As regular Point Hacks readers will know, there are plenty of frequent offers on credit cards. Signing up for these points-earning cards often comes with a very lucrative sign-up bonus. Most offers come with a minimum spending requirement in order to earn bonus points. This is to help the provider recoup some costs associated with offering bonus points – and to get people into the habit of using the card regularly.

How much you usually spend will determine whether you can easily meet a credit card’s minimum spending requirement. For some, regular/everyday expenses may not be enough to meet such a requirement. That’s where this guide comes in. We’ll provide some practical tips on how to meet this requirement without overspending.

It is worth reiterating: we would never suggest going into needless debt just to earn points! Interest rates on rewards credit cards are usually very high. And to avoid interest payments, these cards usually require payment of the full statement closing balance each month.

Most of the tips in this guide are about methods to timeshift your spending. This invariably means bringing payment of your regular expenses forward – not spending extra to reach a credit card’s minimum spend requirement. So, only consider offers and transactions that you know you can repay.

Content in this guide is presented as general factual information only. No personal financial advice is being given.

American Express Velocity Platinum

1. Put as many of your day-to-day transactions on your card as you can

The easiest way to meet a credit card’s minimum spend is to actually use the card – and often. That could mean using it for everything possible until reaching the requirement. Putting the card at the front of your wallet, or saving the card to your phone’s digital wallet, can be a great reminder.

Think about all your shopping, all your bills, every coffee, eating out, takeaway, etc. These could all be charged to your credit card. Many people would be able to meet a credit card’s minimum spend requirement from their regular expenses within a couple of months.

The key here is to not go on an unnecessary shopping spree. The purchases on your card should be largely what you would normally be buying anyway.

And if you’re putting your regular expenses on your credit card, don’t forget to pay off your card as you go, or you’ll risk incurring interest charges. You could pay your credit card weekly, or schedule a payment once a month. Remember, these expenses are ones you’d usually make anyway – presumably, ones you’d already have the cash for.

2. Pay your bills, even before they arrive

While a boring option, it’s also one of the easiest and best ways to reach a minimum spend on your credit card. That’s because bills can often be a larger amount than small incidental purchases. For instance, council rates can run you well into four figures if paid annually.

Many household bills will also let you overpay as a credit to future bills. And having an automatic payment set up doesn’t preclude you from making a manual payment. If you are set up for online billing, it is easy to log on and make a payment using your credit card.

Think about all the bills you pay

Sizeable bills are not just council rates. They are also health insurance, car registration, school fees, phone and internet usage, and many more. For these bills, consider pre-paying them in a lump sum, even for a year ahead. Just note that government-related charges, such as payments to the ATO, are sometimes excluded from earning points. But this is where a company like pay.com.au can come in handy. (Pay.com.au is affiliated with Point Hacks)

Some might consider applying for a sign-up bonus just before expecting some large bills to arrive. This could help to meet a minimum spend – provided the credit card application is approved.

Don’t discount subscriptions, either. If you have a subscription to a music, streaming, shopping (like OnePass or Everyday Extra) or other service, consider paying a few months in advance if possible. Or, purchase an annual subscription instead of a monthly one to help you hit your minimum spend target. This tip could even work for gym memberships or sporting club memberships. Again, the key is to timeshift your payments for ongoing expenses and services you’ll actually use.

3. Pay rent

This tip will depend on whether your landlord or real estate agency accepts credit card payments. It may also require paying through a third-party company. Note that a surcharge may apply when paying with a credit card, so it’s important to weigh up whether the additional fee is worth it to hit your minimum spend target.

Some businesses providing third-party payment services include:

4. Pay for others

We’ve all been there. You go to a restaurant as a group, and it’s time to split the bill. Why don’t you be the hero and volunteer your card for payment? You earn the points, and you can ask your friends to transfer you their share separately.

Obviously, it is a bit of work for you to calculate everyone’s share. And there is also the risk that some friends may ‘forget’ to pay. So proceed with caution on this tip if you’re not too close to your dining companions.

You could also ask trusted family and friends if you can pay some of their bills or expenses on their behalf, then have them transfer you the money. In my experience, most people (who are not earning points anyway) are happy for me to do this, and see no real difference while you reap the rewards.

5. Big-ticket purchases

If you’re thinking about a new fridge, TV, laptop, or any other big-ticket item, you could consider bringing this purchase forward to help you hit your credit card minimum spend (potentially in one fell swoop).

Buying Christmas or birthday presents for others at any time of the year is also a good way to contribute to your minimum spending requirement. Make sure you are maximising your purchases by shopping through a points-earning online mall, such as Qantas Shopping or Velocity e-Store.

Events and celebrations count as big-ticket purchases, too. If you’ve got an upcoming wedding, birthday or engagement party, consider paying your suppliers using your credit card.

6. Gift cards for future purchases

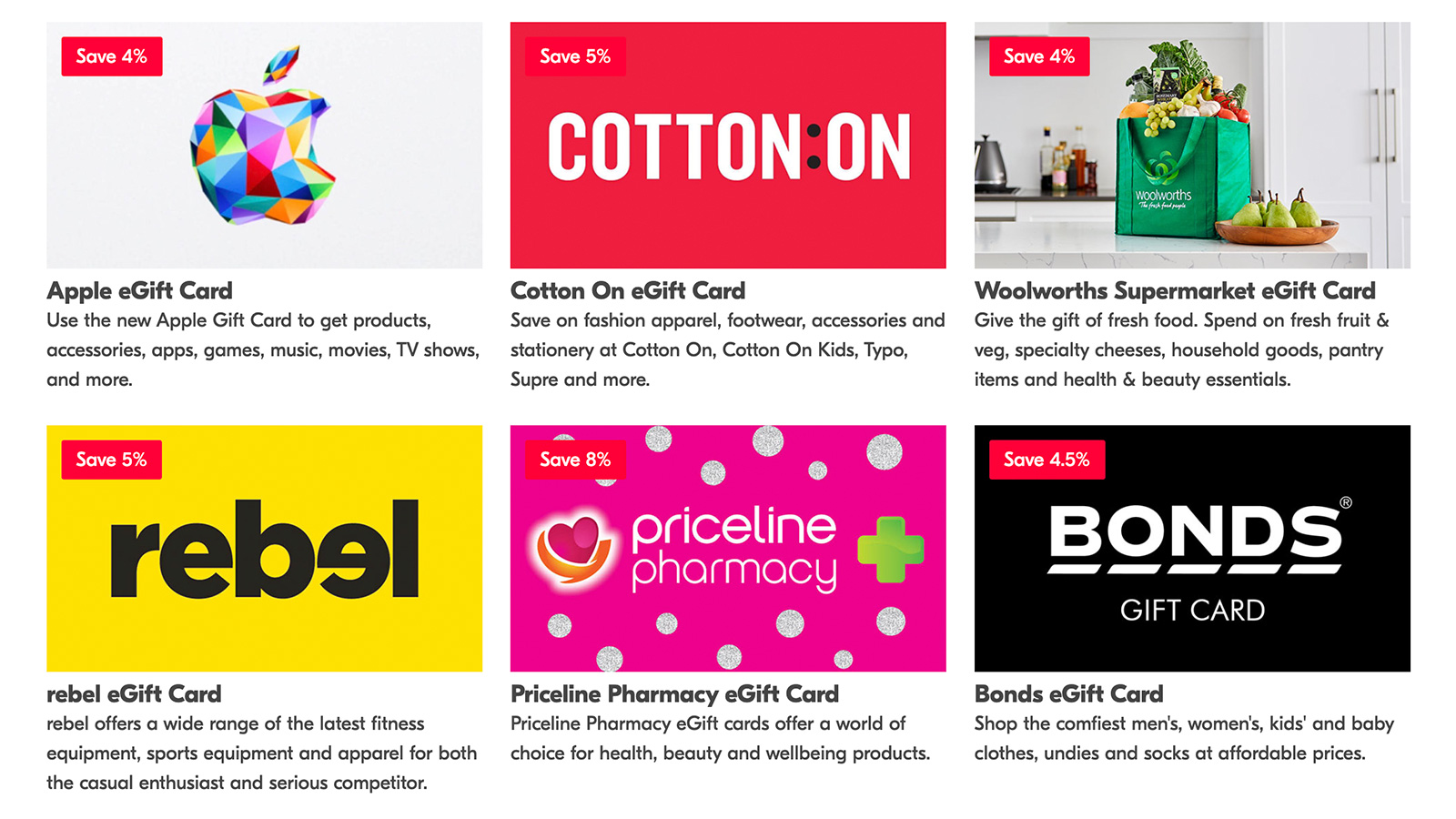

We’ve covered how you can easily earn bonus points with gift cards. But they can also help you reach your credit card minimum spending goal. If you’re a few hundred dollars short, consider buying a gift card now that you can use for future purchases. Many gift cards have an expiry of at least three years, and some have no expiry date at all.

For instance, you can buy supermarket gift cards now to reach your spending target, then use those gift cards for your groceries over the next few months.

With gift cards, be aware that you could lose any protection of insurance that you might have had if you’d bought something directly on a credit card. (How important that is will depend on what you are buying: you’re not likely to need extended warranty cover on a loaf of bread!)

Also for consideration, some gift cards may be offered at a discount through various reward portals, including auto clubs, banks and cashback websites.

7. Business or work expenses

If you are lucky enough to work for a company that will let you purchase work-related goods or services and reimburse you, you can use your credit card to make the purchase and add some extra dollars towards your target. This could work for expenses like stationery, office furniture, fuel, taxis, postage or professional memberships.

8. Book travel

If you’ve got upcoming travels, you can pay for your expenses ahead of time to reach your credit card minimum spend. This may involve pre-paying accommodation, booking insurance, or buying a new luggage.

Keep in mind that if you choose to do this for travel a long way off, you’ll need to take into account the risk of your plans changing, or the extra cost of flexible bookings (if you do not routinely book them).

9. Health-related expenses

Is it time for a dental check-up, a visit to the optometrist, or your regular remedial massage? These expenses can help you reach your credit card minimum spend sooner. Even if you have health insurance, you may be required to pay some out-of-pocket expenses or pay upfront before receiving a reimbursement. You could also use your card to cover expenses incurred at pharmacies or health food stores.

But it’s wise to only put expenses on your credit card that you know you’d be able to pay off in the short term, or that you’ve already budgeted and have the money for, as interest rates can be very high.

10. Pre-pay transport expenses

If you regularly commute on public transport, consider purchasing a monthly pass or loading extra funds on your transport card. These are expenses you’ll incur regardless, so bringing them forward can help you reach your minimum spend target.

You could also purchase gift cards or credit to load onto your Uber or other rideshare account. Or, pre-pay your parking expenses (for instance, if you frequent a carpark or use airport parking services).

Summing up

Some creative thinking about your upcoming spending should yield plenty of ideas to help you hit the minimum spend on your credit card, without spending money you otherwise would not.

Meeting a credit card’s minimum spending requirement should not be challenging or costly if you pre-plan your spending and are able to bring some of your regular expenses forward. Remember, you shouldn’t incur additional expenses or run yourself into debt trying to reach a spending goal to earn points.

Do you have any other tips to help meet a minimum spend requirement? Share in the comments below!

Originally written by Evin Tan Khiew, with updates in September 2025 by Chris Chamberlin. Featured image: Mockuuups, Unsplash.

Also read: How to earn points from energy and utilities

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

![Our roundup of credit card offers to know about this month [December 2025]](https://i.pointhacks.com/2017/06/23173719/credit-card-stocksnap-300x171.jpg)

Community