Qantas Frequent Flyer remains Australia’s most popular loyalty program, and a well-chosen credit card is still one of the easiest ways to earn meaningful Qantas Points on your everyday spend.

With new card offers, varied earn structures and changes to welcome bonuses over the past year, it’s worth reassessing which cards deliver the best value today.

In this guide, we break down the key questions you should ask yourself – from how you spend and whether you value lounge access, to annual fees and bonus point thresholds – before choosing a Qantas-earning credit card that helps you maximise your points earning potential.

Best Qantas Frequent Flyer credit card sign-up bonus point offers this month

| Credit Card | Qantas Bonus Points | Earn Rate | Annual Fee | Card Guide |

|---|---|---|---|---|

American Express Platinum Business ↓ | 175,000 Points (equivalent) | 1.125 points on all eligible spend, and 0.5 point on spend at government bodies | $1,750 | Read the guide |

American Express Qantas Business Rewards ↓ | 170,000 Points | 2 Qantas Points per $1 spent on Qantas, 1.25 on everyday business, and 0.5 on Gov. spend | $450 | Read the guide |

NAB Qantas Business Signature | 150,000 Points | 1 Qantas Point earned per $1.50 spent, capped at $5,000 per statement period | $295 | Read the guide |

Qantas Money Titanium ↓ | 150,000 Points | 1.25 Qantas Points on general spend, 3.25 points with Qantas, 2 points on overseas spend | $1,200 | Read the guide |

Westpac Altitude Qantas Black ↓ | Up to 150,000 Points | 0.8 points on everyday spend, 0.5 points on all other eligible spend. 1.2 points on overseas spend | $370 | Read the guide |

NAB Qantas Rewards Signature ↓ | Up to 130,000 Qantas Points | 1 Qantas Point earned per $1 spent up to $5,000, then 0.5 points per $1 thereafter, capped at $20,000 per statement period, plus 1 additional Qantas Points earned per $1 spent on selected Qantas products and services | $420 | Read the guide |

NAB Qantas Rewards Premium ↓ | 100,000 Points | 1 Qantas Point earned per $1.50 spent up to $3000, then 0.5 points per $1 thereafter, capped at $6,000 per statement period | $295 | Read the guide |

Qantas American Express Ultimate ↓ | Up to 100,000 Points | 1.25 Qantas Point per $1. 2.25 Points on Qantas products. 0.5 Qantas Points on Gov. spend | $450 | Read the guide |

Qantas Money Platinum ↓ | Up to 100,000 Points | 1 point on general spend up, 1.50 points on overseas spend. 1 point per $1 with Qantas | $349 for the first year and $399 p.a. ongoing | Read the guide |

American Express Platinum ↓ | 100,000 Points (equivalent) | 1.125 points on eligible spend, 0.5 point on spend at Gov. spend | $1450 | Read the guide |

The offers displayed on this page are selected from a range of products across pointhacks.com.au as at the time of publishing this article. The use of terms “Best” and “Top” is derived from the highest bonus points offered.

What are the best credit cards for Qantas Frequent Flyer Points?

Here’s a roundup of some Qantas Points-earning cards with bonus offers to know about this month.

American Express® Platinum Business Card

American Express Qantas Business Rewards

NAB Qantas Business Signature

Qantas Money Titanium

Westpac Altitude Qantas Black

NAB Qantas Rewards Signature

NAB Qantas Rewards Premium

Qantas Money Platinum

Qantas American Express Ultimate

American Express Platinum Card

What are the best ways to earn Qantas Points with a credit card?

There are two main ways to earn Qantas Points with a credit card.

- Direct earn: These are Qantas Frequent Flyer–branded credit cards that earn a fixed number of Qantas Points per dollar spent. Points are automatically transferred to your Qantas Frequent Flyer account each month.

Banks currently offering cards that earn Qantas Points directly include Qantas Money, American Express, HSBC, ANZ, NAB, Westpac, St.George, CommBank, Bank SA, Bank of Melbourne, MyCard and Bankwest. - Transfer from other rewards programs: This option is less common for Qantas Frequent Flyer. Only selected cards – such as American Express Platinum cards enrolled in the Ascent Premium Membership Rewards program and Westpac Altitude Business cards – allow you to transfer points to Qantas.

These cards earn their own flexible rewards currencies first, which you can later convert to Qantas Points or other airline partners. The key advantage here is flexibility.

You control when (and where) you transfer your points, and you can also take advantage of occasional transfer bonuses.

What to look for when searching for the best Qantas frequent flyer credit cards?

- Bonus points offer: Qantas credit cards often come with generous sign-up bonuses, with 60,000 to 100,000 Qantas Points or more commonly seen. That said, don’t let a big headline number be the only deciding factor. Always check the annual fee, minimum spend requirement and eligibility criteria before applying.

- Earn rates: How many points you earn per dollar on an ongoing basis matters just as much as the sign-up bonus. As of January 2026, one of the highest day-to-day earn rates is 1.25 Qantas Points per dollar, uncapped, through the Qantas American Express Ultimate card.

Most Visa and Mastercard Qantas cards earn between 0.5 and 1 point per dollar. Many also apply monthly caps, which can limit how many points you earn if you have large expenses coming up.

- Bonus travel inclusions: Higher-end cards often include additional perks designed to enhance your travel experience. One example is the Qantas Money Titanium Card, which offers two Qantas First Lounge invitations each year. Other premium cards may offer standard Qantas Club passes, travel credits, or elite-style perks instead. The key is to consider whether you would realistically use these benefits.

- Included insurances: Many higher-tier Qantas cards include complimentary insurances, most commonly travel insurance when you pay for flights or accommodation using the card. However, these policies often come with strict conditions.

What to be mindful of with Qantas frequent flyer credit cards

It’s important to know that the points you earn from credit cards are not truly free. There’s a cost somewhere, and that’s usually the annual fee.

- Annual fee: Generally, the more benefits a card includes, the higher the annual fee. Premium cards can cost $200 to $1,200 per year. You need to decide whether those fees make sense for your situation. If you rarely travel or don’t use the included perks, a lower-fee card may offer better value.

- Interest rate: Rewards credit cards usually come with high interest rates and are best suited to people who pay their balance in full each month. Doing so avoids interest and late fee charges. If you tend to carry a balance, the interest charges can quickly outweigh the value of any points earned.

- Interest-free days: Most credit cards offer around 44 to 55 interest-free days on purchases, which is standard across the industry. This provides some flexibility, as long as the balance is paid off by the due date.

- Income requirements: Higher-tier cards often require a minimum income. Banks may ask for payslips or other proof of income, and in some cases, they may consider combined household income. Check the eligibility criteria before applying to avoid unnecessary rejections on your credit file. Banks tend to favour regular income over savings, so retirees may find it difficult to apply for a credit card.

What do I need to know before I apply for a Qantas credit card?

Here’s a quick checklist of what you should know before applying for a Qantas credit card:

- Am I eligible for the bonus points? Many bonus points offers exclude applicants who have held a card with the same bank in the past 12 to 24 months.

- Can I realistically meet the minimum spend? Most bonus offers require you to spend a certain amount within a set timeframe, such as $3,000 in 3 months or $1,500 per month for 6 months. If that level of spend doesn’t fit naturally with your budget, it may be better to choose a smaller bonus with more achievable criteria.

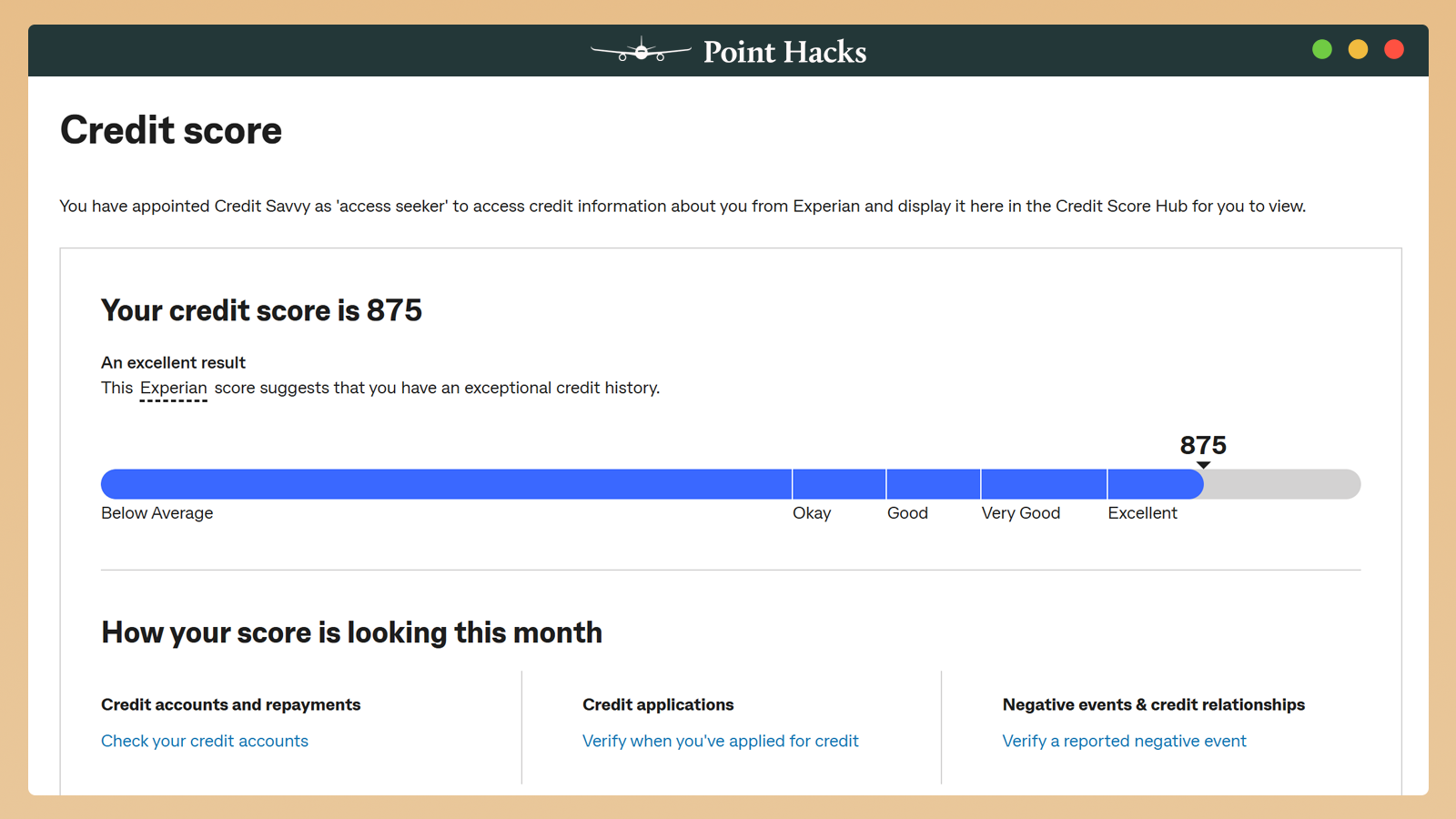

- Is my credit history in good shape? Applicants with a strong credit history generally have a much higher chance of approval. If your credit file shows missed payments or multiple recent applications, it may be worth addressing that first. If you’ve been declined, it’s best to wait a few months before making any further applications.

How can I earn Qantas Points after I get my credit card?

Once you get your Qantas credit card, you’ll usually need to meet the minimum spend requirements to unlock the applicable sign-up bonus. Once that bonus is secured, there are a few strategies to keep the points flowing in.

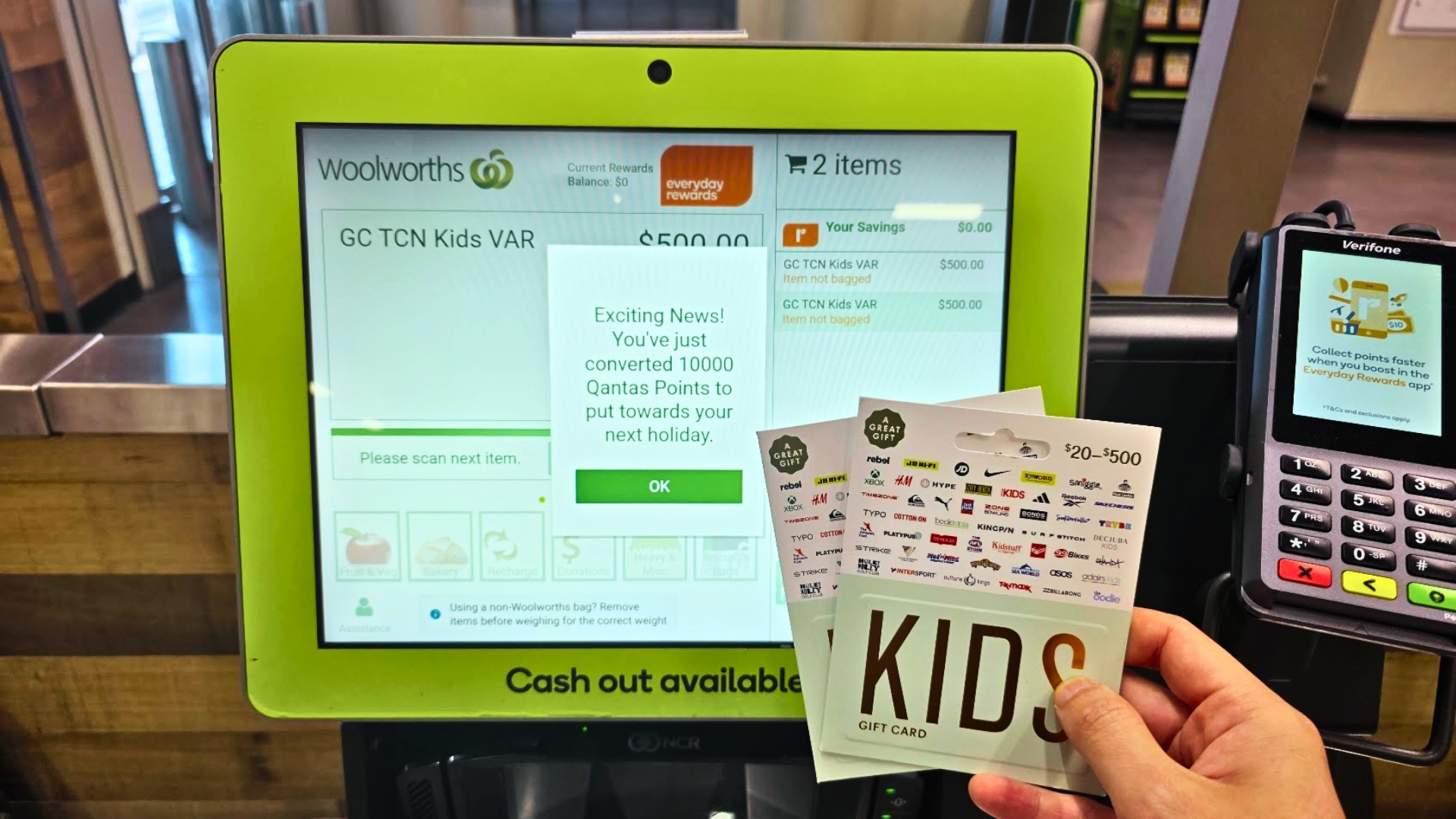

- Use the card for everyday spending: groceries, fuel, subscriptions, bills, flights and online shopping can all contribute to your points balance – as long as you pay the card off in full each month.

- Look for bonus earn partners: Qantas partners with many retailers and services through platforms such as Qantas Shopping and other promotions, allowing you to stack extra points on top of your credit card earn.

- Watch for transfer bonuses: If you hold a card that earns flexible points (such as Membership Rewards), transferring to Qantas during a bonus promotion can significantly boost the value of your points.

Frequently asked questions

The following answers are general advice and do not take into account your personal circumstances. Be sure to consider all aspects of a Qantas credit card before applying.

Generally speaking, the Qantas American Express Ultimate has the highest day-to-day earn rate at 1.25 Qantas Points per dollar spent on most transactions. Many other cards also have high sign-up bonuses.

What is the best frequent flyer credit card in Australia?

The best frequent flyer card depends on everyone’s individual circumstances. This guide will help you understand many aspects of a Qantas-branded credit card so you can make the best choice for yourself.

What credit cards can earn Qantas Points?

As of January 2026, these banks and companies issue credit cards that can earn Qantas Points on spend. Qantas Money (NAB), Commonwealth Bank, American Express, ANZ, NAB, Westpac, Bankwest, St.George, BankSA, Bank of Melbourne, MyCard and Qudos Bank.

Are Qantas Frequent Flyer credit cards worth it?

Qantas Frequent Flyer credit cards can be worth it if you can use the points you earn for premium redemptions with Qantas or other partner airlines. Be sure to assess your personal financial circumstances before applying.

no mention of Commbank Ultimate Awards Card? 70,000 points with no annual fee*

downside is – To be eligible for the 100,000 CommBank Awards points on a new Ultimate Awards card, you need to spend at least $6,000 on eligible purchases (excludes balance transfers, cash advances and any purchase that is reversed or refunded) using your new card within the first 90 days of activation.

Hi Points Hack,

Do you have a page where new Qantas credit cards are mentioned as soon as they are released? Which isn’t very often as they have really gone downhill since 2020.

Thanks

How many credit cards can I apply for in a year? Even with a 100k sign up bonuses, you don’t have enough to fly business return for example to Europe.

Thanks

Would there be any issue with getting a card and grabbing the free points and/or air miles and then cancelling before the 12 months is up so not to pay the renewal? Anything in the small print to state you have to renew it or pay back the points/air miles?

Hi Jeff, once you’ve earned the points and they’ve landed in your frequent flyer account, you won’t lose them if you then close your card account before the 12 months are up.

I have just accepted an offer from Amex to upgrade my free Amex back to the Qantas Ultimate (that I have previously held but downgraded whilst living outside of Australia) for 60k bonus points with 3k spend in 3 months.

I am able to keep spending on the old card until the new one arrives (very convenient). I have some major purchases to make this week: will they count towards my 3k in 3 months even if made on the old card?

Hi Andy, this is quite a unique situation so you’ll need to check with Amex. To be on the safe side, I would only count transactions made on the Amex Ultimate card from the date you activate it.

What about the St. George Amplify Qantas Signature (90k points + other benefits at $279/pa).

For me this makes more sense as it includes a free additional cardholder that I need.

With periodic card renewals between my husband and I, we like to pick up the best deals in year. Currently we renew most in January but was wondering whether there is a trend on the max points offered over the year. For example, if May is the optimal renewal month for certain cards based on prior year bonus points, would be good to plan accordingly. Any intel on this? Thanks

The annual fee listed on the table for the Qantas ANZ Frequent Flyer Black card appears to be wrong. On the link and Qantas’ website the annual fee is listed as $425, not $0 as listed above on the comparison chart…Am I missing some cool loophole?

Thanks Jordan, this has been fixed.

Evin, one hidden downside of QF Premier credit card is that if you organise a direct debit to pay off in full each month, QF will attempt to take the full amount owing even if you have paid off in full eg to make room in your available balance. If this payment is dishonoured even if you have paid off in full QF will slug to a $15 dishonour fee. The bank the direct debit comes from may also charge yiu a fee.

Hhhmmmmm. Good piece Evin, but after tonight’s booking debacle, heck, why bother, really?

This isn’t the first such desertion of its FFrs by Qantas, is it? Points only useful if usable….when you want to. Guess I’m not the only one in Oz tonight, totally helpless in the face of “Qantas.com is not responding'” on their booking site, & without a voice (laryngitis!) to even TRY ringing in. My first ever first class booking (that lovely Emirates taste, Syd-Christchurch) has been stuck at the very last stage for 62 mins now, that was starting some 2.5 hours before, presumably, the deadline, not just ten minutes. Trying to sneak in via another browser was way worse: couldn’t even get the destination in. Spent all arvie on getting ducks in row for this, impossible before today, as for others I’m sure. Where are you when we need you Qantas?! Hi there, again, Velocity!