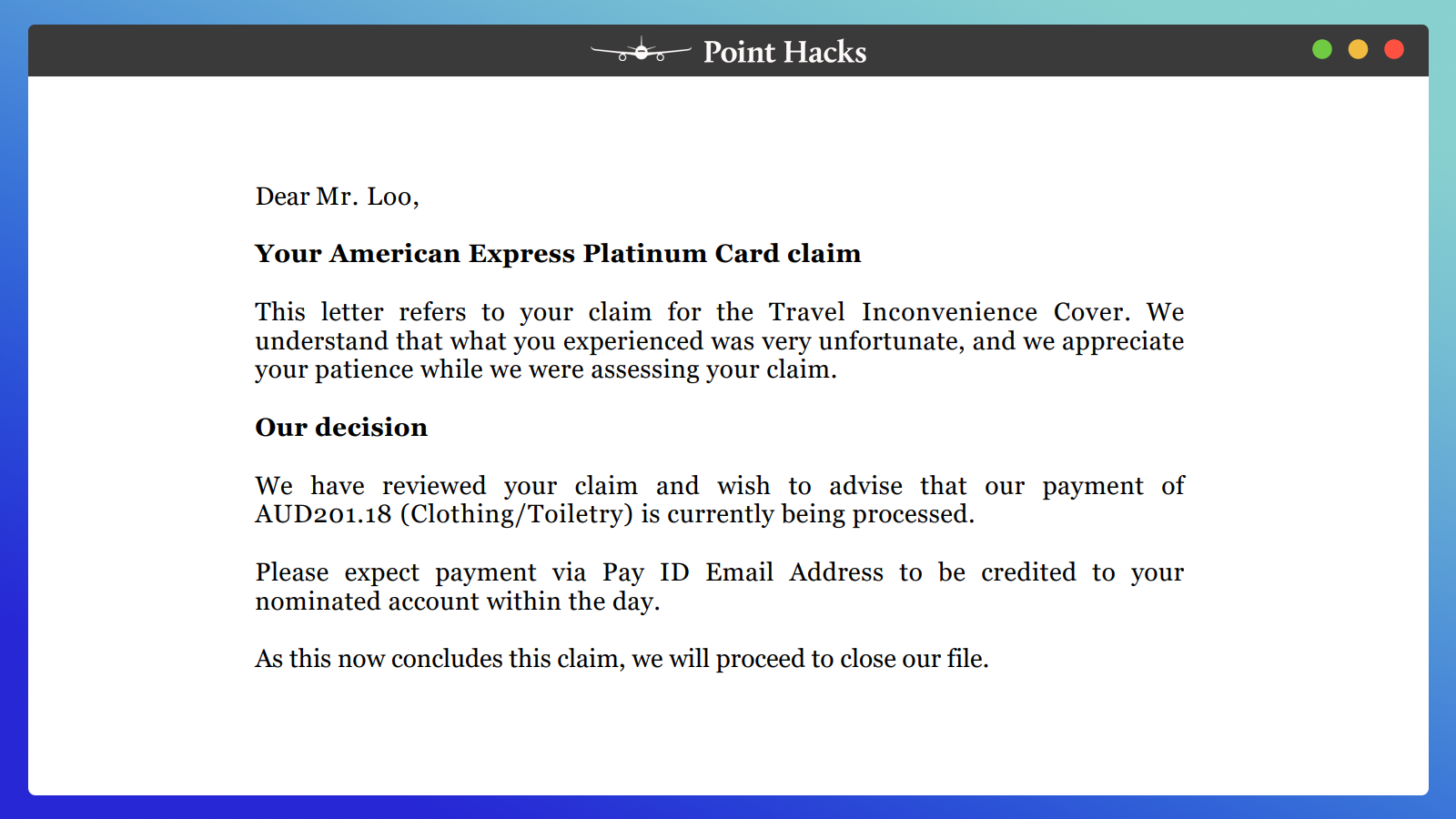

It takes eight days, but eventually, I get an email from Chubb. My claim has been approved, and the sum has been sent via PayID to the bank account I registered.

Overall, I can’t fault the claim experience, and I’ll continue to use my Platinum Card to book future trips.

Brandon Loo travelled at Point Hacks’ expense. American Express was not involved in the publication or outcome of this story.

Another thing which sucks is that nothing to do with train travel is covered (it’s the primary means of intercity and inter-country transportation in Europe).

The eligibility criteria for the Amex Platinum insurance with Chubb states the following:

International Return Trips

4. You are going on an International Return Trip and You pay the

full amount of Your outbound ticket for a Scheduled Flight or

Scheduled Cruise leaving Australia on Your:

i. American Express Card Account;

ii. corresponding American Express Membership Rewards

points or frequent flyer points (where applicable); and/or

iii. Travel Benefit.

I have a trip planned to Europe which I paid for with KF points earned flying with SQ. Even though I have paid the flight taxes with my Amex Platinum, I don’t think I will be eligible to claim because the full amount of the outgoing fare did not originate with Amex points.

Chubb advised that to satisfy that criteria there must be some link between Amex Rewards and the points used to book the flight (i.e. points transferred from AR to KF). In my case this did not happen.

As a backup I have taken out additional insurance. Has anyone had any experience with this circumstance?

So you booked using points from different sources but all taxes were paid using your Amex which makes you eligible for travel insurance?

Submitted the ER and specialist bills to Chubb and they were paid promptly.

Two months later I receive another bill for $1000 just for walking through the hospital door for the specialist’s clinical session. Pretty rude, but it is North America.

Chubb reopened my claim and again paid promptly. Outstanding.