Editor’s View: Virgin Australia v2.0 full-service or LCC? Why only one of these makes sense

What we'll be covering

There has been much speculation about the make-up of Virgin Australia v2.0 post the voluntary administration, and whether a revived Virgin Australia Group should retain their dual-brand, full-service offering, or revert back to a single low-cost or ‘hybrid’ airline.

I discuss this issue in more detail below and argue why only of the above models really makes sense.

What many ‘industry experts’ are saying

Many industry experts are of the view that Virgin Australia should look to dump its current full-service offering and permanently ground its low-cost offshoot Tigerair. They state that it should revert to a single low-cost or ‘hybrid’ airline that would look to either compete directly with Jetstar or to place themselves between Jetstar and Qantas in what would be a unique mid-market product offering.

But is this the correct move?

The above view revolves around the argument that Virgin’s expenses are too onerous and prevent the airline from generating consistent profitability, something that frequently did occur in its previous lives as both a low-cost and later in its ‘New World Carrier’ hybrid iterations of Virgin Blue.

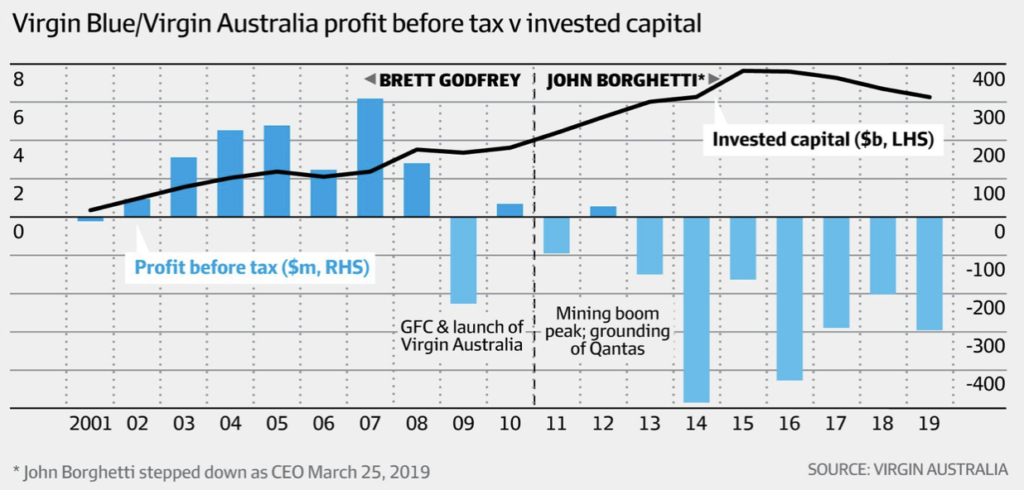

If you look at the profit and investment graph below, it is hard to argue against this proposition. Pre-tax profits were consistently in the black from 2001 until the GFC hit in 2008, and then, with the exception of a few years, were drowned in a sea of red. This profit inversion coincided with the strategic move of taking Virgin Blue upmarket to compete directly with Qantas under a rebranded airline, Virgin Australia.

From these figures, it seems the solution is pretty clear. Revert back to a low-cost, single product offering and all of Virgin’s financial worries will be resolved.

But are such calls just a bit too simplistic and backward-looking?

A quick look back at Virgin’s business models

Virgin Blue started out with just 3 planes in 2000, introducing what had not been seen in Australia’s skies since Compass Airlines in the early 1990s, a low-cost airline. Initially, struggling against the combined might of Qantas and Ansett, the airline steadily grew, sharing the low-cost market with Impulse Airlines, another low-cost start-up that was eventually bought up by Qantas.

Virgin Blue’s big break came when Ansett collapsed in 2001 and began to rapidly fill the void left by what was then the number 2 airline in Australia’s skies.

And for a few years, without any competition in the low-cost market, Virgin Blue was able to both increase investment into the airline to allow it to expand as well as increase its profits. Seeing a monopoly market beginning to take shape in this low-cost space, and the threat Virgin Blue posed to the leisure sector of its business, Qantas gave birth to Jetstar in 2003. It wasn’t long before Magda Szabanski convinced many of us to ‘Let’s do it, let’s fly Jetstar!’, with the airline beginning to eat away at Virgin Blue’s market share through a dominant cost base allowing for competitive pricing.

Seeing profits beginning to slow, Virgin Blue’s response to this competition in late 2005 was to create a ‘hybrid’ product offering, which they famously dubbed ‘A New World Carrier’. This initially meant investment in lounges, but on a pay-as-you-use basis and a basic earn and burn frequent flyer program called Velocity Rewards.

The shift to a ‘New World Carrier’ was a play at the value-conscious leisure traveller looking for slightly elevated perks without the higher costs of Qantas. However, this shift also brought about a lessening of its cost advantage that it initially had against Qantas and all but effectively ceded it completely to Jetstar.

The ‘New World Carrier’ model continued it’s ‘premium creep’ by evolving into new products, such as introducing Premium Economy Class in early 2008, as well as lounge memberships and creating elite status levels as part of Velocity Rewards.

This second iteration of a ‘New World Carrier’ was clearly a play at self-funded small business and looked to bring competition to the business travel market. Under this version, the airline continued to be very reliant on price-sensitive business and leisure travellers, as opposed to the more price-resilient corporate travel market so heavily dominated by Qantas.

The result was a further erosion of the cost advantage it had against their competitors and in effect, Virgin Blue committed themselves to compete against Qantas and Jetstar within this new carved out niche market they had developed.

It was the GFC in 2008 that heavily exposed one of the greatest pitfalls of this ‘hybrid’ offering. As economies, small businesses and self-funded travellers had their discretionary income curtailed, many of Virgin Blue’s customer base fled to Jetstar, who could afford to offer lower fares through their comparatively low-cost base to that of Virgin’s, while passengers seeking a full-service experience remained with Qantas

Virgin Blue had placed themselves in a classic pincer movement, sandwiched between a full-service offering from Qantas on one-end, and a lower-cost alternative in Jetstar on the other, with their ‘hybrid’ product appealing to a shrinking customer base.

This became the catalyst for the ‘Game Change Program’, that saw the move upmarket under a rebranded Virgin Australia to compete directly with Qantas for business and corporate accounts.

This was followed in later years with their famous acquisition of Tiger Airways for $1, to compete directly with Jetstar and create their own dual-branded strategy for the Virgin Australia Group.

With that history, my argument for full-service

The objective of the above section was more than just to reminisce about the past, rather, to highlight the large levels of investment that has gone into Virgin’s product and act as a basis for my argument that Virgin v2.0 remaining as a full-service airline is the only course of action that makes financial and strategic sense today.

This is best exemplified by the above profit graph showing the billions of dollars on invested capital over the years. Most recently, the four major shareholders of Virgin Australia have contributed over $6 billion in investments to help upgrade the product to one that effectively competes with Qantas.

While it is true that the airline suffered greater losses in the years that it shovelled large amounts of capital into upgrading their product, I would argue that it was the execution, through taking on large amounts of debt, rather than the strategy itself, that caused much of its financial woes. Year after year, the heavy and increasing interest burden from this debt wiped out what was also an increasing revenue base. Add to that uncompetitive airline leases, sub-optimal route selection (remember 777 to Phuket and Nadi) and outright bad luck (Hong Kong riots after launch) and it became near impossible to turn a profit without some major restructuring of the business.

The CEO of Virgin Australia, Paul Scurrah, had begun to implement such a restructuring plan, reducing the corporate headcount by 750, simplifying the fleet of aircraft used, and pulling out of unprofitable routes in both the mainline and Tigerair brands.

Unfortunately, the COVID-19 outbreak abruptly put pay to this plan, with the airline going into Voluntary Administration and the responsibility of carrying on with a restructuring plan now falling to the Administrators, Deloitte.

Bidders for Virgin Australia are now facing the possibility of acquiring an airline with a world-class product that can compete effectively with Qantas in terms of standard and product demand. They will acquire years of multi-billion dollar investments to upgrade these products, and for the eventual owner, this will be a sunk cost that has been borne by others.

At the same time, the Voluntary Administration should ensure that a significant portion of the debt pile will be wiped or restructured into other forms, such as debt for equity swaps.

The resulting value proposition of inheriting an airline with competitive product and service, unshackled from the excessive burden of debt and able to be bought at a discount price in a depressed aviation market, should be quite appealing. The above argument, of course, assumes that the current business structure of Virgin Australia remaining as a full-service airline remains intact.

I have never understood the argument to revert back to a hybrid model. There is nothing to suggest that the same issues I mentioned above that were faced by Virgin Blue using this model during the GFC years of 2008-2010 will not be present today. Especially when the economic environment today is similarly subdued as it was back then and the competitive landscape has remained largely the same.

It could well be argued that these issues could be exacerbated today, given that many of Virgin Australia’s most dedicated customer base, elite members of the Velocity Frequent Flyer program, who have become quite accustomed to a certain level of service and elite perks that were not offered in the first iteration of the Velocity Rewards program, would likely flee en mass to Qantas if the ability to redeem these points for a variety of premium and global travel is dumped.

There is a ‘tipping point’ where the benefits of reduced expenses from a cut-down product offering is outweighed by the reduction in revenue from a product that no longer meets the expected level and travel needs of its customer base.

The argument to revert back to a low-cost carrier (LCC) model is one that I do have sympathy for. This model can provide sustained profits, even though it relies on very price fickle travellers. A very low-cost base buffers an airline from this risk, and these profits were shown to be consistently achievable in the early years of Virgin Blue. However, this model makes the most sense at a time when an airline is starting-up in a new market, with little to no competition from other LCCs, and wants to practice fiscal prudence as it grows. Not in the current environment where the bidders can benefit from an airline with billions of dollars already invested, able to be snapped at a lowball price.

I often hear that there isn’t space for 2 full-service airlines in terms of demand for the upscale product as justification for these alternate models, but the numbers do not support this proposition. In fact, Virgin Australia generated record revenues for the half-year ended 31 December 2019 of $3.12 billion. The overall loss resulted from excessive interest expense and restructuring costs, which will hopefully be dealt with to a large part by the administrators.

What about the broader strategy?

The argument about Virgin v2.0’s future business structure is generally contextualised around its mainline domestic offering, but what about its international operations as well as its low-cost arm Tigerair?

The calls for Virgin Australia to return back to a lower-cost form always comes in toe with calls to dump its international operations. These are not calls to just suspend operations while the COVID-19 pandemic plays out, but to permanently dump the entire international network.

I believe that such blanket calls are misguided. While many international routes are unprofitable and should be considered for the chop, there is a number of routes that are profitable such as those to Auckland and Los Angeles and will be again, post the pandemic.

Nobody, for example, would suggest that if the Melbourne-Queenstown route is unprofitable, then all flights between Australia and New Zealand, profitable or not, should be axed.

This is not to mention an integral part that an international network, being directly operated by the airline or through a joint venture or codeshare relationships, can have on other areas of the business, such as the Velocity Frequent Flyer program. Providing members with the ability to redeem for flights redemptions and upgrades will have an accretive effect on the value of the program

In terms of Tigerair, well, what can we say? Aside from its poor brand reputation, which I believe never really recovered from the popular Air Ways show over a decade ago, it has also suffered from a scarcity of flights. If one flight is cancelled, you’re likely to be waiting 8-10 hours for the next scheduled flight. Not really worth the risk to save a small amount in fare cost.

Aside from dumping Tigerair altogether and ceding any effective competition to Jetstar, an obvious approach would be to rebrand the airline and add more services to close the gap in flight schedules with Jetstar. But this would not be a cheap exercise and very likely not one that the new owners would like to implement in the short-term.

So how to preserve a moniker of a dual-brand strategy? I believe the answer may lie on the other side of the Pacific. Many legacy US airlines such as American, United and Delta have introduced what is known as ‘Basic Economy’ fares, that provide ultra-low-cost fares but with a ‘no-frills- service, such as no seat selection, no checked or hand luggage, minimised frequent flyer points and status earn, but to ensure efficient delivery, complimentary snacks and drinks are usually still included.

The introduction of such fares has proven to be quite profitable for these legacy carriers, especially in their attempts to compete against ultra-low-cost rivals, such as Southwest, Frontier and Spirit.

This could be a great alternative to retaining Tigerair and may go a long way to blunting the possible $19 Jetstar airfares between Sydney and Melbourne recently mooted by Qantas CEO Alan Joyce.

The elephant in the room

An issue that must be occupying the minds of the likely bidders for the airline is how travel will look in a post-travel restriction, but a vaccine-less world?

It is widely believed that the use of online forms of communication such as Zoom will remain high following the pandemic, which may lead to reduced travel, especially for business but could flow into the leisure market as well.

I do not share this view. We’ve heard it before. Remember when shopping centres were to become extinct once online shopping became a reality? This overlooked the clear reality that humans by nature are social creatures, and we like to socialise and gain experiences. Many smart shopping-centre owners spent money upgrading their centres on capital works that encouraged these social gatherings, such as improved food courts and inviting different breed of retailers into their centres like cinemas, arcade parlours and gyms.

Future travel, for the same reasons of wanting to socialise and explore, will not be permanently dented. It’s just not the same having an important business lunch over Zoom, right?

Summing Up

While I’m not necessarily in the V-shaped recovery camp, especially in terms of travel, I do think that the demand for travel will recover over the coming months and years. Humans are a very resilient group, with a great capacity to get up, dust ourselves off and move on.

A Virgin Australia structured as a full-service airline, retaining its most profitable domestic and international routes, while also incorporating ‘Basic Economy’ type fares, is in my view the most optimal structure. Tigerair has never really captured the Australian market and requires more than just a new brand and a lick of paint on its planes to rectify its issues.

And with a reduced debt pile, offering a product proven to generate high revenues, this should provide the airline with the greatest chance for success for the future.

Blanket calls for reverting the airline back to a ‘hybrid’ or LCC is simplistic, backward-looking, and not to mention, quite an expensive exercise. It could well be the case of throwing the baby out with the bathwater.

Check out the other Point Hacks Editor’s View articles here →

I’d love to hear your views on what business model Virgin Mk II should take. Please comment below.

Tiger should be rebranded virgin blue flying the remaining eastcoast and transtasman routes in the new world model 737 and atr

Virgin regional should be rebranded virgin west and rely on the fokker planes

Just being selfish here, I do not want to lose the Virgin Economy X seats. They make a big difference to my flying experience and are within my budget. QF doesn’t have them, and are not likely too.

We need another full service airline to keep Qantas from hiking fares and lowering service past the rock bottom where they are now, if they get a monopoly. You can almost see Joyce salivating at the prospect of Virgin going down and leaving Australians with no choice at all, other than cars and substandard trains and buses.

I think it is also interesting to note that there may be added interest from these carriers given they do not have profitable domestic networks to operate while international travel shows no signs of recovering from COVID19.

The Virgin Blue was growing and making profits. The full-service Virgin that collapsed, did not, as it was only profitable in 1 of its last 6 years. I don’t understand why there is a call for an unprofitable full-service Virgin, similar to the collapsed Ansett, when there are examples of profitable lean airlines in Australia

If you haven’t already done so, I would recommend reading a book called ‘Ansett The Collapse’ by Geoff Easdown and Peter Wilms. I found it to be a great read and it clearly highlights all the issues and missteps faced by Ansett, and while there are some similarities in the current Virgin Australia situation (like too many fleet types), there are many differences as well, so not easily comparable.

As I mentioned in my piece, I believe the economic and competitive environment in the early years of Virgin Blue was different and more favourable to Virgin than it is today. Jetstar is today much stronger and competitive, in a segment of the market that primarily competes on price rather than a mixture of additional factors such as service quality, frequency of flights, frequent flyer benefits etc, so there is a much greater chance of price wars ensuing here than at the full-service end of the market. Also, the losses for Virgin Australia were not revenue related, they were expense related, primarily interest expense that can be addressed to some extent by the administrators and unlikely to grow given little additional investment capital is now required in their product offering along with very low-interest rates.

Should Virgin end up being liquidated, an LCC approach may well be the best model, but absent of this, I believe full-service is still the way to go. But thanks for sharing a contrarian view and hope you enjoyed the article.

I hope Virgin survive in a profitable form but otherwise I am looking to see if the govt has the courage to simply open Australian aviation domestically to Air New Zealand and or Singapore Airlines.

The premise is true for leisure travel, as tourists are seeking “experiences”. But business is about seeking value. And as technology improves, the justification for business travel decreases – particularly in an age where businesses will not have excess money lying around just to give someone a business trip.

In governments, business meetings will be re-evaluated vs VTC or telepresence solutions (which actually saves time as you do not need to travel as well as saves money). In the research domain, conferences are seriously looking at online solutions to present ideas, and I have never understood why people need to be there to present. Online TED talks are examples of where it should go.

And not only does VTC/Zoom save costs. It actually results in a more pandemic-robust society, as we are meeting less people

Full service with limited international flying and a single shareholder would also make it a lot easier to join an alliance in a few years.