KrisFlyer is the points program of the Star Alliance member Singapore Airlines. It’s an extremely versatile scheme, and one that’s easy to build miles via eligible KrisFlyer-earning credit cards.

It’s not possible to directly earn KrisFlyer miles from credit cards in Australia, but there are various flexible points programs that have partnerships. In this article, we’ll guide you through many of the essential questions you might consider when maximising the points earning potential of a KrisFlyer-linked credit card.

What are the best Singapore Airlines KrisFlyer credit card sign-up bonus deals?

| Card | Bonus Flexible Points | Transfer Ratio | KrisFlyer Miles (equivalent) | Annual Fee | Expiry | Card Guide |

|---|---|---|---|---|---|---|

American Express Platinum Business ↓ | 300,000 Membership Rewards Points | 3:1 | 100,000 KrisFlyer Miles | $1,750 p.a. | 13 January 2026 | Read Here |

ANZ Rewards Black ↓ | 180,000 ANZ Rewards Points | 3:1 | 60,000 KrisFlyer Miles | $375 p.a. ongoing | ongoing | Read Here |

St.George Amplify Rewards Signature ↓ | Up to 160,000 Amplify Points | 3:1 | 53,000 KrisFlyer Miles | $199 for the first year, $295 p.a. ongoing | ongoing | Read Here |

Westpac Altitude Black ↓ | Up to 160,000 Altitude Points | 3:1 | 53,000 KrisFlyer Miles | $200 for the first year, $295 p.a. ongoing | ongoing | Read Here |

American Express Platinum ↓ | 150,000 Membership Rewards Points | 3:1 | 50,000 KrisFlyer Miles | $1,450 p.a. | 13 January 2026 | Read Here |

American Express Explorer ↓ | 50,000 Membership Rewards Points | 3:1 | 33,000 KrisFlyer Miles | $395 p.a. | 3 February 2026 | Read Here |

The offers displayed on this page are selected from a range of products across pointhacks.com.au as at the time of publishing this article. The use of terms “Best” and “Top” are derived from the highest bonus points offered.

What are the best credit cards for KrisFlyer miles?

Below, you’ll find a roundup of some flexible points earning cards that allow transfer to KrisFlyer miles, with noteworthy bonus offers to know about this month.

American Express® Platinum Business Card

American Express Platinum Card

St.George Amplify Rewards Signature

ANZ Rewards Black credit card

Westpac Altitude Rewards Black

American Express Explorer Credit Card

What is the easiest way to earn KrisFlyer miles?

In Australia, the easiest way to earn KrisFlyer miles is by first earning points in other participating rewards programs, and then transferring those points onwards to KrisFlyer.

The main benefit of this arrangement is flexibility. Just send points to your KrisFlyer account when it suits, rather than wait for a monthly transfer as with many airline co-brand credit cards. Sometimes, there can be bonuses for transferring points, too.

These programs can transfer to KrisFlyer miles:

- American Express Membership Rewards: 3 points to 1 KrisFlyer mile

- ANZ Rewards: 3 points to 1 KrisFlyer mile

- Citi Rewards: 2.5 points to 1 KrisFlyer mile (3:1 from base Citi Rewards cards)

- Westpac Altitude: 3 points to 1 KrisFlyer mile

- HSBC Rewards: 2 points to 1 KrisFlyer mile (Premier customers only)

- NAB Rewards: 3 points to 1 KrisFlyer mile

- Star Alliance Rewards: 5 points to 4 KrisFlyer miles (1 point = 0.8 miles)

- St.George Amplify: 3 points to 1 KrisFlyer mile

- Suncorp Rewards: 2.5 points to 1 KrisFlyer mile

Velocity Points can also be transferred to KrisFlyer (1.55 Velocity Points to 1 KrisFlyer mile). Check out our guide to learn more.

What to look for in KrisFlyer miles-earning credit cards

- Transfer rates: Flexible reward programs may have different transfer ratios to KrisFlyer miles, which you may have observed above. This means that the same number of ‘bank points’ can be worth two different volumes of KrisFlyer miles, depending on which program those bank points are from. That’s why it’s key to know the transfer rates of each program, to check that you’re getting the best value.

- Bonus points offers: It’s not uncommon to see sign-up bonuses of 100,000 rewards points or more on new points-earning credit cards (which could be worth 33,000 KrisFlyer miles, or even more)!

- Earn rates: Each credit card has its own ‘effective earn rate’. That is, how many miles could be earned on a per-dollar basis, when factoring in the card’s own earn rate and transfer rate. This can be calculated by taking the points earned and dividing it by the card’s applicable transfer rate to KrisFlyer miles.

For example, a card that earns 2 reward points per dollar spent and has a 3:1 transfer rate to KrisFlyer miles effectively earns 0.66 KrisFlyer miles per dollar spent.

Most Visas and Mastercards effectively earn 0.33 to 0.66 KrisFlyer miles per dollar, depending on the card. Some will have caps on the number of points earned per month. That’s something to keep in mind if planning a few large purchases or for those who spend heavily.

- Bonus travel inclusions: Platinum and Black-tier credit cards often include extras such as Priority Pass membership for lounge access. This may help differentiate one card from another.

- Included insurances: Those same grade rewards credit cards also tend to include some form of complimentary insurances. The most common is travel insurance, which may be activated when purchasing flights or accommodation using the card.

Refer to the relevant Product Disclosure Statements (PDS), as complimentary insurances may have clauses that could catch people out. Some cards may also throw in price-drop protection, extra extended warranties on products, or even smartphone screen damage cover.

What else to be mindful of with KrisFlyer miles-earning credit cards?

Like any other credit card, there are other financial factors to consider.

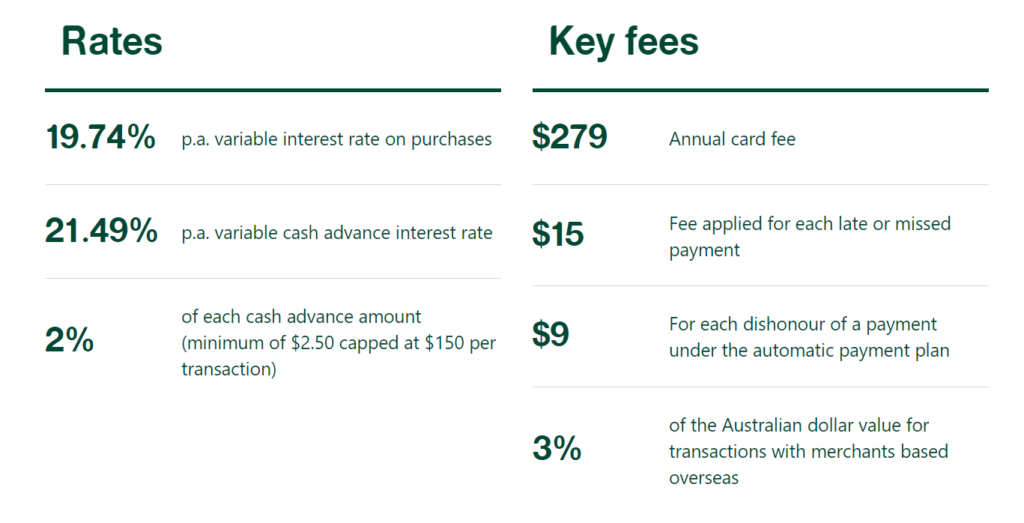

- Interest rate: All rewards cards have high-interest rates on purchases and cash advances. These can generally be avoided by paying the card’s statement balance on time each month, and in full.

Those who have issues with credit card debt may find that a rewards card isn’t the best option, for that reason. Especially when the fees and interest incurred from carrying a balance will very often outweigh the value of any KrisFlyer miles earned (plus, points aren’t earned on bank-imposed fees and interest charges).

- Annual fee: A yearly charge by a credit card’s issuing bank. It’s designed to cover the benefits and costs associated with your particular card.

For example, the American Express Explorer Card has a $395 annual fee, but which is offset by a $400 travel credit each year. There’s usually a sign-up bonus to sweeten the deal in the first year, while the card also earns 2 Membership Rewards points per dollar (0.66 KrisFlyer miles) on most everyday spend.

- Interest-free days: Many credit cards can allow 44 to 55 days of no interest charged on purchases. However, this may not apply if also taking out a balance transfer at the same time – and usually won’t apply if carrying a balance.

- Income requirements: Credit cards with increasingly higher tiers (i.e. Platinum and Black) will often have a higher income requirement to apply.

What else to know before applying for a KrisFlyer miles credit card

Here’s a quick summary of some other factors that people consider when assessing a rewards credit card:

- Bonus points offer criteria. Many bonus point offers may require spending more than a certain amount (often $1,000+) per month, for a few months.

- Eligibility for the offer. Many cards will exclude returning customers from bonus points, where the customer has held a similar credit card with the same bank in the last 12-18 months. This will be in the terms and conditions.

- A good credit score. The chances of having an application accepted could be much better for those with a good credit history. This might mean not having a history of late or missed payments, or applying for too many credit services (e.g. loans or even mobile plans) in a short period of time.

- Transfer bonus offers. From time to time, bank reward programs may sometimes run transfer bonuses. This could deliver 15-40% more points when transferring points from that program to a particular partner. If KrisFlyer miles are part of that promo, that could be a good time to transfer.

- Maximising miles from everyday spend. From insurance premiums to car hire, new indoor plants to a gym membership, cardholders could maximise their points by putting most normal household expenses onto the points-earning credit card, and paying it off in full every month.

Frequently asked questions

The following answers are general advice and do not take into account your personal circumstances. Be sure to consider all aspects of a credit card before applying.

The best frequent flyer card depends on everyone’s individual circumstances. This guide may help to provide an understanding of many of the key aspects of a rewards-earning credit card, which could assist when assessing which option might be best.

In Australia, Singapore Airlines and KrisFlyer do not offer any direct-earning cards. However, this guide highlights some of the other cards with flexible rewards programs that can convert reward points to KrisFlyer miles.

In Australia, most credit cards treat airfare purchases like any other everyday transaction. However, some Qantas and Velocity-branded cards offer bonus points when buying flights through Qantas and Virgin Australia, respectively.

I really need to top up my wife’s KF balance, and everything I need to know is in this article!