Emirates is a favourite airline partner for many Qantas Frequent Flyer members. But recently, the airline has hit the news for all the wrong reasons. In April 2021, Emirates removed many of its First Class rewards when booked through its partner airlines. Thankfully, this change did not apply to Qantas Frequent Flyer members. But Emirates Rewards did become more expensive from August 2020 given the airline’s shift to the more expensive Qantas Classic Flight Reward Table.

Then earlier this month, we saw not one but two hikes in carrier charges for Emirates rewards when booked through Qantas. And these hikes occurred within a span of just a few days!

A string of back-to-back negative announcements is never a good look. It has raised the issue of what this means for the future of the Qantas Emirates partnership. I discuss this issue, along with the alternatives for Qantas members should Emirates continue to ‘enhance’ this partnership.

How the Qantas-Emirates partnership was born

In 2011, Virgin Australia made a strategic shift away from its low-cost airline roots to become a full-service airline. Such a shift placed it head-to-head with Qantas. As a result, Virgin needed to make a number of changes to its product and service offering.

One major change was to its Velocity Frequent Flyer program. Velocity needed to expand its partnerships, especially with regard to its international airline partners. And they wasted no time in doing this. Velocity quickly established partnerships with Singapore Airlines, Delta Air Lines and Air New Zealand. But the catalyst for creating the Qantas-Emirates partnership was Velocity inking an airline partner deal with Etihad.

The Velocity-Etihad deal allowed Velocity members to travel to many European cities with just one stop, Abu Dhabi. As such, Qantas found itself offering its members an inferior redemption option to Europe. Qantas had already scaled back its own flights to just London Heathrow and Frankfurt at the time. And its only reliable European airline partner was fellow oneworld member British Airways. This meant Qantas members needed to make stops in Singapore and London before backtracking to other European destinations. In effect, the Qantas-Emirates partnership was a response to Velocity-Etihad. With Emirates on board, Qantas members could now travel to a number of European destinations with just one stop, Dubai.

The partnership is was beneficial to Qantas members

Until a few weeks ago, Emirates provided a solid partnership option for Qantas members. While Emirates didn’t price their rewards to be the cheapest available for Qantas members, their surcharges were reasonable given the high calibre of the Emirates product. (For the cheapest flight redemptions to Europe using Qantas Points, make sure to read our article on using Qantas Points with Finnair).

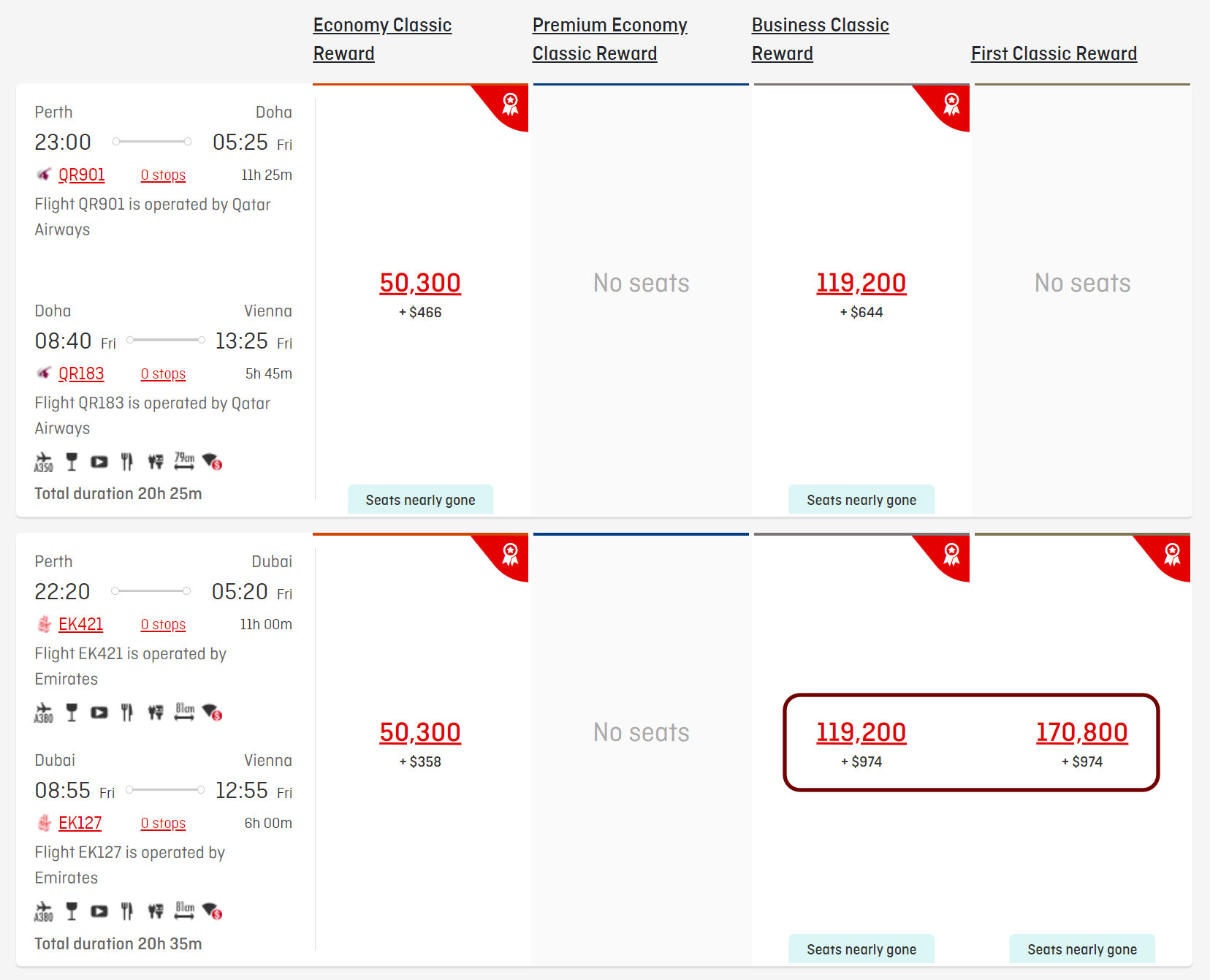

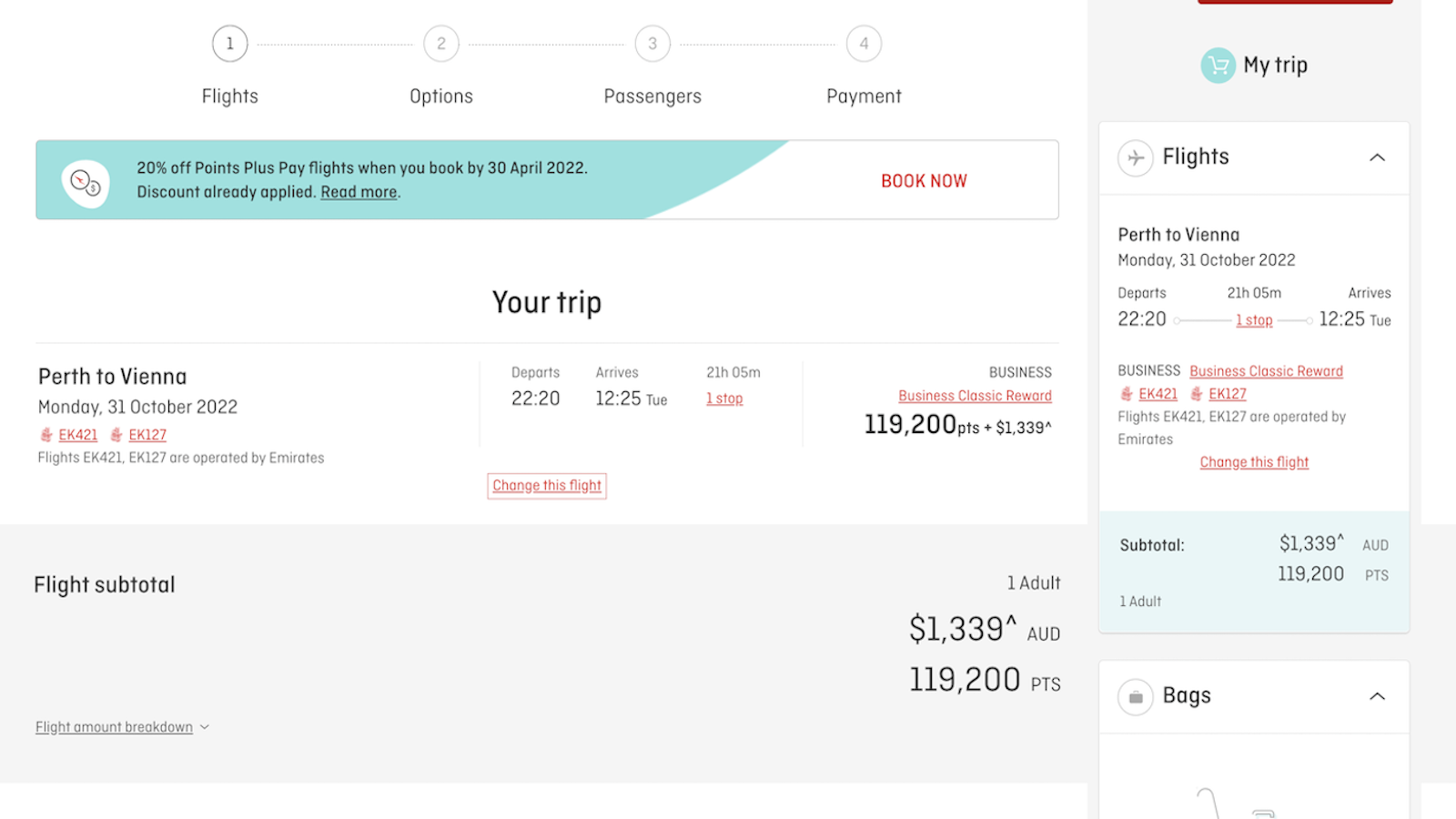

But consecutive carrier charge hikes have seen Emirates become the most expensive Qantas airline partner by a country mile. Wondering what the scale of these hikes is? Take a look below.

When asked about the reasoning for the carrier charge hikes, Emirates provided the following response to Point Hacks:

Emirates, like other airlines, has been impacted by the surge in fuel prices. We have therefore implemented a modest increase on the Carrier Imposed Charges applied to Skywards Classic Rewards. This enables us to respond to market dynamics without increasing the number of Miles required for flight rewards. It also allows us to reduce or remove these charges more easily in the future, where appropriate.

Emirates spokesperson

From the response above, you can see that the airline didn’t directly respond to an increase in the Qantas Classic Rewards charges. They just referred to the increase in their own program’s Emirates Skywards charges. And while they described the increase in charges to Skywards as being modest, there is nothing modest about those for the Qantas program!

Is the response justifiable?

I believe that the Australian travelling public has every right to question the above response. Yes, we all understand that oil prices are increasing, along with the general level of inflation. But to blame both increases on just oil prices, when these hikes represented a 196% increase is quite frankly beyond the pale. Especially when their charges were coming off a modest level to begin with, rather than a low one. Along with the fact, of course, that other airlines can manage to navigate the current environment with no or truly modest increases in their charges.

Have Emirates overreached here? Quite possibly. The airline is definitely going to benefit from an increase in the co-contribution from passengers via increased surcharges. However, Emirates may have cut their nose to spite their face. There is a very real chance that the benefits from increased surcharges are more than fully negated by a drop in demand for Emirates flights booked as Classic Flight Rewards by Qantas members. This means that Emirates will forgo a payment by Qantas to Emirates for these reward seats. Should this scenario play out too often, Emirates will end up in the red in net terms from hiking their charges.

And why do I say there is a real chance the above may occur? Because there are alternatives for Qantas members. And quality ones at that.

What must Qantas be thinking?

Officially, the response from Qantas to Point Hacks was:

Any changes to carrier charges on partner airline reward seats are determined solely by the partner airline, not Qantas.

Qantas spokesperson

But I suspect in private, Qantas cannot be happy with this change and would be taking a more proactive approach with Emirates than the above quote implies. Qantas is correct in that carrier charges on partner airlines are determined solely by the partner airline. But good luck trying to explain that to Qantas customers. From their point of view, the steep carrier charges are showing up on the Qantas website, when trying to use Qantas Points for a carrier charge payment to be paid to, wait for it, Qantas.

Qantas members are least interested in the back-door business arrangements of reward programs. And therefore, it will be Qantas that is marked down by customers for Emirates’ carrier charge hikes, and not Emirates themselves. As they said in the movie The Castle, ‘it’s the vibe’. A vibe I would think Qantas would want to remove as quickly as possible.

What does the future hold for the partnership?

I have been analysing the airline loyalty industry long enough to know that when a string of significant changes is made to a program, it is usually the precursor to a diluting of the partnership. As an example, Velocity members saw the removal of a series of reciprocal benefits when flying Delta Air Lines before it was finally announced that Velocity dropped Delta as a partner in favour of United.

However, it may be a bit premature to forecast the demise of the Qantas-Emirates partnership. In October last year, Qantas and Emirates extended their joint partnership to 2028. But while the partnership may not come to an end anytime soon, Emirates may well be crab-walking away from it. By raising their surcharges to a level that makes them uncompetitive, they may be intentionally ceding market share for these heavily discounted Classic Flight Reward seats.

This should not necessarily come as shock. It is understood, and logic also would dictate, that Qantas benefits far more from the partnership than Emirates does. The world literally opens up to Qantas members by accessing the large Emirates network that flies through the geographically-blessed hub of Dubai. Contrast that with the much smaller Qantas network that restricts the benefits to Skywards members to predominantly destinations within Australia. This inequality may well be priced in through the agreement between the airlines. But not necessarily. And should this not be the case, a disincentive exists for Emirates to continue to aggressively push this partnership, given they bear more of the costs.

Alternatives to Emirates

Fortunately for Qantas members, there are alternatives to Emirates. Qatar Airways is among the best of them. For trips to the Middle East and beyond to Europe, Qantas members can redeem their points for what is arguably the best Business Class cabin in the air today: Qatar Airways Qsuites.

Since the COVID-19 pandemic hit our shores in early 2020, Qatar Airways has extensively grown its network in Australia. According to the 2020 Bureau of Infrastructure and Transport Research Economics Statistical Report, Qatar Airways held just 2.8% of the international market share in Australia in December 2019. Fast forward 12 months to December 2020, during the height of the pandemic, and its market share grew to 13.1%, making it the second-largest airline by market share to serve Australia, just behind Singapore Airlines on 15.7%.

Qatar Airways’ market receded slightly by the end of 2021, capturing 9.3% of the market according to the 2021 Bureau of Infrastructure and Transport Research Economics Statistical Report. This figure, however, incorporates the return of Qantas onto international routes, albeit in a heavily restricted capacity.

The most recent market share statistics for Qatar Airways, which sit well above its pre-COVID share, suggest that the airline will service Australia in an increased capacity for the long haul. Will this eventually see the Qantas-Emirates partnership get diluted or even displaced by Qantas’ oneworld bedfellow, Qatar Airways? All signs at present indicate this is at the very least a plausible scenario.

Summing up

It’s a shame that Emirates has increased their carrier charges by the amount they have. I believe that many people would have accepted a modest, temporary increase in charges given the current global upheaval. But back-to-back, triple-digit percentage increases come across less as meeting a temporary external challenge and more as financial opportunism.

On this score, Emirates has stated that these hikes are intended to be temporary in nature. We will definitely be monitoring fuel prices to ensure that Emirates is true to its word and reduces its fuel charges should oil prices fall significantly.

The risk for Emirates is that these hikes could do more than just temporarily damage its brand among Australian-based consumers. The incentive they have created for Qantas members to try out none other than their highly regarded main Middle East rival, Qatar Airways, is one that is baffling.

Perhaps what we are seeing here is a correction by Emirates of the imbalance between what they stand to gain from their partnership with Qantas, and what Qantas gains. But such a correction, via increased surcharges, is done at their peril.

Check out the other Point Hacks Editor’s View articles here →

Oddly you can find some Melbourne to Dubai ones through the direct search, not the multicity calendar.?

Plenty of emirates flights in Europe in late April? any insight would be great.

I was comparing recently, and the carrier charges for business redemptions are around 7-8 times more expensive with QFF/Emirates than Velocity/Singapore airlines, and otherwise Singapore was also cheaper in points cost by a bit.

There is absolutely nothing – not even first class, which to me would justify this, it is absolutely absurd.

This is just the latest in a number of developments that are making the QFF program more and more poorer value for money, so I am switching to Velocity for my main earn program and credit cards. They have fewer partners, but it seems like the deals they have with them are very good value for customers’ money and points, so it just seems more worthwhile. Between Singapore Airlines, ANA and United, you will be able to get anywhere, but they have others as well.

While this move by Emirates is quite clearly a middle finger to QFF customers essentially saying “we don’t want your points business, but we need to offer something as part of our agreement with Qantas”, I don’t doubt there is a poor business deal being pushed onto Emirates by Qantas from behind the scenes, and so to me, it reflects most poorly on Qantas – and not Emirates.

Perth to Europe on QR Business attracts around $640 in taxes and charges. The return flight attracts around 600 EUROS in taxes and charges.

Needless to add that premium cabin availability has drastically decreased for both airlines on QF program. A shame.

I’m not sure why Emirates would care about revenues from the provision of classic award seats to QF FFlyers, which attract only marginal income.

As you point out, EK has already removed classic award seats in first class from some partners. It wouldn’t do that if “lost income” on first class classic award seats was an issue.

The practical reality is that there is hardly any award seat availability in premium cabins between Australia and DXB anyway: virtually none is showing on the QF website until very late in 2022 (accepting EK may release inventory close to the flight departure date).

Even that often turns out to be “ghost” availability. IME you also need to speak with the a well trained QF call centre agent for them to “find” those EK award seats, especially if a multi-city itinerary is in play.

The key issue is that QF no longer flies via DXB. It has clearly been looking beyond the former format of the EK alliance for several years already.

Perhaps QF is being somewhat specious in entirely blaming EK fo the carrier charge hikes – not all partner airlines pass on the full whack of carrier charges.

That all said, and in agreement with your general opinion, I’m looking at my current classic award seats on EK first using QF points (my wife and I are due to travel SIN-DXB-MXP and FCO-DXB-SIN for the Venice Film festival and Biennale in September) and absolute expect that that will be the last time we do that (unless those carrier charges miraculously come down). We paid AUD1200 for the two of us for those four sectors: I am assuming the revised charges would be in the ballpark of AUD3500 to AUD4000 or more. That’s mental – it just ain’t gonna happen!

Access to EK first has been a huge driver for us to engage with QF FF. The overall value of that engagement has been severely eroded.

One can but wonder whether the senior folk at QF are on top of stuff. The bad PR over call wait times, the horrendous mess at SYD over the last couple of days, the pathetic excuses from the CEO, all combine to be very concerning. Please. Call centre staff numbers were brutally cut some years ago. What a fuster cluck!