With Qantas having recently hiked the number of Qantas Points needed to book most flights, savvy travellers may be considering their other options in the loyalty space. Even if you plan to keep flying with Qantas, it pays to know the other ways that you can secure seats using points. For instance, by earning flexible credit card points, and redeeming those points through the frequent flyer programs of Qantas’ other partner airlines.

For example, did you know that you can also book Qantas flights via The British Airways Club? And by using Asia Miles from the loyalty program of Cathay Pacific? These are just two of the many alternative programs through which you can get yourself a seat on Qantas. All without parting with the higher numbers of Qantas Points these tickets would now otherwise command.

But how can you earn these other types of points from credit card spend? The key is to have a credit card attached to a flexible rewards program. Some of the popular programs in Australia include:

These programs offer a number of transfer partners, providing you with options when you redeem your points. This can include spending points on Qantas flights. That can be the case even if your credit card isn’t a ‘direct earn’ product attached to the Qantas Frequent Flyer program, like this.

Qantas American Express Ultimate

Book Qantas flights from flexible credit card points

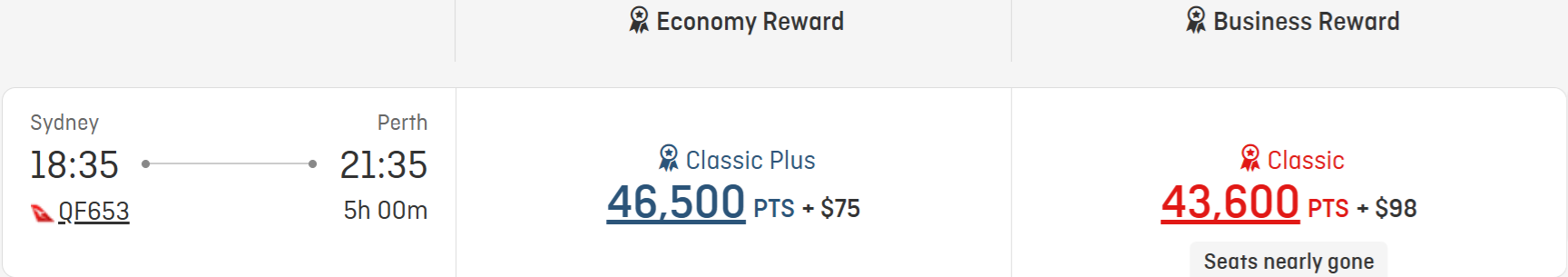

Let’s say you’re planning a Business Class jaunt from Sydney to Perth. When booked through Qantas Frequent Flyer, you’d need 43,600 Qantas Points + $98 in taxes, fees and charges for a Classic Reward seat.

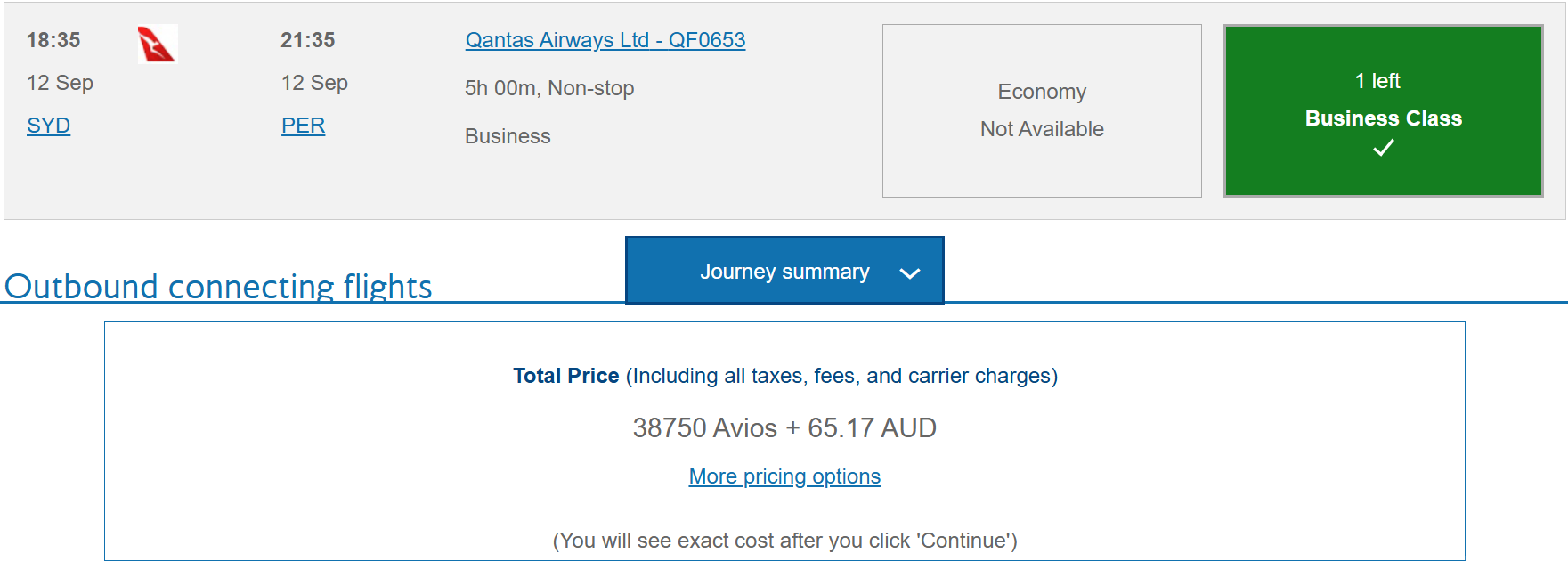

But what if you had Avios to spend through The British Airways Club? The same seat on the same flight costs even less, requiring 38,750 Avios plus $65.17. This is what we mean by being able to book Qantas using flexible credit card points, rather than with Qantas Points directly.

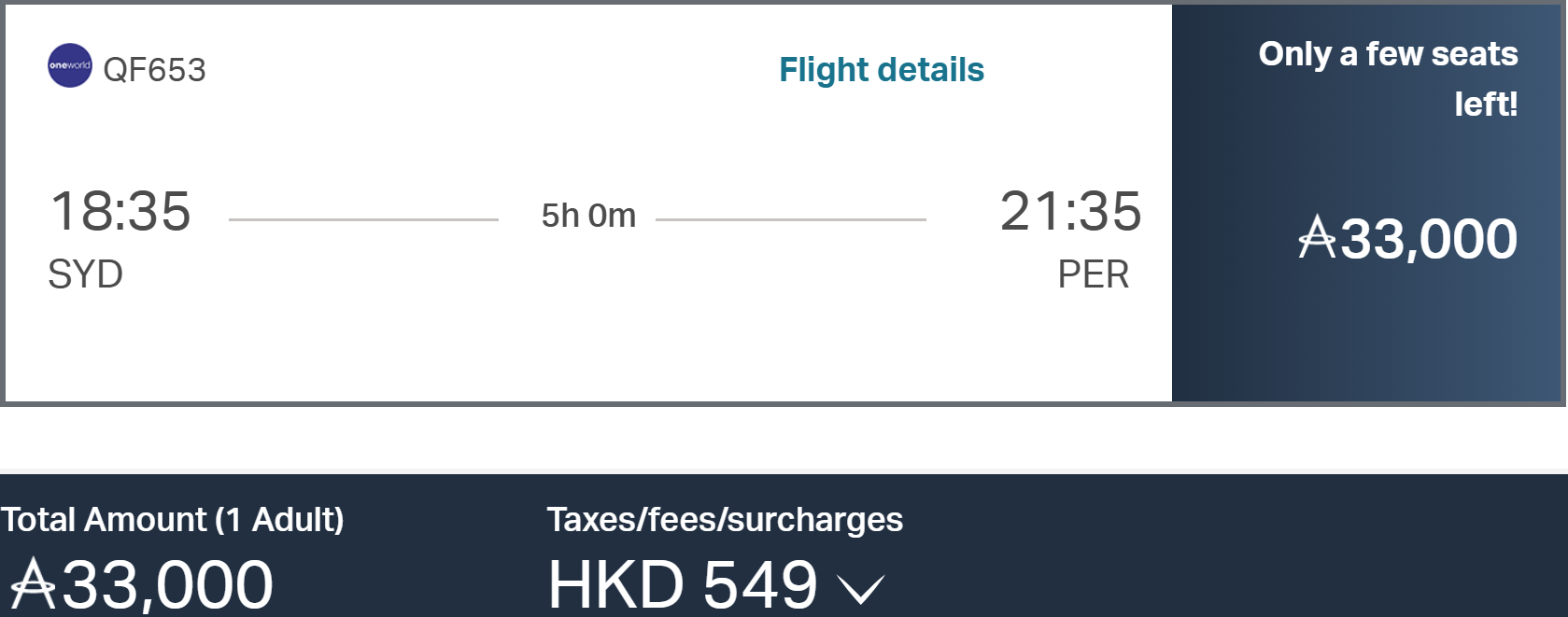

Hmm, but what if you have access to Asia Miles with Cathay Pacific? That same flight would cost just 33,000 Asia Miles, plus $549 HKD (around $109 AUD). Sure, you’re paying around $11 more in fees and charges… but you’re also saving more than 10,000 frequent flyer points in the process. That’s by using Cathay rather than Qantas Frequent Flyer.

So, even if you have Qantas flights in your sights, you don’t necessarily need a Qantas-affiliated credit card to book them. You can take advantage of having flexible points. These would give you access to other frequent flyer programs too, with a greater number of opportunities when it’s time to spend them.

Transferring credit card points and booking Qantas via partner airlines

The frequent flyer programs of British Airways and Cathay Pacific are just two of the options available for booking Qantas flights via flexible credit card points. Here are all of the options available from flexible credit card points programs in Australia. We’ve excluded those that are changing imminently, like CBA Awards which is about to remove almost every points transfer partner.

| Credit card rewards program | To book Qantas flights, transfer to… |

| American Express Membership Rewards | The British Airways Club (2:1) Cathay (2:1) Emirates Skywards (3:1) Malaysia Airlines Enrich (2:1) Ascent Premium members can also convert directly to Qantas Frequent Flyer. |

| Amplify Rewards (St.George, Bank of Melbourne and Bank SA) | Everyday Rewards (1.5:1) and onwards to Qantas Frequent Flyer (2:1) |

| ANZ Rewards | Cathay (3:1) |

| Citi Rewards (applicable to Prestige cards only) | Cathay (2.5:1) Qatar Airways Privilege Club (3:1) and onwards to The British Airways Club (1:1) |

| HSBC Rewards (applicable to Premier cards only) | Cathay (2:1) |

| NAB Rewards | Cathay (3:1) |

| Virgin Money Rewards | Qatar Airways Privilege Club (3:1) and onwards to The British Airways Club (1:1) |

| Westpac Altitude Rewards | Cathay (3:1) Everyday Rewards (1.5:1) and onwards to Qantas Frequent Flyer (2:1) |

Just keep in mind that when you book reward flights, the taxes and fees may often be payable in that program’s home country. For instance, how the co-payment amount is calculated in Hong Kong dollars when redeeming through Cathay. On most credit cards, this may trigger an international transaction fee in the region of 3% of the payment value.

Before transferring your reward points…

Keep in mind that different frequent flyer programs can have access to different reward seats. In our example, every program we’ve highlighted could ‘see’ the same Business Class reward seat on the same flight. But this isn’t always the case.

Qantas generally makes more reward seats available to its own Qantas Frequent Flyer members. Especially so, those with elite status (Silver or higher, but even greater at Gold and beyond). So it can still pay to have Qantas Points at your disposal, when the flight you want is only bookable through Qantas itself.

But the beauty of online searching is that you can check what’s available to the partner program of your choice. More importantly, you can see how many of that program’s points or miles you’d need, and what you’d pay in taxes and fees. Then, you could book your Qantas flights by transferring points from your credit card to that program, only as required.

Be mindful that frequent flyer programs can have differing policies on things like points expiry. Policies can also differ on how reward booking changes and cancellations are handled. Consider these policies before you transfer and book.

Summing up

There are many ways that you could book Qantas flights using flexible points earned from a non-Qantas credit card. Given the different earning, conversion and redemption rates, you’ll want to do your own sums to see which combination is the most cost-effective for the types of reward flights you’d typically book. Ditto, for the routes you’d usually aim to get a reward seat on.

Don’t forget as well, by having flexible points, you’re not stuck with just one airline or alliance. Programs with Singapore Airlines as an option can be a great way of unlocking reward seats on The Lion City’s home carrier itself, as well as across Star Alliance. Anything that makes it easier to secure reward flights in the cabin you want, to the destination you desire, is a win in our books.

Also read: The benefits of flexible rewards programs

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

I have a question…. do you think you can upgrade a flight booked with Qantas using your BA Avios points?

However, with the Amex Platinum Edge card and typical household spending patterns, you’ll probably find that you average 1.5 MR per $ or higher anyway (given all the 3:1 and 2:1). This makes it more of an even proposition in my books.

Point taken on lack of coverage elsewhere on the site but CBA’s offers, and points program offering, are usually not competitive with what else is out there, hence not prioritising coverage of them. That said I do have a CBA Awards guide in the works which should be ready to go pretty soon.

Thanks for your comment.

I just had a quick look at the CommBank awards program. From what I found, yes, they allow transfers to Qantas or Velocity; to use Qantas you have to opt in to the Qantas direct earn option, meaning a monthly sweep to Qantas rather than when you decide. This effectively makes any CBA card once opted in a Qantas direct earn card (and no different to what any other bank do except they market a single product with the option, rather than a separate Qantas or flexible program card)

The only cards in the market I’m aware of that allow flexible program transfers to Qantas at will rather than the direct monthly sweep, are the Amex Platinum and WBC Altitude Business cards I mentioned in the article. If you know of any others from CBA (if I missed one) or otherwise I’d be more than keen to hear about them!

Jason