You may have heard of the introduction of Comprehensive Credit Reporting in Australia, but may not have an idea exactly what it is and how or even if it could affect you This guide takes a detailed look into the new credit reporting mechanism, highlights how it differs from the previous mechanism that was in place, and why this may or may not be beneficial for you.

Please note that this guide is purely fact-based and outlines some of the possible factors that credit providers may look at when assessing a credit application. It is not intended to provide any guarantee or advice on the success or likelihood of attaining credit.

What is Comprehensive Credit Reporting?

Comprehensive Credit Reporting, or CCR, is an enhancement to the current credit reporting system used in Australia in that it allows for additional information to be reported between credit providers and credit reporting agencies. CCR now allows for positive credit behaviour to be reported, such as making your credit repayments on time, as well as additional information including account open and closed dates, types of credit, credit limits and up to 2 years of repayment history information.

Previously, only negative actions by the borrower were recorded, such as defaulting on a loan, becoming bankrupt or incurring other credit infringements as examples.

By allowing for a more holistic view of a borrower’s credit behaviour, a credit provider should be able to better assess their capacity to make the required repayments. Having previously only having ‘bad’ credit behaviour to work off, credit providers were left in the dark with regards to how well a borrower could manage debt. For example, a borrower that consistently made all their repayments on time versus one that frequently made their repayments 59 days late would have had near-identical credit reports assuming all other factors were also identical. This Is because late payments were not enough to constitute an actual default or other recordable adverse action.

What are some factors considered by credit providers?

There are a number of factors that credit agencies use to come up with a final credit score. It should be noted that each credit agency uses its own proprietary models to assess a borrowers creditworthiness and assign them a credit score. They also keep the specific details of these models a very well kept secret, however, there are still some clues as to the factors they assess when determining credit scores.

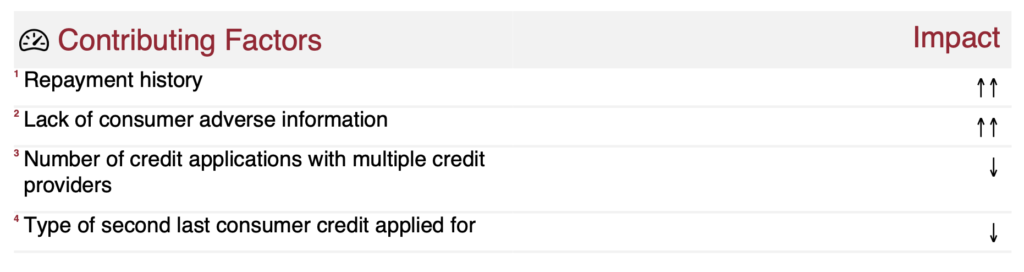

I am a client of Equifax and subscribe to receiving an updated credit report every 3 months. The report clearly highlights some factors that contribute to my overall credit score, such as repayment history, lack of consumer adverse information, number of credit applications with multiple credit providers and type of second last consumer credit applied for, as shown in the image below.

It is the first factor in particular that signifies the greatest change to the model going forward. It is unknown how much each factor exactly contributes to the overall credit score, but with Equifax at least, there is some indication of the relevant weighting that is indicated by up and down arrows under the ‘Impact’ column, with the three up arrows indicating a large positive impact on your credit score, three down areas in dictating a large negative impact on your credit scores, and of course all other combinations in between.

Equifax to adjust Credit Scores

After spending the last 24 months accumulating repayment behaviour, Equifax recently sent an email to its subscribers outlining the launch of a ‘new generation of credit scores’.

The new Equifax credit score will form a new industry standard towards fairer and more transparent credit reporting, helping you better manage your financial wellbeing.

The Equifax Team, email sent 21 May 2021

The change came into force on 22 June 2021 and Equifax advises its subscribers not to be alarmed if their credit score changes.

If your credit score changes, please don’t be alarmed. This reflects more granular information that is being used to calculate your new credit score, which can also give you greater control to improve your score faster in the future.

The Equifax Team, email sent 21 May 2021

Due to the transition from negative to positive reporting, the model used by Equifax is substantially different to warrant the removal of old credit score history, as these scores will no longer appropriate or accurate. A new history will be built with the new scores.

I can confirm that as a result of the change, my credit score went from a GOOD rating of 720 to an EXCELLENT rating of 945, with a new contributing factor of ‘Strong credit history’ now having the largest weighting on my score and the resultant credit score boost.

Why CCR may or may not work in your favour

The new CCR approach can either be a blessing or a burden, depending on your credit behaviour but most people should likely see some improvement in their credit score given that positive credit behaviour is now taken into account.

For those that do miss making minimum payments, even if it just by a few days, then these near misses will be recorded and will likely have some negative impact on your score. Those that have consistently struggled with credit in a material way, such as those that eventually default on their loans or become bankrupt, are likely to not see such much change, given this type of information was already recorded and factored into credit scores prior to CCR launching.

A good barometer for the likely outcomes of CCR in the future is the United States. CCR has been used over in the US for over 2 decades and as highlighted by Professor John M. Barron from Purdue University in a 2003 paper titled The Value of Comprehensive Credit Reports: Lessons from the US experience, CCR allows for more accurate pricing of credit risk (among other findings). The finding that credit is more accurately priced ultimately means that those who exhibit positive credit behaviour stand to benefit from greater amounts or types of credit being extended to them.

For example, a borrower who has always paid their credit cards off on time might have only been accepted for a mid-tier credit card prior to CCR based on other personal factors such as their income, but may now qualify for a top-tier card under CCR. And this can explain why I personally know a number of people in the US who have over 20 active credit cards on the go at one time, something that is rarely possible in Australia, even today.

The above paper has been backed up by Andrew Grant from the University of Sydney Business School in a 2019 paper titled The Impact of the Introduction of Positive Credit Reporting on the Australian Credit-seeking Population, which concludes that negative credit information now augmented with positive credit information, based on empirical evidence, is likely on average to see the risk profile of consumers improve. And this improvement will cover a broad range of demographic groups; across income wealth brackets, in high and low socioeconomic areas, from the young to old, the city and the country and for established and non-established households.

Summing up

Overall, whether you see an improvement or decline in your credit score will continue to be based on your credit behaviour, but with CCR, both positive and negative is now taken into account, rather than just the latter.

CCR is welcome news, as it will allow credit providers to more accurately assess and price risk, which from empirical evidence suggests, should lead to more accurate amounts and type of credit being offered to borrowers, and the risk of overextension being reduced.

Disclaimer: Point Hacks Australia Pty Ltd. provides general information only. You should assess whether the information is appropriate for you having regard to your objectives, financial situation and needs and consider obtaining independent professional advice before making an investment decision. If information relates to a specific financial product you should obtain a copy of the PDS for that product and consider that statement before making a decision on whether to acquire the product.

Frequently Asked Questions

Comprehensive Credit Reporting (CCR) is an enhancement to the current credit reporting system used in Australia in that it allows for additional information to be reported between credit providers and credit reporting agencies. CCR now allows for positive credit behaviour to be reported, such as making your credit repayments on time, as well as account open and closed dates, types of credit, credit limits and up to 2 years of repayment history information.

Comprehensive Credit Reporting (CCR) will allow credit providers to more easily determine borrowers who effectively manage their credit obligations, which will allow them to more accurately assess the amount and type of credit that should be extended to a borrower.

You can access your credit score by heading to one of the 3 main credit reporting bodies in Australia, Equifax, Experian and Illion.

Alternatively, you can access a free report by going to https://www.mycreditfile.com.au, https://www.creditsavvy.com.au, https://secure.getcreditscore.com.au or https://www.freecreditreport.com.au.

Your credit score may change due to Comprehensive Credit Reporting (CCR) being implemented, but do not be alarmed. Such changes reflect additional information being supplied by credit providers to credit reporting bodies, which shows a more holistic view of a borrower’s credit behaviour, both positive and negative, rather than just purely negative before CCR was implemented.

Community