Reloadable prepaid travel cards promise convenience and the certainty of a locked-in exchange rate when spending money overseas. Qantas Pay (formerly Qantas Travel Money) is a popular example – and it earns Qantas Points. But with all these prepaid cards, you often pay a premium in fees and commissions.

An alternative is a bank debit card. These are linked to an ordinary transaction account in Australia and function just like any other debit card you might have. However, some banks offer no international transaction or ATM withdrawal fees, plus no markups on exchange rates. Over one holiday, that could be a lot of money saved without you realising it.

Westpac Altitude Qantas Black

Is a prepaid travel card for me? What about Revolut?

Prepaid travel cards, such as Qantas Pay, are best suited to you if:

- You are looking to accrue Qantas Points (specifically for Qantas Pay).

- You’re looking to spend loaded funds predominantly overseas and not overspend.

- Perhaps you might not be eligible for a credit card or want to set up a travel card for a minor.

- You’d like the certainty of knowing what rate you’ve locked in for popular currencies.

The main disadvantage is the price of that convenience: there’s usually some significant padding on the exchange rate.

An exception to this is Revolut, a more innovative version of a travel money card. With Revolut, you can also pre-load currencies or spend ad-hoc using Australian dollars with no international transaction fees. Still, the exchange rate is significantly better than traditional travel money cards.

The main downside is that Revolut limits fee-free ATM withdrawals overseas to A$350 or five per month on the free plan. After this, a 2% or A$1.50 fee per withdrawal applies.

How about a bank debit card?

Not all bank debit accounts are equal. For the best overseas benefits without restrictions, consider:

- UP Everyday: Debit Mastercard

- Bankwest Easy Transaction Account: Platinum Debit Mastercard

- Macquarie Transaction Account: Platinum Debit Mastercard

- HSBC Everyday Global Account: Visa Debit Card

These accounts are entirely fee-free. There are no monthly account-keeping, international transactions, or ATM withdrawal fees. You’ll still be charged any ATM operator fees, which is the norm across all travel cards. Many countries do have some bank operators that don’t pass on fees.

UP, Bankwest and Macquarie use Mastercard, so you can use this online calculator to see what exchange rate you’ll get. HSBC uses internal rates for supported currencies or the Visa rates for non-supported currencies. The advantages of using these debit cards overseas are:

- Significantly improved exchange rate compared to prepaid travel cards.

- Ability to keep your money in a separate savings account to accrue interest and transfer what you need to the transaction account for increased security of funds if your card is lost or stolen.

- No account-keeping or international transaction/ATM fees.

The main disadvantage of UP, Bankwest and Macquarie is you can’t lock in a specific exchange rate if it’s high. What you are charged will depend on the exchange rate of the day. HSBC lets you lock in ten currencies, though their internal rate is usually not as high as the Visa rate.

Comparison of exchange rates

Make sure to look at your card’s exchange rate when converting your AUD into a foreign currency, as this can be the most significant driver of whether you are receiving good value for money.

We’ve compared published exchange rates from a few products below (as of 27 February 2025). The winning currency rate is highlighted in blue, the second place in green, and the lowest rate in red.

| HSBC Everyday Global | UP, Bankwest & Macquarie Transaction | Revolut | Qantas Pay | Travelex Money Card | Commbank Travel Money Card | |

|---|---|---|---|---|---|---|

| US Dollar | 0.617 | 0.6357 | 0.6292 | 0.6014 | 0.6152 | 0.6051 |

| British Pound | 0.4845 | 0.5015 | 0.4967 | 0.4703 | 0.4761 | 0.477 |

| Euro | 0.5856 | 0.6042 | 0.6007 | 0.5711 | 0.5773 | 0.5766 |

| Canadian Dollar | 0.8805 | 0.9088 | 0.9031 | 0.8460 | 0.8672 | 0.8566 |

| New Zealand Dollar | 1.0776 | 1.1099 | 1.1067 | 1.0473 | 1.0631 | 1.0621 |

| Japanese Yen | 91.6582 | 94.78 | 93.8022 | 88.7718 | 89.8944 | 89.87 |

| Singapore Dollar | 0.8218 | 0.8493 | 0.8435 | 0.7893 | 0.8055 | 0.8078 |

| Hong Kong Dollar | 4.77 | 4.9428 | 4.8932 | 4.5861 | 4.6726 | 4.693 |

| Overseas ATM fee (charged by card issuer) | None | None | Free limit of $350-$1,400 per month, then 2% or $1.50 | AUD 1.95; USD 1.95; GBP 1.25; EUR 1.50; NZD 2.50; SGD 2.50; HKD 15.00; CAD 2.00; JPY 160 | None | $3.50 |

Rates were calculated on 27 February 2025 and will fluctuate.

The results above show a clear trend. UP, Bankwest and Macquarie, which all use the Mastercard rate without any mark-up, come out on top. Revolut closely follows behind in second place. Qantas Pay fares the worst in our tests.

What does that mean in real life? Let’s say you want to exchange or spend A$1,500 to use in the USA. At those rates:

- Bankwest/Macquarie: You’ll get US$953.55.

- Revolut: You’ll get US$943.88.

- Qantas Pay: You’ll get US$902.10 + earn 2,250 Qantas Points.

That’s quite a significant spread between the highest and lowest options – about 5.4% less. The difference in exchange rates means you lose out on US$51.45 (~A$82) for the same transaction. Think of it as paying $82 to earn 2,250 Qantas Points – a terrible deal by anyone’s standards.

Summing up

Prepaid travel cards: some people love them, and others hate them. Being a points hacker means knowing when to spot a poor offer and not blindly spending to earn points. With Qantas Pay, you’re paying through the roof with heavily padded exchange rates.

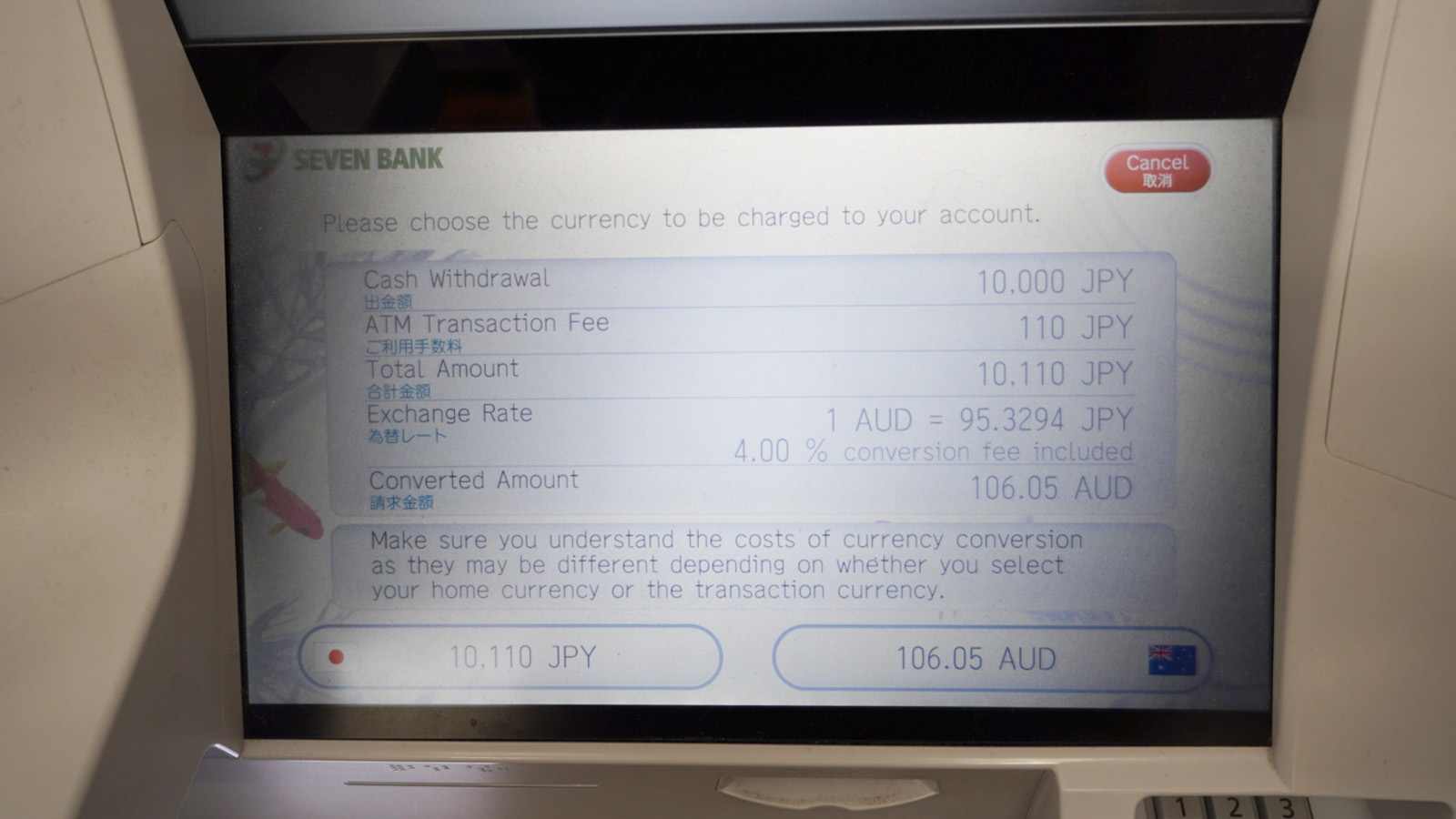

When I travel, I use an Australian debit card with no international transaction or ATM fees to manage my money. I’ll usually withdraw from an ATM (preferably with no operator fee) to get the best possible rate. But even if I can’t dodge the operator fee, the few dollars they charge is still usually a better option than being ripped off by money changers.

Supplementary images courtesy respective frequent flyer programs and financial providers. Point Hacks has no affiliations with the debit card products mentioned in this study.

Wondering if you guys will look into comparing it with newer options like Wise’s multi-currency card for example?

little use now the holday is over. A SECOND BACK UP CARD IS ESSENTIAL.

Your assertion that “you are forgoing 4-5% of your Australian dollars by using one of these two prepaid travel card compared to the official rates set by the two big card issuers.” is bold. Could you cite a specific card that gives these rates directly? or remove this part of your article? Otherwise … great article and comparison! Thanks.

Generally speaking, using a debit or credit card overseas will result in a more favourable exchange rate than a prepaid travel card. No card will offer the exact official rate that Mastercard or Visa post but the difference is much larger for a prepaid travel card.

I think there is one feature you didn’t compare, which is how quickly could you load the currency, and make it available to be used. If I am not wrong, at least one of the card you have compared have an instant load feature. (e.g. convert AUD to USD, you could use the USD straight away)

thanks for this article.

I have used travel cards in the past and also 28 degrees till I noticed there is a small fee attached to the 28 degrees (it was under AUD$1 last time I looked), which is annoying as it always means you have to add this to your balance if you want to pay the total amount.

So I have swapped to a Citibank debit card (which, I think is the same one as another reader (Geoff) uses). I load it in AUD, use almost any ATM in the world without any fees, and obtain local currency or I can use it as an ordinary debit card in stores. At the end of my trip, any unused money gets returned to my usual bank account. It isn’t attached to any of my usual bank accounts, so much safer to travel with.

I would never return to using any travel cards.

I usually have a big overseas trip every couple of years. This travel card could be useful for me during the trips, but not much use when home. If I just just opt back-out of the service afterward, it’d be a bit more attractive.

I’ve been using Qantas Cash for a few years now and while their exchange rates are not the best unless you’ve got a card that has no conversion fee then you’re going to be worse off. The option of a card like 28 Degrees is on the table however by using Qantas Cash I’m earning points which helps to offset any losses.

However there are two very valid reasons that you don’t touch upon:

Who uses cash?

In the past twelve months I’ve had AUD cash in my wallet on 5 occasions (1 Melb Cup Sweeps, 3 for office farewell gifts and 1 for a cash only bar). I’m assuming everyone here puts all spending through their points-earning-credit-cards?

Why would I want $500 cash in my wallet when I’m travelling and at my most vulnerable?

So by using the Qantas Cash debit card for all transactions while OS I’m spending my money, not getting charged ATM Fees or additional conversion fees and the only cash I’m carrying is for tips.

AND I’m earning a high rate of FF Points.

Qantas Cash Bonus Loads.

If you are a regular traveler or online shopper this becomes particularly useful. Regularly throughout the year Qantas offer bonus FF points for loading funds into foreign currencies – $2-4K = 1500 bonus points, $4K+ = 4000 bonus points.

If you’re spending a lot in foreign currencies this adds up nicely – providing even more offset to the mildly lower exchange rate.

https://www.citibank.com.au/aus/banking/everyday_banking/citibank_plus.htm

It is just a bank account so anyone can apply without any hoops to jump through compared to a CC like the 28 degrees. There are no fees for having the account open and no fees for overseas ATM withdrawals. The biggest benefit though is not paying the 3-4% transaction fees on these withdrawals. Obviously no points are earned but the saving of 3-4% far outweighs any gains from points from these travel cards.

I have now complimented this with the new ANZ Rewards Travel Adventures credit card.

https://www.pointhacks.com.au/credit-cards/anz-rewards-travel-adventures-card-guide/

For the $225 annual fee, this card already has some great benefits including a free return flight each year (great for Perth!), 2x virgin lounge passes. It also now earns the equivalent of 0.75 velocity points per dollar (more recently if you transfer during May or November Velocity bonus periods). Finally, this credit card also has no overseas conversion fees. It also has the ability to go into a positive balance for fee free overseas ATM withdrawals.

To sum up, when overseas I use the Citibank Plus account for ATM withdrawals, and the ANZ Rewards Travel for any purchases. I think this is a great combination, and is good to have a backup if you lose either card, knowing you won’t revert to paying exchange fees on your hard earned $$$.

Cheers,

Geoff