If you sign up for any of the various premium credit card offers on our site, chances are your new piece of plastic will come with a suite of complimentary insurances. Now, travel insurance is generally the one most people check, but what about complimentary shopping insurance?

It’s often overlooked, but as I found out recently, shopping insurance benefits can come in handy. Here’s a comparison of purchase protection cover from a variety of card issuers, plus details of my own personal experiences.

Disclaimer: All content in this article is general in nature and does not take into account your personal circumstances. Read the credit card insurance PDS documents to see if each cover is right for you.

What is purchase protection?

Purchase protection is an umbrella term for a range of insurance benefits that cover physical items you buy with the credit card. This could cover for damage to your new goods, extended warranty, price-drop protection and more.

The actual insurance perks offered depends on the type of credit card you hold (generally some Gold, and most Platinum/Black-grade cards offer this), plus the bank or card issuer that you are with.

Which cards offer purchase protection?

Most banks offer some credit cards with purchase protection insurance included. In this guide, we are covering a snapshot of the most popular reward cards here, so not all card products or banks are included (e.g. non-rewards cards are excluded).

There are four main types of purchase protection cover, most of which are similar (though not identical) between different credit card providers:

- Purchase security insurance: Covers repair or replacement cost of goods which are lost, stolen or damaged within 90 days or 3 months.

- Extended warranty insurance: Extends the manufacturer’s Australian warranty on most purchases by up to a year.

- Refund protection: Cover for up to $500 if you’re having trouble getting a refund within 3 months of purchase.

- Price guarantee: Covers the difference in the price of a purchase if the same item is found in a printed catalogue:

- advertised for a lower price in-store within 21 days of purchase

- within 25 kilometres of the store it was purchased, and

- the difference is greater than A$75.

Remember that even though the following cards usually follow the purchase protection guidelines above, every card may vary in terms of eligibility, exclusions and limits. Always check the PDS to see if each cover is right for you.

American Express

American Express

Amex is one of the most generous card issuers when it comes to purchase protection. Even its fee-free cards include some (though not all) covers!

That roster includes the Amex Platinum Charge, Platinum Edge, Explorer, Essential, Qantas Ultimate, Premium and Discovery cards, Velocity Platinum and Escape cards, plus the David Jones and David Jones Platinum cards.

- Purchase protection insurance: ✅ [All cards above]

- Extended warranty insurance: ✅ [Amex and David Jones-branded cards] | ❌ [Qantas and Velocity-branded cards]

- Price protection cover: ❌

- Refund protection: ✅ [Amex, Qantas and Velocity-branded cards] | ❌ [David Jones-branded cards]

As American Express has different forms of cover, choose your AMEX card from this list to find the insurance PDS, and for more information on eligibility and cover.

ANZ

ANZ

All of ANZ’s Platinum and Black-grade reward cards include purchase protection. These cards include the ANZ Frequent Flyer Platinum, Frequent Flyer Black, Rewards Platinum, Rewards Black and the Rewards Travel Adventures.

- Extended warranty insurance: ✅ [All cards above]

- Purchase protection insurance: ✅ [All cards above]

- Guaranteed Pricing Scheme: ✅ [All cards above]

- Refund protection: ❌

Read the ANZ Premium Cards Insurances PDS for more information on eligibility and cover.

Commonwealth Bank

Commonwealth Bank

All three of Commbank’s Awards cards — Platinum, Diamond and Ultimate Awards — includes purchase protection.

- Purchase security insurance: ✅ [All cards above]

- Extended warranty insurance: ✅ [All cards above]

- Price guarantee: ✅ [All cards above]

- Refund protection: ❌

Read the Commbank Credit Card Insurances PDS for more information on eligibility and cover.

NAB

NAB

Hold NAB’s Rewards Platinum or Rewards Signature card (or the Qantas Rewards Platinum and Signature)? Then you’re in luck with purchase protection.

- Extended warranty insurance: ✅ [All cards above]

- Purchase protection insurance: ✅ [All cards above]

- Price protection cover: ✅ [All cards above]

- Refund protection: ❌

Read the NAB Credit Cards Insurances PDS for more information on eligibility and cover.

St.George/BankSA/Bank of Melbourne

St.George/BankSA/Bank of Melbourne

If you’re a cardholder of St.George Amplify Platinum or Signature (or the Qantas-equivalent Platinum and Signature cards), then you’ll have access to purchase protection, although the Platinum cards miss out on price guarantee cover.

- Extended warranty insurance: ✅ [All cards above]

- Purchase security insurance: ✅ [increased up to four months cover for Amplify Signature]

- Price guarantee cover: ✅ [Amplify Signature] | ❌ [Amplify Platinum]

- Refund protection: ❌

Read the St.George Credit Cards Insurances PDS for more information on eligibility and cover.

Westpac

Westpac

Both Westpac’s current Altitude Rewards cards — the Altitude Platinum and Altitude Black — come with complimentary shopping insurance, though the Black card has slightly better perks.

- Extended warranty insurance: ✅ [increased up to two years for Altitude Black]

- Purchase protection insurance: ✅ [increased up to four months cover for Altitude Black]

- Guaranteed Pricing Scheme: ✅ [Altitude Black] | ❌ [Altitude Platinum]

- Refund protection: ❌

Read the Westpac Credit Cards Insurances PDS for more information on eligibility and cover.

Case Study: how ‘purchase protection’ covered a damaged item

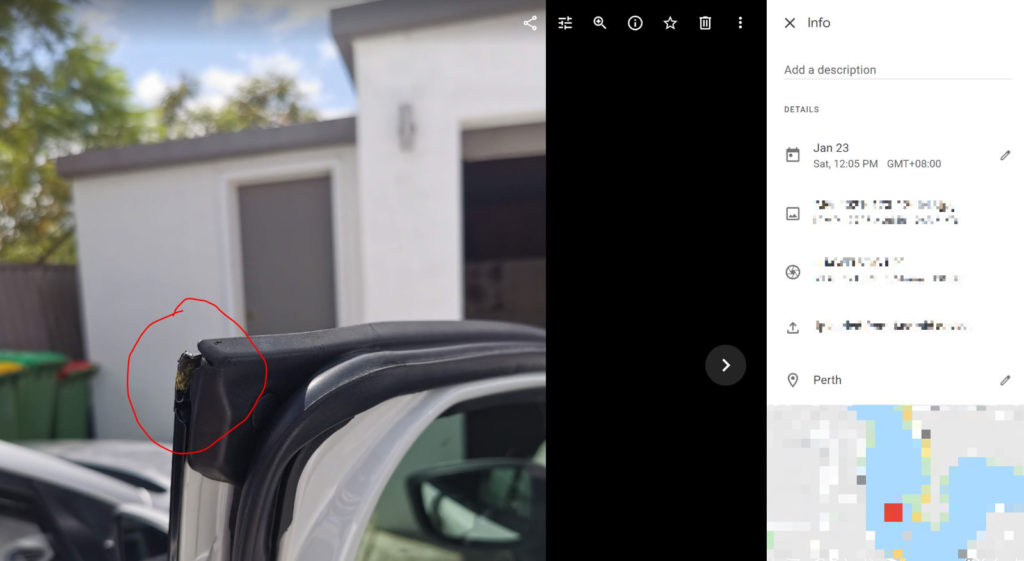

Now we move on from dreary insurance wordings to a real-life scenario I unexpectedly found myself in early 2021. I purchased a new shirt for A$49.90, but less than two weeks later, I accidentally ripped it open on an exposed part of my car door (which I wasn’t aware of at the time).

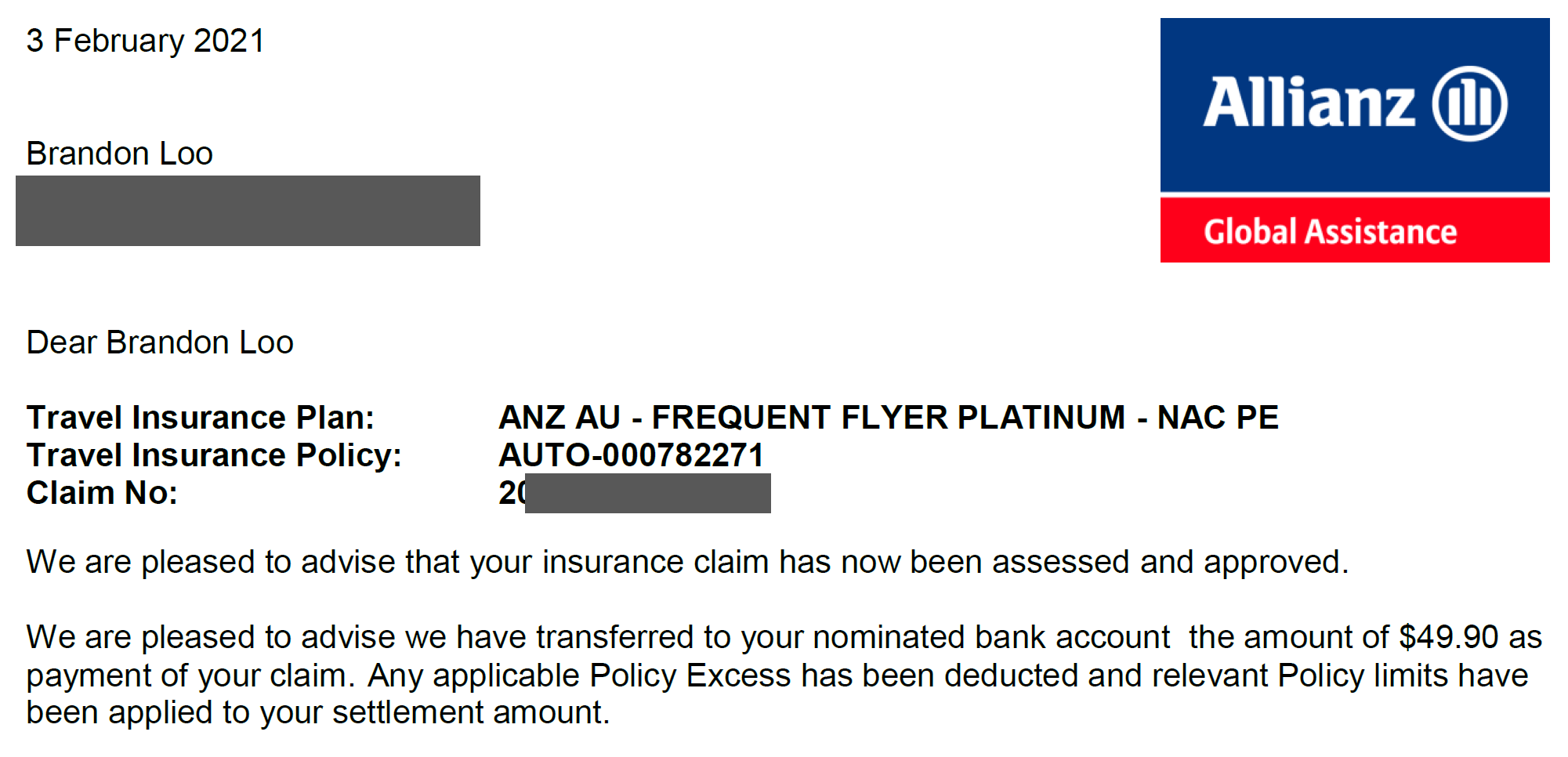

I was initially going to write it off as bad luck, but then I remembered to check to see if my card included insurance. Thankfully, I had purchased it on the ANZ Frequent Flyer Platinum Card, which does. Here’s the overall timeline of events:

- 10 January: Purchased shirt

- 23 January: Accidentally damaged shirt beyond repair

- 25 January: Lodged claim with Allianz (ANZ’s credit card insurer). A form was emailed to me. I completed the form and sent it back, including a description of what happened and copies of receipts

- 29 January: Received request for additional supporting documentation (in this case, photos of the damaged shirt)

- 2 February: Notified that my claim was recommended for settlement

- 3 February: Notified that my claim was approved

- 5 February: Received $49.90 settlement via bank transfer

All-in-all, the claims process took just under 2 weeks from initial contact to receiving the pay-out, which is quite reasonable. There was also no excess to pay in this instance, though you’ll need to check your card insurance PDS to see if additional charges would apply for your case.

Summing up

Purchase protection insurance may not be something you’d consider when signing up or using a card, but it definitely pays to know what benefits you may be able to claim.

In my case, I was lucky I had used a card with purchase protection (my other points-earning card wouldn’t have covered me), and that my damage occurred within the first 90 days of purchase.

I don’t see ‘extended warranty’ or ‘price guarantee’ as something that would be used often, but it’s nice to have in the small off-chance that you are eligible to make a claim under it.

Arguably, the 3-4 months of ‘purchase protection’ that covers you for loss, theft or damage to your new items, is invaluable. This could apply to more expensive tech gadgets as well — including accidentally cracked screens.

Just be sure to read your policy wording carefully, and ensure you follow all the rules in regards to the cover, so you don’t run into issues.

Please update your article with the correct information.