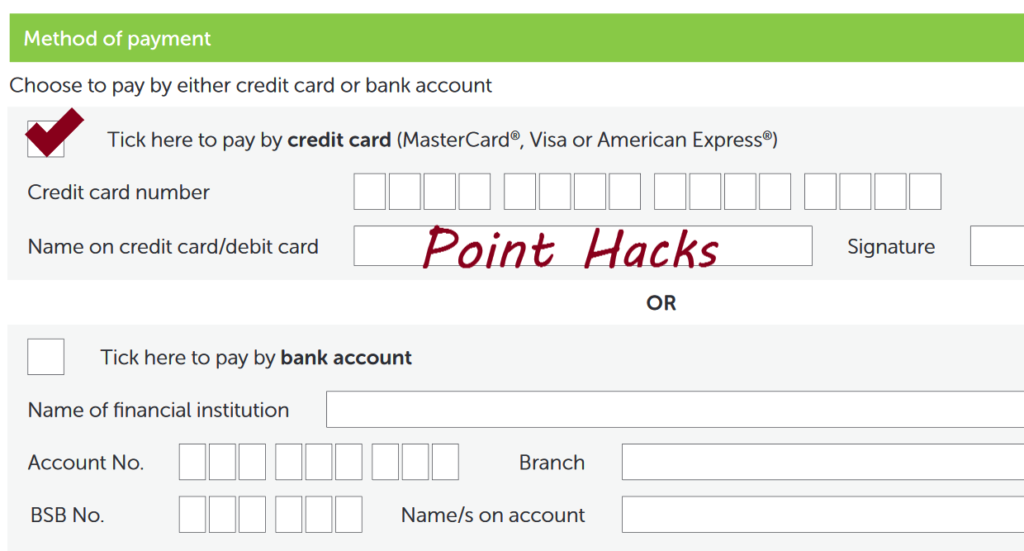

There are a number of ways to pay your bills and earn points, with the most common being BPAY and ‘direct debit’, either through your bank account (a true direct debit), or more commonly now through your credit card.

The term can describe either scenario, which does get confusing. Throughout this article, we generally mean ‘using your credit card to regularly and automatically pay bills’ when we say direct debit. Different providers may call this process different things, so it pays to read the terms carefully.

The main advantage of direct debit is that once you’ve filled in the form and sent it off, your bills are paid automatically, so there’s minimal chance of being late with a payment. Use a suitable rewards card, and you can be getting a regular boost of Qantas or Velocity Points!

If your utility provider doesn’t seem to offer automated credit card payments, there’s no harm in asking.

There are other companies where automated payment from a credit card just isn’t possible, so you may have to pay manually every cycle if you want to use a credit card.

As we’ve noted in the First Principles series, direct debit is a pretty big part of a good points strategy.

List of Utilities and their Direct Debit forms

Here’s the set of quick links to make it easier for you to get your direct debits happening. Even though we’re only covering the main utility providers at this stage, don’t forget that you can more than likely have direct debit set up for your insurances, as well as many other regular bills such as gym memberships and rent.

The links below will take you to either

- A form that will need to be printed and posted

- A form that will need to be filled out online and submitted

- Instructions on how to change your payment method to an automated credit card system

Telecoms

Telstra: direct debit setup page via login

Optus: instructions on setting up a direct debit

Vodafone instructions on setting up a direct debit

Virgin Mobile: instructions on setting up a direct debit

iinet: instructions on setting up a direct debit

Internode: instructions on setting up a direct debit

iPrimus: direct debit setup page

TPG: instructions on setting up a direct debit

Gas, Electricity and other Utilities

AGL: direct debit setup page

Energy Australia: direct debit setup form

Ergon Energy: instructions on setting up a direct debit

Lumo Energy: instructions on setting up a direct debit

Origin Energy: direct debit setup page via login

Red Energy: direct debit setup form

More about paying your bills with your credit card using direct debit to earn points

The obvious downside to direct debit is lack of control. You have to know there’s enough credit available on your credit card for the payment to clear, and to trust that the correct amount is billed.

Of course, there will be some providers that might not even have a credit card direct debit option. In this case, consider a standard bank account direct debit or pay your bill manually each cycle.

Some credit cards will assign a lower points earning rate to amounts spent on utilities, insurances and government charges including Australia Post Billpay, and some may not even offer any points at all. This will normally be buried somewhere in the card application page (see below example).

A workaround could be to use Paypal for utilities that accept it, as Paypal has been handling payments via American Express for a while now and Paypal payments should earn you points on your Amex at the full earn rate. However, not all billers that accept PayPal will allow Amex cards to be processed through them.

How to set up a direct debit with PayPal

Even if you are able to make direct debits to a certain provider with a standard credit card (Mastercard, Visa or American Express), there may be some advantages to using PayPal to process the payments, depending on your personal circumstances.

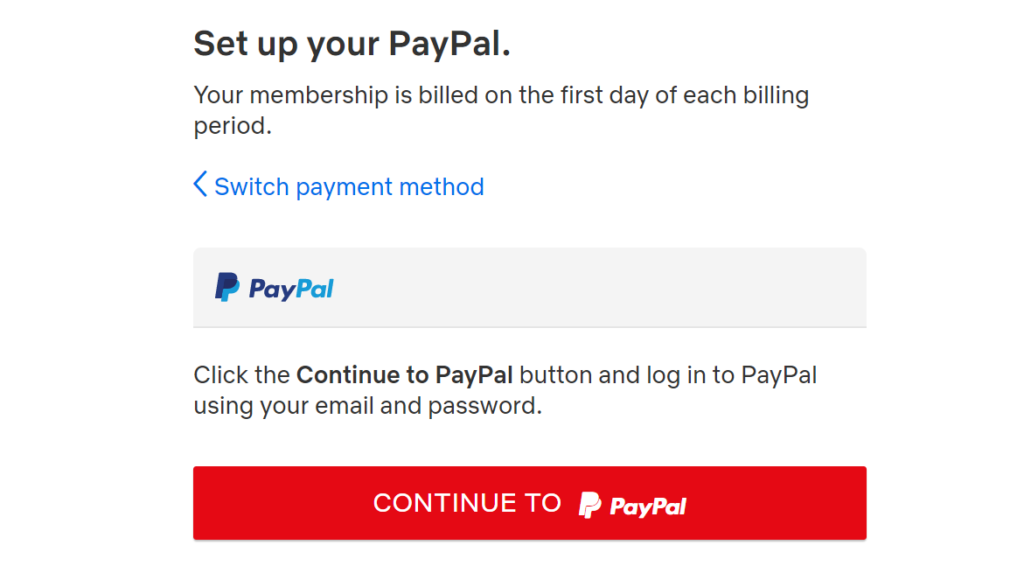

Here is a step-by-step guide on how to set up a direct debit with PayPal.

Note that your provider must accept PayPal as a form of payment and you can check this on the provider’s website. The page will most likely be different from the screenshots below, but should still have the same basic flow.

- Find the page where you can set up direct debits with your provider and select ‘PayPal’.

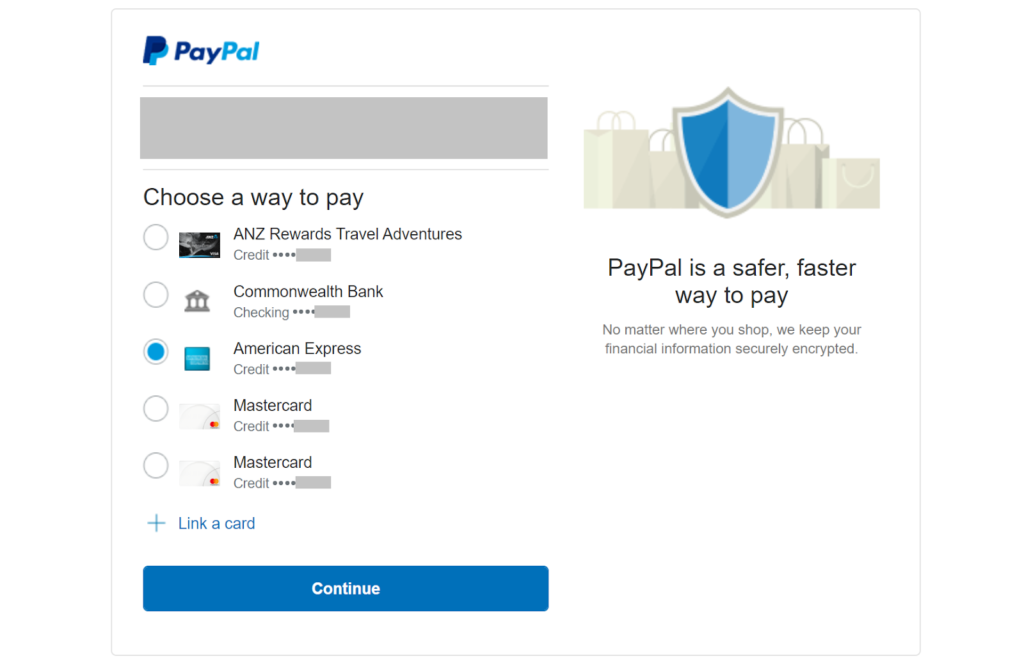

- Log in to your PayPal account (assuming it is already set up with your cards).

- Choose how you would like to fund your direct debit. This could be with your PayPal balance, or any cards and bank accounts attached to your PayPal account.

- Your direct debit with PayPal is set up.

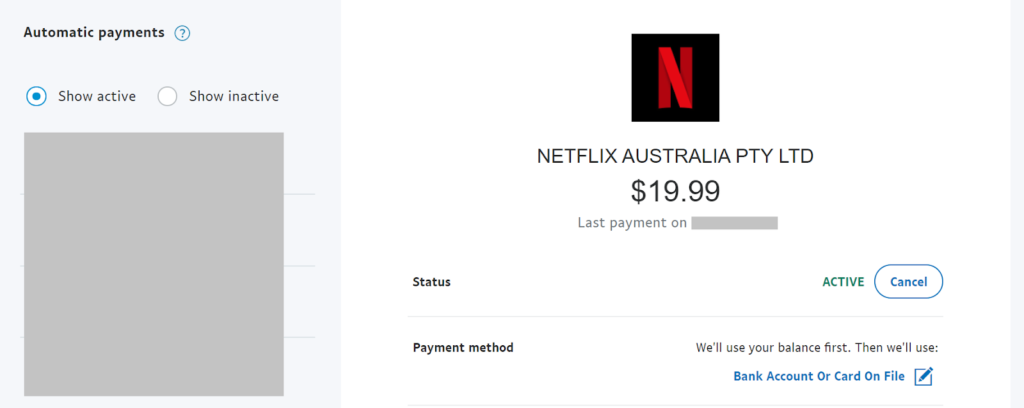

To check on the status of direct debits with PayPal, follow these steps:

- Log in to your PayPal account.

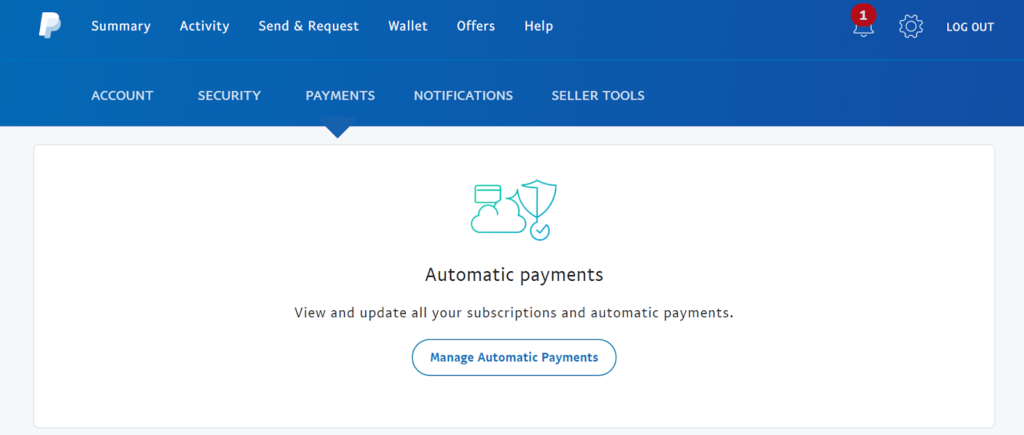

- Click on the ‘Settings’ button (gear icon, top-right corner) then on ‘Payments’.

- Under ‘Automatic Payments’, click on ‘Manage Automatic Payments’.

- Your existing direct debits will be shown here.

Summing Up

Direct debit isn’t for everyone, and to be clear, there are no incentives at play here for Point Hacks to encourage you to switch – but it just could make points earning that little bit easier and faster on things that you would normally be paying for anyway.

Your options usually include two of the following: bank account, credit/debit cards and PayPal. We recommend you use a points-earning credit card, either on its own or through PayPal, in order to maximise the number of frequent flyer points you are earning.

And lately more and more bills are starting to charge to use a credit card

Direct Debit is a term that applies strictly to bank accounts – charges against a Scheme Card (Visa, MasterCard, American Express and so on), is the same as any other card not present payment with a particular flag set on the transaction in most cases. Technically, Direct Debit against Credit Card doesn’t exist and the use of the term is generally confusing to all the financial parties involved – especially when it comes to refunds, duplicate/incorrect charges and dispute handling.

The other benefit here is that Scheme Card payments are more-or-less real time in settling bills for the most part. There are a number of providers who will wait 3 business days before marking a payment as received, which can be a problem when signing up for a new service.

The Post Billpay + PayPal option is an interesting one, but there are a few caveats there. Whether a merchant accepts payments via Post Billpay online or not is one factor (many only accept over-the-counter payments) and the acceptance of PayPal and/or American Express (and Diners Club for that matter) is decided on a merchant-by-merchant basis.

Thanks for pointing that out. Most of the utility providers I’ve come across have a single DD form where either debit or credit card details can be added, which obviously adds to the confusion!

Another benefit of having a provider hit your card as opposed to a bank account is the speed with which disputes can be handled. Hopefully something most people will never need, but very handy when required.

Question on BPay though. I never used it because I thought BPay transactions on a credit card went through as a cash advance. Is that correct? I’ve avoided it because I don’t like paying interest.

Should point out that in some cases, paying monthly direct debit may cost you marginally more that paying annually due to admin fees or the like. In my situation, I’m happy to pay them for the bill smoothing effect. Otherwise, make sure that’s factored in, as well as any surcharges.

However another trick that I had heard was that on your utility bills look for the option to pay by Credit Card (as opposed to BPAY) and use that. Sometimes this will be a website based payment, sometimes you’ll actually have to ring an automated service an punch numbers etc, but I believe these payment options do accrue points also where BPAY doesn’t.

I agree – I’ve got a TPG account and would like to use Amex if possible but not sure how to fill out the form to make it happen?

I’ve just updated the TPG link to a section on their site that explains how to set up automated payments from your credit card.