As your business expands, corporate spending can become more cumbersome to manage, especially across multiple employees. Enter Archa. It’s a cutting-edge card platform designed specifically for medium-sized and high-growth businesses.

Unlike traditional banking options, Archa is scalable and easily customisable. You can issue new cards with just a few clicks and have complete control over individual limits and more. Best of all, Archa offers many business-friendly perks such as Velocity Points on overall spending, no foreign exchange fees^ and even integrated Travel Cover, underwritten by Mastercard and AIG Australia Ltd.

How to earn Velocity Points with Archa

It’s quite simple. For every dollar you or an employee spends on an Archa corporate card, you’ll earn 1 Archa Reward Point. You can then convert 2 Archa Reward Points to 1 Velocity Point via your linked Virgin Business Flyer account.

Archa also offers massive Velocity Points sign-up bonuses. Check the website for the latest offer. At the time of writing, you can earn from 50,000 bonus Velocity Points (open at least five corporate cards) to 250,000 bonus Velocity Points (open at least 20 corporate cards) with the Professional or Custom plan.

At the top end of the scale, 250,000 Velocity Points are enough for three one-way Business Class tickets from Sydney to Singapore with Singapore Airlines* (and you’re only 10,000 points away from having a fourth ticket).

Or if your travels are closer to home, that’s also enough for a whopping 16 one-way Business Class tickets between Sydney and Melbourne with Virgin Australia*.

* Fees and charges are also applicable to reward seats and are not included in the points cost.

Save on fees and simplify corporate cards with Archa

Don’t rely on employees spending their own money in advance and then lodging reimbursement claims later on. They can easily spend with their corporate card, nearly anywhere in the world.

Zero transaction fees on overseas spend^

Archa uses Mastercard with no foreign exchange markups, potentially helping businesses save thousands each month. Unlike some other bank cards, which often charge international transaction fees and might not be widely accepted, Archa is ideal for common expenses such as travel, entertainment, and subscriptions.

^ You’ll only pay the Mastercard FX fee, and save on the bank markup which is typically 3%+ on all overseas spend.

Built-in accounting integrations

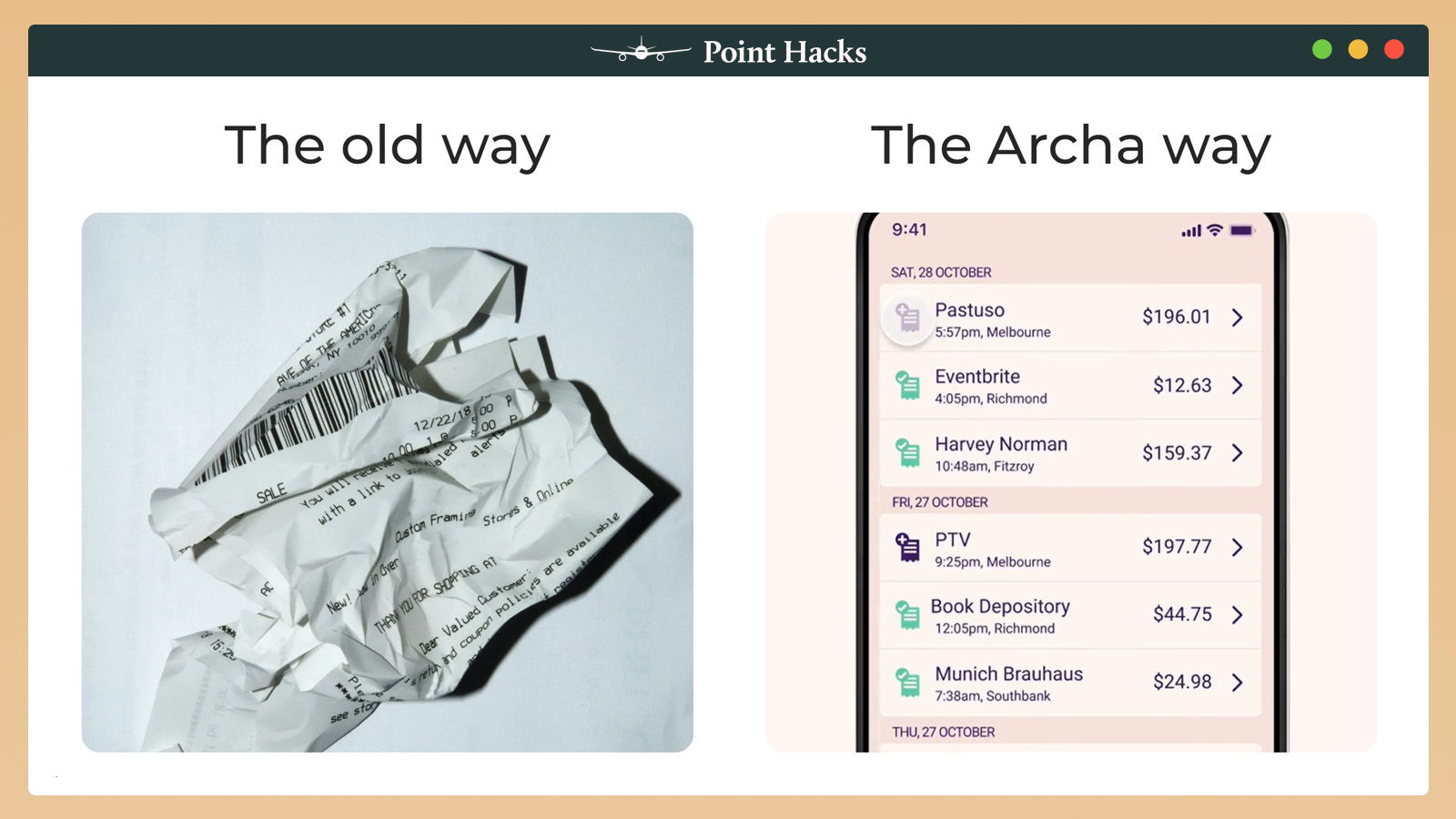

The all-in-one card and spend management platform is designed to simplify business operations. You can easily issue and manage cards and customise limit settings. Your accountants will thank you with seamless integration with systems like Xero and SAP Concur. Cut down on data entry, manual work, and chasing down receipts, saving many business hours each month.

Archa Apple Pay and Google Pay support

Archa cards support Apple Pay & Google Pay, meaning you can use their cards on your compatible device for easier payments.

How much does Archa cost?

While traditional corporate card products often cater to sole traders or micro businesses, Archa is primarily designed for companies with 25 to 500 employees. Having said that, Archa offers a range of plans that start with a minimum of two cards.

- Essential: From $50/month with two cards, a 30-day line of credit and a $5,000 credit limit (not eligible for points).

- Professional: From $150/month with five cards and a $20,000 credit limit. Scalable with additional cards and credit limit increases available. Earns Velocity sign-up bonuses and Archa Rewards Points.

- Custom: Tailored to your business with flexible credit options.

Yeah, na.