Airline alliances make travel easier for passengers – especially when it comes to sharing status perks, co-locating flights within the same terminals and booking connections to more obscure destinations. But joining an alliance comes with a hefty price tag. These include potential costs to upgrade systems for compatibility, meeting the alliance’s standards and procedures and accepting award bookings from other carriers within the alliance.

Another barrier to entry is existing partnerships. Many airlines establish links with carriers in different alliances. These links may make it complicated to join an alliance later on. Read on for a list of major carriers not yet in oneworld, Star Alliance or SkyTeam, and whether we think that we could see more members join in the future.

Starlux

| Likelihood of joining an alliance: possible |

Taiwan’s ‘detail-orientated’ new carrier, Starlux, is one of the most likely airlines in this article, in our eyes, to join an alliance. Apart from offering a fantastic onboard product, it already runs a fully-fledged loyalty program called COSMILE. With competitors EVA Air in Star Alliance and China Airlines in SkyTeam, our bets are on Starlux joining oneworld one day.

The COSMILE program already has three elite status tiers, which could broadly match with oneworld Ruby, Sapphire and Emerald status. All Starlux needs to do now is to introduce flights to Australia.

Virgin Australia

| Likelihood of joining an alliance: unlikely for now |

We’re sure Virgin Australia joining Star Alliance is on the wishlists of many frequent flyers. Previously, that would have been difficult with its partnership with Delta. But now, that’s nixed, and Virgin Australia is partners with five Star Alliance carriers: United, ANA, Air Canada, Singapore Airlines and South African Airways. Down the track, that could also again include Air New Zealand.

Could Virgin Australia join Star Alliance? Maybe, but we currently don’t see it as likely. Virgin Australia’s owners, Bain Capital, have made it clear they want the airline to run as efficiently as possible. Going down the path of joining an alliance would be costly and time-consuming. Instead, we see Virgin Australia choosing to maintain bespoke partnerships with individual airlines.

It’s not bad as strategies go, and Velocity Frequent Flyer members have a good range of airlines to redeem points on. It just means that there will continue to be inconsistencies with status perks between different partner airlines.

Etihad

| Likelihood of joining an alliance: unlikely for now |

Like Virgin Australia, Etihad is a different airline from long ago. It’s now slimmer and no longer harbours the ambitions to be as big as Emirates – instead focusing on being a ’boutique airline’. It also has a range of individual partnerships across all alliances, including with Air Canada, Air France, Korean Airways and Virgin Australia.

We also don’t see Etihad putting its hand up to join an alliance anytime soon. But if it does, the call will likely be answered by SkyTeam, which shares multiple partner airlines with.

Emirates

| Likelihood of joining an alliance: unlikely for now |

We reckon Emirates has the opposite problem of Etihad and Virgin Australia – it’s not in an alliance because it doesn’t need to be. Emirates boasts the world’s largest Airbus A380 and Boeing 777 fleets. With huge connectivity across the world and plenty of bespoke partnerships – including the joint venture with Qantas – Emirates probably has more than enough traffic on its hands.

It probably doesn’t want to deal with all the red tape that being in an alliance entails.

WestJet

| Likelihood of joining an alliance: unlikely |

If WestJet were to join an alliance, our money would be on SkyTeam. It isn’t hard to figure out – the majority of its partner airlines are also in SkyTeam. There would also be too much overlap with American Airlines and Alaska Airlines if WestJet were to join oneworld.

But WestJet’s former CEO, Ed Sims, told CAPA back in 2021 that the airline’s growth strategy is cemented around joint venture partnerships and not airline alliances. We haven’t heard much since then that would indicate that the airline has changed its tune.

JetBlue

| Likelihood of joining an alliance: unlikely for now |

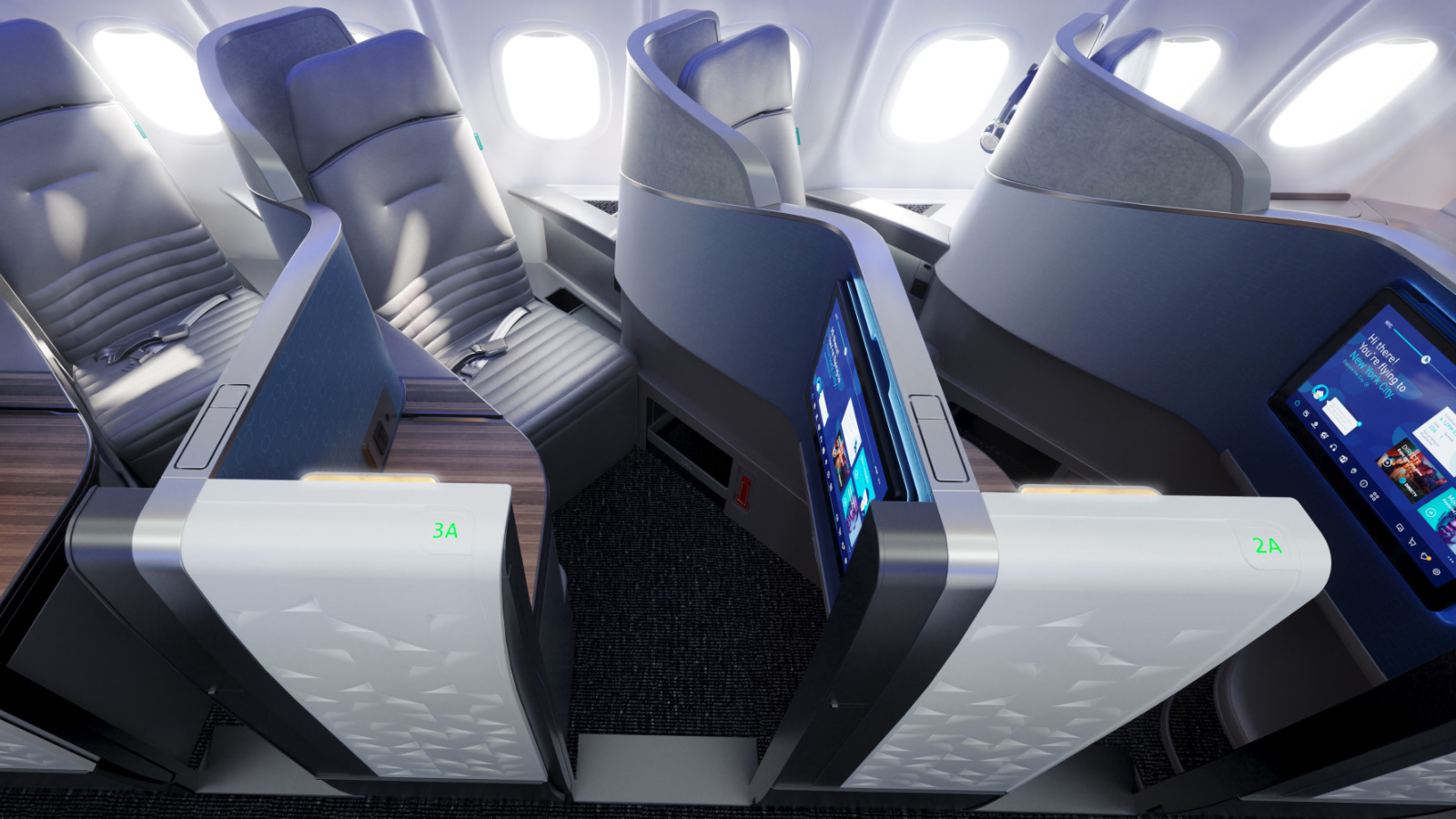

As far as we know, JetBlue isn’t against joining an alliance. The value carrier is well-known for its Mint Business Class cabin offering lie-flat seats on single-aisle jets, so it would be a desirable partner as well.

In fact, JetBlue was in a partnership with American Airlines, dubbed the Northeast Alliance. Unfortunately, this was terminated in 2023 after a US federal judge ruled against it, calling it anti-competitive. It appears American Airlines was planning to sponsor JetBlue into oneworld, similar to how it helped Alaska Airlines do the same.

But now that Alaska Airlines is planning to merge with Hawaiian Airlines and introduce a new partner into oneworld, we see the chances of yet another US carrier – such as JetBlue – also being allowed to join as fairly low. So that puts JetBlue off our alliance radar, for now.

Honourable mentions: LATAM and Rex

Both LATAM and Rex have links with Delta Air Lines. Is SkyTeam membership on the horizon for either airline? We’d say probably not for a while. LATAM, of course, was part of oneworld until it left in 2020. Since then, it has pursued individual partnerships, including with Qantas and its major partner, Delta.

Rex is likely too small to join an alliance right now. But as the carrier gradually builds up its domestic network and unlocks more key components of its Rex Flyer loyalty program, we could see it look towards SkyTeam as well. Just not anytime soon.

Upcoming members: Vistara and Hawaiian Airlines

India’s second-largest domestic airline, Vistara, is an interesting beast. Firstly, it’s 49% owned by Singapore Airlines as part of a joint venture with India’s Tata Sons. Does that mean Vistara is a shoo-in for Star Alliance?

Well, it’s a moot argument, as government officials have approved a merger of Air India and Vistara. Once the merger is complete, the Vistara brand will be retired and the larger Air India will undoubtedly remain part of Star Alliance.

Meanwhile, Alaska Airlines is seeking to merge with Hawaiian Airlines. If approved, Hawaiian Airlines will share a loyalty program with Alaska Airlines, and likely be integrated into oneworld.

Summing up

Airline alliances provide an excellent opportunity for airlines to expand their global reach. It’s a coming-of-age rite, in a way. But most of the airlines in this list are already well established, and they may have reasons for not wanting to join. An example is Emirates, which might find itself too constrained by the requirements of an alliance.

Over to you – do you think there are any airlines that could join an alliance in the near future? Let us know in the comments below.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

When LATAM Airlines Group was formed, one of the conditions imposed by the authorities was to stay either in oneworld (LAN) or Star Alliance (TAM) but not join any other alliance, so they chose to stay in oneworld and ditch Star Alliance. Then, Qatar Airways (oneworld) bought a stake in LATAM. Years later, Delta Air Lines (SkyTeam) did the same that Qatar but with a bigger share and made the decision of retire LATAM from oneworld but not join SkyTeam as its almost-sister Aeroméxico. Another reason is the European port of entry. The biggest share of LATAM passengers are people from South American countries and due to the common language, their preferred port of entry in Europe is MAD in Spain. MAD is a hub for Iberia (oneworld) and AirEuropa (SkyTeam), but both airlines are in a merger process and the resultant airline will likely be Iberia staying in oneworld. Other known SkyTeam hubs in Europe are CDG in France (Air France), AMS in Netherlands (KLM) and FCO in Italy (ITA Airways, soon to left SkyTeam and join Star Alliance due to Lufthansa buying a stake on it), but due to every of them being in non-Spanish speaker countries, they are less ideal as port of entries for South American passengers, so LATAM prefers to maintain its bespoke alliance with Iberia as when both were oneworld mates instead of joining SkyTeam and making the entry to Europe a hassle for a lot of their passengers and customers by routing them through CDG or AMS.