Pay.com.au is a business-to-business (B2B) payment processor that lets you earn full credit card rewards points on bills and transactions, even if the recipient only accepts bank transfers. That’s handy when you’re paying suppliers or government agencies, such as the ATO, which may usually offer reduced or even no points on your credit card.

But what sets Pay.com.au apart from other payment processors is its in-house, flexible points PayRewards program. For an extra 1% or 1.8% fee (on top of the payment transaction fee which varies), you can opt to earn 1 or 2 PayRewards points per dollar, respectively.

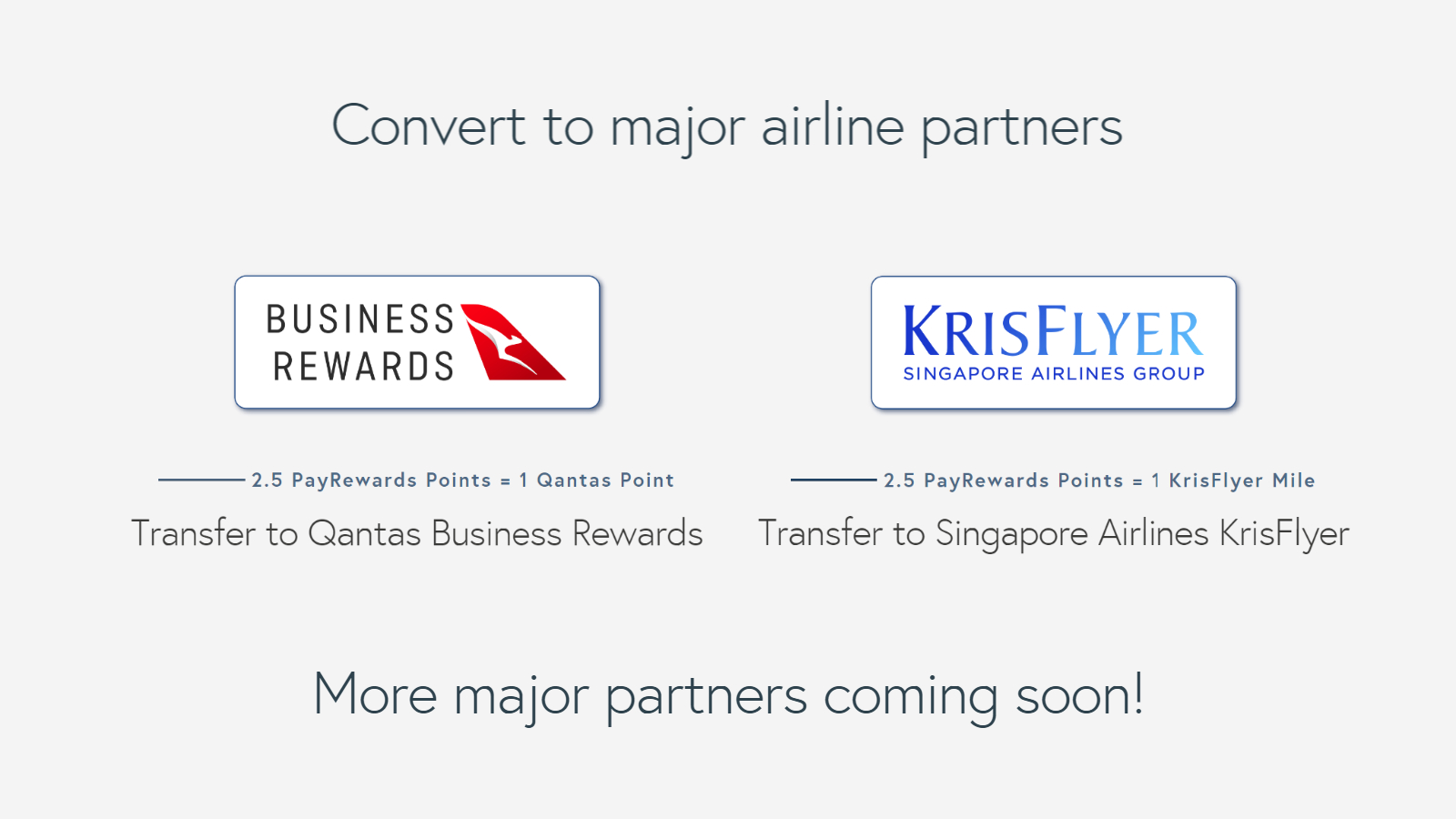

PayRewards points can then be transferred at a 2.5 to 1 rate to Qantas Business Rewards or Singapore Airlines KrisFlyer.

Here is the latest bonus offers with earning points at Pay so that you can jet away in luxury sooner.

1. Get up to 25% bonus points when transferring PayRewards points to Qantas Business Rewards

| Expiry: Transfer by 6 December 2022 |

For a short time, points transfers from PayRewards to Qantas Business Rewards can attract a bonus of up to 25% more Qantas Points, as follows:

- Convert 100,000 to 199,999 PayRewards points: get 15% more Qantas Points.

- Convert 200,000 PayRewards points or more: get 25% more Qantas Points.

The conversion rate from PayRewards to Qantas Business Rewards is 2.5:1. This normally makes 100,000 PayRewards points equal to 40,000 Qantas Points, and 200,000 PayRewards points worth 80,000 Qantas Points.

With a 15% bonus in play, a transfer of 100,000 PayRewards points gets a more generous 46,000 Qantas Points instead. At the higher tier, transferring 200,000 PayRewards points fetches 100,000 Qantas Points, given the 25% boost.

2. Up to 160,000 bonus PayRewards points (new customers)

| Expiry: Pay by 30 November 2022 |

New customers to Pay.com.au can earn from 8,000 to 160,000 bonus PayRewards points by making an eligible payment to the ATO. Just process the payment with a credit card or bank transfer and opt to earn PayRewards points. Your first payment will earn bonus points based on the following tiers:

- 160,000 PayRewards points: process a payment of $1,000,000 or higher.

- 120,000 Pay Rewards points: process a payment of $750,000 to $999,999.

- 80,000 PayRewards points: process a payment of $500,000 to $749,999.

- 40,000 Pay Rewards points: process a payment of $250,000 to $499,999.

- 8,000 Pay Rewards points: process a payment of $50,000 to $249,999.

While this offer is for new customers, existing customers should check their email to see if they’ve been targeted for a similar offer.

3. 10,000 bonus PayRewards points (new customers)

| Expiry: ongoing |

New to Pay.com.au? Sign up and transact at least $10,000 in your first month as a member to get 10,000 bonus PayRewards points. That’s worth 4,000 Qantas Points or KrisFlyer miles. As a new member, you also get a 30-day free trial of the ‘Premium’ membership tier, which grants you the lowest card processing rates available on pay.com.au.

But you have to sign-up through our special Point Hacks link to get this offer.

Summing up

PayRewards is a unique flexible rewards program that’s part of Pay.com.au. Earn extra points on all your business expenses and transfer them at will to two major airline groups – Qantas Frequent Flyer or Singapore Airlines KrisFlyer.

Covering the two largest airline alliances in Australia, and with more to come, these PayRewards points offers will see you flying further.

Disclaimer: Point Hacks is affiliated with Pay.com.au.

You have to look at the cost of the flights to see if this works.

For example, I potentially make $18500 monthly payments to the ATO for my tax. That works out as 37000 points. Sounds good right? But, that ends up being converted to only 14800 Qantas points (divide by 2.5). But the 1.8% fee there costs me $333.

That will get me a one way flight to somewhere with a Q points price of 12000 PLUS the $60 fee. So that works out at (12000/14800)*333 = about $270. Add in the $60 booking fee and your flight now costs you $330. It’s not that cheap. Of course some legs can be more expensive and you still get the benefit but if you are paying off your ATO bill with a payment plan, GIC is around 9% now. That adds an extra fee per month in interest unless you can get your ATO fees waived and it more than likely neuters any benefit.

The bonus for paying your tax bill in one go isn’t that high either. I suppose the key here is to get the ATO to waive your GIC if you’re on a payment plan if at all possible.