HSBC unveils Star Alliance Credit Card in Australia

Enjoy flexibility and a shortcut to Gold status with the HSBC Star Alliance Credit Card.

What we'll be covering

Australian-based frequent flyers are the lucky launch audience of the new HSBC Star Alliance Credit Card. A world-first by a global airline alliance, this innovative credit card reimagines bank and airline loyalty. You’ll be able to earn points and fast-track to Gold status with some of the card’s seven airline partners, including Singapore Airlines and United.

Tantalisingly, successful applicants will enjoy limited-time benefits including a waived first-year annual fee. But (arguably) even better is the ability to mint yourself Gold status within Star Alliance, simply by spending AU$4,000 within the first 90 days of card approval.

Jeffrey Goh, CEO of Star Alliance, says this new product is the outcome of many strategic discussions with airlines.

It will offer a new world of loyalty experience with not only the ability to earn points, but also a fast track to Star Alliance Gold Status through everyday spending. Star Alliance Gold Status offers a range of benefits such as lounge access and priority boarding across all Star Alliance member carriers.

– Jeffrey Goh, Star Alliance CEO, 15 November 2022

There’s a lot to unpack, including the tiered earning rates and rules around transferring points to one of the seven airline partners. Here’s the full Point Hacks take on the HSBC Star Alliance card.

Enjoy lounge access with a fast track to Gold

Initially, the seven airline partners with the HSBC Star Alliance Credit Card are:

- Air Canada (Aeroplan)

- Air New Zealand (Airpoints)

- EVA Air (Infinity MileageLands)

- Singapore Airlines (KrisFlyer)

- South African Airways (SAA Voyager)

- Thai Airways (Royal Orchid Plus)

- United Airlines (MileagePlus)

You can nominate a Star Alliance ‘Status Airline’, which is the program that you want to get Gold status in. For Australian residents, we recommend picking Singapore Airlines KrisFlyer or United MileagePlus. Gold status in those programs will also get you reciprocal Virgin Australia perks such as domestic lounge access and priority check-in!

No matter what you pick, you’ll also enjoy Star Alliance Gold-level perks across all other Star Alliance partner airlines, including the other six partners of the HSBC Star Alliance Credit Card.

To actually get that status, you need to fulfil one of the criteria:

- Spend AU$4,000 within 90 days of card approval (one-off sign-up benefit).

- Spend AU$60,000 over a membership year to earn or retain (ongoing benefit).

If you spend $30,000 over a membership year instead of $60,000, you’ll qualify for Star Alliance Silver-equivalent status in your desired Status Airline program. This doesn’t come with lounge access, though.

There are lots of other T&Cs to read, which you can do on the Star Alliance website. Some important points to note are that your complimentary status via the HSBC Star Alliance card can only be maintained with the necessary spend, not by flying. And if you cease to hold the HSBC Star Alliance card, your corresponding Gold status may also be terminated soon afterwards.

Earn points with Star Alliance Rewards

The core of this new loyalty paradigm is Star Alliance Rewards, a separate flexible rewards program where you’ll earn your Star Alliance points. From there, you can choose to transfer a certain number of points to a participating Star Alliance partner airline frequent flyer program.

This is separate from the ‘Status Airline’ above. You can nominate to get Gold status in KrisFlyer and still be able to transfer some points to Aeroplan, for example.

If there’s one drawback of this new card, it’s that the transfer rates are a bit limiting. You’ll essentially earn 1 Star Alliance Point per AU$1 spent, for the first $3,000 in a statement month. Afterwards, your earnings will be capped at 0.5 Star Alliance Points per AU$1 spent.

(Using KrisFlyer miles as an example, that’s equivalent to 0.8 KrisFlyer miles per dollar for the first $3,000, dropping to 0.4 Kris Flyer miles per dollar for the rest of that statement month).

These points accumulate in your Star Alliance Rewards account, waiting for you to transfer them to a participating airline program of your choice.

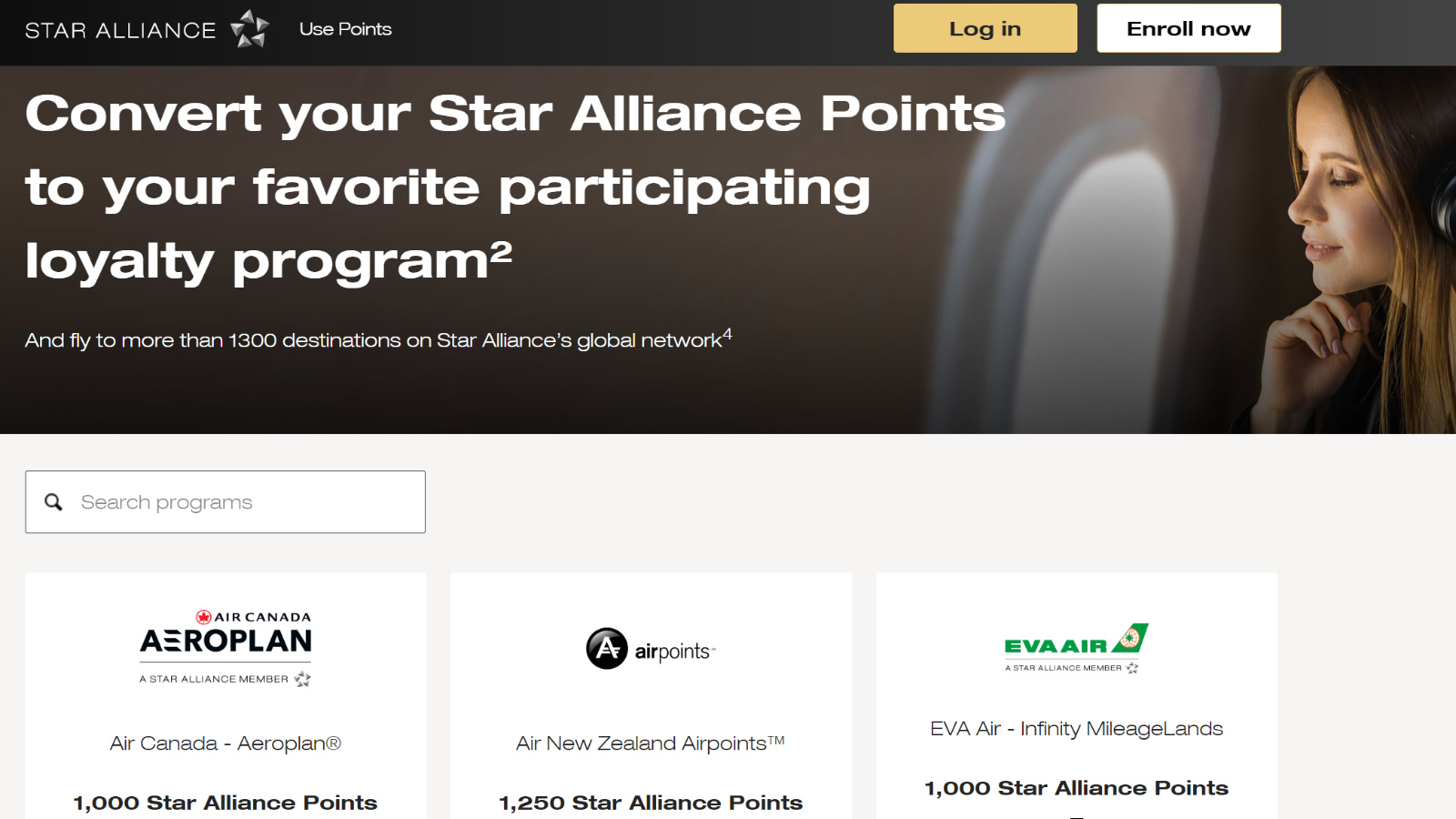

Convert Star Alliance Points to airline miles

Every 1,000 Star Alliance point converts to 800 airline miles with most programs, except for Air New Zealand. Here are the starting transfer rates:

- Air Canada Aeroplan: 1,000 Star Alliance Points = 800 Aeroplan points.

- Air New Zealand Airpoints: 1,250 Star Alliance Points = 10 Airpoints Dollars.

- EVA Air Infinity MileageLands: 1,000 Star Alliance Points = 800 Infinity MileageLands Miles.

- Singapore Airlines KrisFlyer: 1,000 Star Alliance Points = 800 KrisFlyer miles.

- South African Airways Voyager: 1,000 Star Alliance Points = 800 Voyager miles.

- Thai Airways Royal Orchid Plus: 1,000 Star Alliance Points = 800 Royal Orchid Plus miles.

- United Airlines MileagePlus: 1,000 Star Alliance Points = 800 MileagePlus Miles.

This makes Star Alliance Rewards a flexible rewards program. At Point Hacks, we love these types of programs because you get a much wider choice of airline partners – including some that aren’t even in Star Alliance!

For example, want to fly Bamboo Airways from Sydney to Ho Chi Minh? You can, simply by transferring your Star Alliance points to Air Canada Aeroplan, which partners with Bamboo Airways.

HSBC Star Alliance Credit Card: the Point Hacks take

Full kudos to HSBC and Star Alliance for creating a new credit card product that stands out from the pack. At a time when it’s increasingly difficult to enjoy rewards when you only have one type of points currency (such as Qantas Points), spending on a card with flexible rewards is very handy.

The main drawcard is the fast track to Gold status with your preferred airline after spending just $4,000 in 90 days. But it might be hard to decide whether to maintain Gold status via the card in the future.

On one hand, it’s a relatively easy way to keep Gold-plated perks without flying that much. You just need to run $60,000 worth of expenses on the card, each year. But the tradeoff is the ongoing $450 annual fee, plus the lower earning rates which get further clipped in half after you spend $3,000 each month.

By chasing your status goals, you’ll essentially be getting half the rewards for at least $24,000 of your spend, which could otherwise be put to better use with a higher points-earning card.

HSBC Star Alliance Credit Card

A simple case study with the HSBC Star Alliance Credit Card

For example, the similar St.George Amplify Signature Visa earns a steady uncapped 0.75 KrisFlyer miles per dollar, plus a 10% bonus on your birthday. Here’s a quick comparison showing your points-earning potential on the two cards for a $60,000 annual spend.

| HSBC Star Alliance Credit Card | St.George Amplify Signature Visa | |

| KrisFlyer miles earned per month ($5,000 spend) | 3,200 KrisFlyer miles (from 4,000 Star Alliance Points) | 3,750 KrisFlyer miles (from 7,500 Amplify Points) |

| KrisFlyer miles earned per year ($5,000/month spend) | 38,400 KrisFlyer miles | 45,000 KrisFlyer miles + 10% birthday bonus (variable) |

| Ongoing annual fee | $450 p.a. | $279 p.a. |

With the HSBC Star Alliance card, you’d be paying $171 more a year and lose out on at least 6,600 KrisFlyer miles compared to the St.George Amplify Signature Visa. But in return, you’d maintain Gold-level status with a Star Alliance airline. It could certainly be worth it for some people. How about you?

Applications are now open for the HSBC Star Alliance Credit Card →

Featured image designed by the author with elements courtesy of HSBC and Star Alliance.

Additionally, Air Canada Aeroplan has reciprocal rights with Virgin Australia for domestic lounge access, priority baggage, priority boarding etc.

They need to clarify this before in bold letters, Looks like HSBC is dodging the status claims.

I have just got my card and I can spend $4k next week, will I be eligible for lounge access in February as I am flying in Singapore Airlines and I have connected to Kris flyer.

Is there any loss connecting with Kris flyer like it can delay getting gold status which can restrict lounge access. If so can I undo that that?

What can I do to get Loiunge access? Pls if someone can help

I am bit confused 🙁

If someone can please help me

The product is new so we’re all still learning the ropes. But the card FAQs indicate that your KrisFlyer Gold status should be activated within 10 business days of Star Alliance sending the request to Singapore Airlines. We don’t know exactly how long that happens after meeting the minimum spend, but I would venture a guess that it should be done by February.

Sorry for the trouble and thank you in advance.

I just read that on the Star Alliance Rewards FAQ site under the Issuance of Gold Status section:

“Please note that if you choose Singapore Airlines as your Status Airline to receive Star Alliance Gold or Silver status, your request can only be processed upon the next anniversary of your HSBC Star Alliance Credit Card account opening. Exceptions may apply if you already hold an equivalent or higher status with your selected Status Airline – please refer to the applicable rules for more information.”

I think this means that even if you spend $4000 in the first 90 days you would have to wait another year for the benefit of the Gold Status associated with KrisFlyer to kick in…..

The KrisFlyer Elite Silver or KrisFlyer Elite Gold status will commence on your next HSBC Star Alliance credit card account opening anniversary date, unless the KrisFlyer Elite Silver or KrisFlyer Elite Gold status is earned from the welcome offer, which will commence within 10 business days of Star Alliance’s request to Singapore Airlines.

https://www.staralliance.com/en/web/rewards/au/faqs?subCategory=87

are there any other cards that offer you the ability to earn status?

” $0 Annual Fee in the first year does not apply to existing HSBC customers transferring from another HSBC credit card.”

Wish there was an option to get a points incentive instead of status. Some of those other currencies are not so easy to earn in Australia.