Travellers departing from Australia can claim a tax refund on eligible goods thanks to the Tourist Refund Scheme (TRS). This applies to both temporary visitors and Australian citizens heading off on holidays. And what better way to kick-start your trip than with some extra spending money?

Keep in mind though, there are some criteria you need to meet in order to make a TRS claim, and you’ll need to arrive at your port of departure with documents and goods in tow. Below, we’ve covered everything you need to know about the Tourist Refund Scheme and how to claim TRS before you leave Australia.

Watch our video or continue reading below to learn more:

What is the Tourist Refund Scheme (TRS)?

The Tourist Refund Scheme (TRS) allows travellers departing from Australia to claim a refund on tax payable on eligible goods in Australia. This refund applies to the 10% Goods and Services Tax (GST), as well as the Wine Equalisation Tax (WET).

You can only make a TRS claim for certain goods, and there are some exclusions to the scheme.

Who can claim the Tourist Refund Scheme when leaving Australia?

Despite its name, the Tourist Refund Scheme isn’t just for tourists. Anyone departing Australia can claim a GST refund – this includes citizens and overseas visitors. So if you reside in Australia, this doesn’t mean you have to leave for good. As long as you’re heading overseas – even just for a holiday – you can claim the TRS refund.

What purchases are eligible for the GST refund?

The TRS covers a range of goods in Australia that have a 10% GST applied, but there are certain criteria you need to meet before you make a claim.

- The purchase must be $300 or greater.

- You must have paid for the goods yourself.

- The purchase must be made no more than 60 days before your date of departure from Australia.

- The original hardcopy tax invoice needs to be presented (no duplicates or digital versions are accepted).

Online purchases made from an Australian retailer are eligible for the GST refund, but you’ll need to print a copy of the invoice for presentation at the TRS counter.

Also, a duty-free limit on all goods applies to each passenger entering Australia – $900 for adults and $450 for children. If you’re a returning resident, note that anything you’ve claimed under the TRS scheme will count towards this limit.

What can’t you claim under the Tourist Refund Scheme?

You can’t claim a refund on goods purchased from a business or entity that isn’t registered for GST. In order to register, the entity needs an Australian Business Number (ABN), which should appear on the invoice you provide when making a claim. In short, if the business doesn’t have an ABN, or it’s not visible on the invoice, you’re out of luck.

Naturally, you can’t claim a refund on GST-free goods, as no tax has been applied.

As a guide, here are some of the items you can’t claim a GST refund for:

- Services like accommodation, transport and car hire.

- Dangerous goods.

- Tobacco and tobacco products.

- Alcohol, with the exception of wine with less than 22% alcohol content.

- Medication and medical aids.

- Gift cards, as GST is not payable when a gift card is purchased. However, you can claim for items purchased using a gift card if they otherwise qualify.

- Unaccompanied goods that are shipped, or any goods that you’re not carrying on the plane with you.

The Australian Border Force website has a comprehensive, up-to-date list of what can and can’t be claimed under the TRS.

How much do you need to spend to receive a GST refund when you leave Australia?

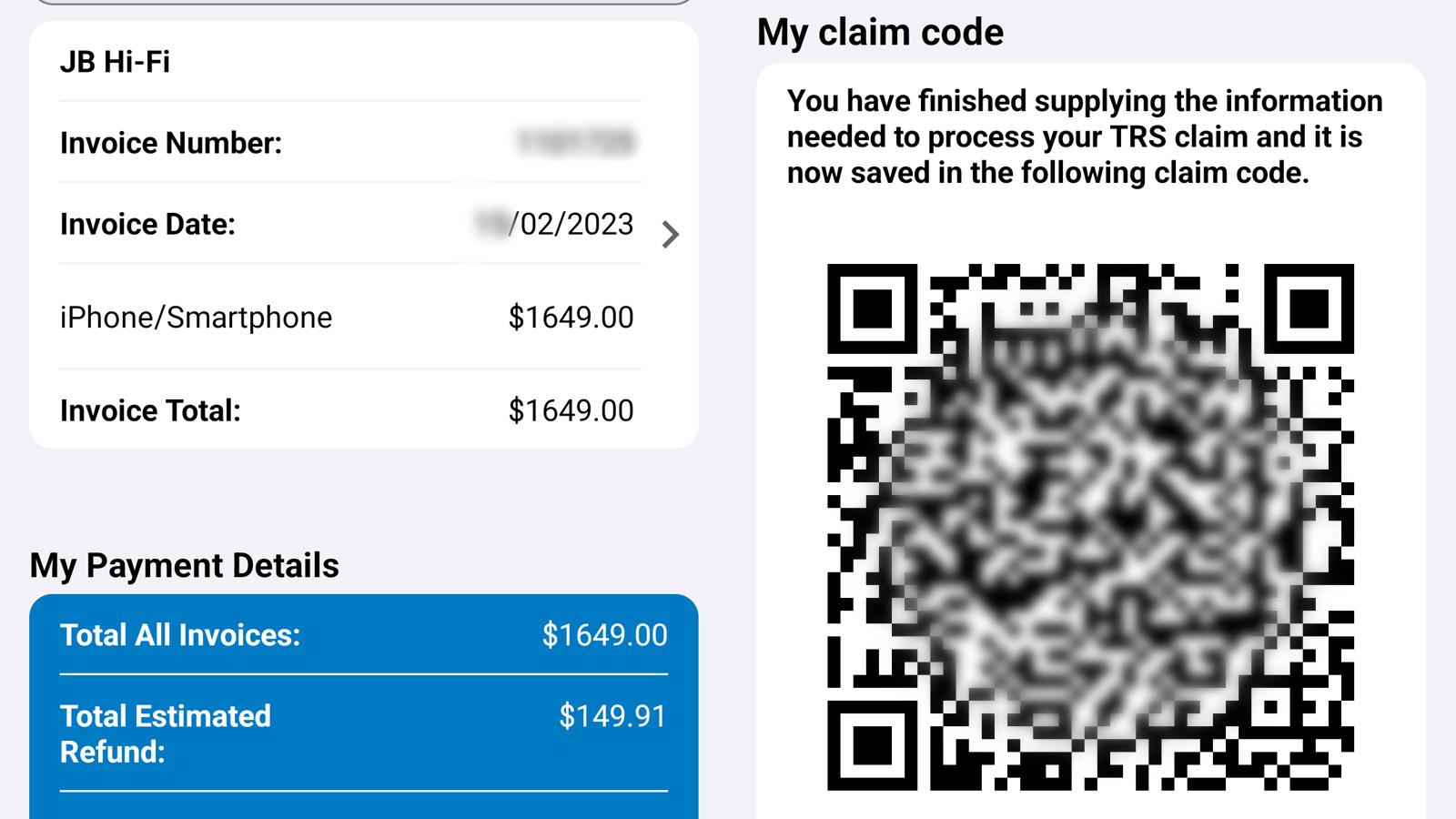

There’s a minimum spend requirement of AU$300 at a single retailer before you’re eligible for the GST refund. This can be across several transactions, as long as the total is over $300. And if the business has several stores or branches – like JB Hi-Fi, for example – you can shop across multiple locations. As long as they all fall under the same ABN, the minimum spend can be achieved with multiple visits. You’ll need a tax invoice for each transaction, though.

If you spend over $1,000, the invoice must also include the identity of the buyer. Acceptable details include your full name (identical to your passport) or passport number. You may need to request that your information be added to the tax invoice at the time of purchase if you intend to make a TRS claim when you leave Australia.

To work out the refund payable, simply divide the total price paid by 11. For example, an item that costs AU$600 including GST may be eligible for a A$54.54 refund via TRS.

When making your purchase, you may want to consider paying with a points-earning credit card to earn frequent flyer points from your transaction. For that matter, be sure to browse Qantas Shopping or the Velocity e-Store to earn bonus points on purchases from retailers.

Where can I make a TRS claim?

Refunds can be claimed at the airport or seaport you’re departing Australia from. The Australian Border Force lists the locations of TRS counters in airports across Australia. If you’ve got a domestic leg, you won’t be able to make a TRS claim prior to your domestic flight – you’ll have to wait until your final port of departure from Australia.

The GST refund can’t be submitted online, as you need to present the goods for inspection by an Australian Border Force official, as well as your passport and boarding pass. But you can complete your details online beforehand to save time at the refund counter, which we cover how to do below.

If you’re claiming a GST refund at an Australian airport, the claim must be made at least 30 minutes before your scheduled departure time. If you’re departing on a cruise, you’ve got until 60 minutes before your scheduled departure.

Allow plenty of time to clear immigration, and prepare for long lines at the TRS counter. Once you’ve left Australia, you can’t retrospectively claim your GST refund!

Using a TRS Drop Box

In some instances, you may be required to use the secure TRS Drop Box facility instead of the physical counter. Providing you meet the criteria, your claim will still be processed, just at a later time. You’ll need to drop all of your original invoices into an envelope and fill out a claim form with your details. Learn more about making the claim and the process of using a Drop Box.

Speed up your TRS claim using the mobile app or website

TRS claims can’t be lodged online, but you can speed up the process at your point of departure by entering some details online before you arrive at the airport. Note that this method won’t let you skip the queue (which is often long) and it doesn’t submit your claim, either. It just saves the officer from having to type your details when you present at the refund counter.

How to enter your details for the TRS claim online

You can use the My TRS Claim online portal – an official Australian government website – to enter your details. Alternatively, you can download the Australian Border Force mobile app for Android or iOS.

What details you can provide online

- Your travel details.

- Details of the goods you’re claiming a GST refund for.

- How you prefer to receive your GST refund – credit card, Australian bank account or mailed cheque only.

Once you’ve entered these details online, you’ll be issued with a QR code. Present the QR code, your original paper tax invoices and the goods you’re claiming the GST refund for at the TRS refund counter at your point of departure.

There’s a limit of 10 invoices per batch – any more and you’ll need to generate another QR code. Entering your details online can ensure a smoother process, especially if you’re claiming a refund with multiple invoices. Note that if you have to use the TRS Drop Box, the QR code isn’t accepted and you’ll have to fill in the paper form with your details.

How to apply for the TRS GST refund when leaving Australia

Keen to make your TRS claim as stress-free as possible? Then make sure you’re prepared well before you arrive at the counter by having the following on hand:

- Your passport.

- Your boarding pass.

- Your QR code, if you’ve entered your details online.

- An original paper tax invoice – photocopies, reprints or digital invoices aren’t accepted. The invoice should state the total of the goods purchased, the GST paid on the goods, the ABN of the business where the goods were purchased from, and be dated no more than 60 days prior to your departure. If your spend is $1,000 or more, the invoice must also include the buyer’s full name or passport number.

- You must keep the goods you’re claiming the refund for with you, either worn or in your carry-on baggage.

It’s possible to claim a GST refund on oversized items like golf clubs or surfboards, and liquids, aerosols or gels that can’t be carried onboard with you. These must still be sighted by an Australian Border Force official prior to check-in, and you can find out where to do this on the Australian Border Force website.

Summing up

Australia’s Tourist Refund Scheme (TRS) is a simple and effective way for outbound travellers to claim a refund on GST. As long as your purchase meets the criteria, you can submit a claim – and pocket some savings towards your getaway.

Before you travel, refer to the Australian Border Force website for the latest information about the TRS. As one final tip, use a debit card or bank account to receive your refund instead of your usual points-earning credit card. That’s because refunds on rewards cards often cause you to lose the equivalent number of points linked to that refund.

Westpac Altitude Qantas Black

FAQs

The tourist refund scheme (TRS) allows travellers to claim a refund on tax paid on eligible goods. To lodge a claim, visit the TRS counter at your port of departure with the required documentation and the goods you intend to claim a GST refund for.

Yes, if you’re an Australian citizen departing from Australia, you can make a TRS claim on eligible goods purchased no more than 60 days before your departure.

Unfortunately, no. The items you’re claiming the GST refund for must be presented for inspection to Australian Border Force personnel, in addition to your boarding pass and the original tax invoice. As such, there is no option to lodge the refund online.

You can’t lodge the GST refund online, but you can enter your details before you arrive at the counter which can save you a bit of time. With the My TRS Claim website or Australian Border Force mobile app, you can enter your personal details and the details of the items you’re claiming a refund for, which will be saved to a QR code that can be presented at the refund counter.=

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Thanks for the info.

I do have a question regarding the TRS Drop Box facility you mentioned. When would travelers be required to use this instead of the physical counter, and are there any specific criteria for eligibility? Also, is there a significant difference in processing times between the two methods?

Thanks for providing such valuable information – it’s making the pre-travel preparations much smoother!

“A duty-free limit applies to each passenger entering Australia – $900 for adults and $450 for children. If you’re a returning resident, note that anything you’ve claimed under the TRS scheme will count towards this limit.”

Australia’s incoming passenger card asks a question about whether you’re bringing in goods exceeding the personal passenger allowance, including any goods purchased duty-free in Australia (e.g. TRS claims). If you’re above that personal passenger concession, you’d need to tick ‘yes’ on the incoming passenger card.

Further to your comments, can we combine the allowance amount? For example an iphone costs $1500 claimed GST but brought back by 2 adults travelling together.

Thanks

You enter Australia for 10 days, purchase items, leave Australia for New Zealand to join a cruise that ends in Sydney 12 days later and you stay for a further 5 days before leaving for UK. Can any purchases made on first leg qualify for GST refund be claimed on last leg?

If the previously exported goods on which a TRS claim has been made exceed the $900 limit, or my new souvenirs plus the previously exported goods exceed the limit, does this mean that I have to pay GST on all the goods imported (i.e. including the full value of the TRS claimed goods)? So no concession is available to set off against this total?

I think you have missed the point of Tony’s question. I think he was asking: if the TOTAL value of any goods brought in to Australia (including goods previously taken out on which GST refund was claimed, plus any goods purchased overseas) exceeds the allowance that applies (whether that be an individual allowance or a pooled allowance), will he be charged GST on the TOTAL amount of the all the goods, or just on the amount that exceeds the allowance (which for general goods is $900 for individual, $1,800 for a couple (if pooled), +$450 for each dependent child)? So say he is traveling for a month as an individual and before departure from Australia buys a $2,000 smart phone and claims the GST via TRS on departure. When he returns is he liable for GST on the full $2,000 or only $1,100 (= $2,000 – ?900)

As per the ABF page on duty free:

If you exceed Australia’s duty free limits, duty and tax will apply on all items of that type (general goods, alcohol or tobacco), not just the goods over the limit.

And I don’t appreciate your condescending tone.

Our reading of it is that if you exceed your limit, taxes will then be applied to the full value of all items of that category, not just the amount over the concession, as there is no specific mention of the concession being taken into account.

In fact, I brought back and declared a high value item once and I’m fairly certain GST was charged on the full value, not the value minus $900.

The website is vague on the specifics though, so we’ll put the question to ABF and see if we get a clarification.

“Families coming back to Australia on the same flight or voyage may combine (pool) their individual duty-free concession limits. To do this, families must stay together when going through Customs clearance.”

For more information, refer to the Border Force website.

Thanks